[ad_1]

CoinBase Pro is where you can start trading in minutes—that is what we get from their homepage. Previously known as GDAX, the professional trading wing of CoinBase, the exchange draws investors as well as individuals wishing to trade in a regulated and insured environment. Complementing the exchange’s deep liquidity is an intuitive, easy to use interface with “real-time order books, charting tools, data exporting, and no fee for maker trades.”

CoinBase Pro is Restructuring

In a bid to deepen liquidity, improve price discovery as well as smoothing price movement, CoinBase pro is restructuring and charging maker fees. These fees will help “to increase liquidity by reducing the delta between maker and taker fees” which will in turn have a cascading effect helping traders have better trading opportunities. Aside from introducing maker fees, the exchange will also remove stops on market orders, add market order protection points of 10 percent, introduce new tick sizes and update maximum order sizes to “protect customers from large price movements.”

In a post the CoinBase Pro said:

“CoinBase Pro will implement a set of changes to further optimize the market health of our platform. These changes are designed to increase liquidity, enable better price discovery for trades, and to make price movements smoother.”

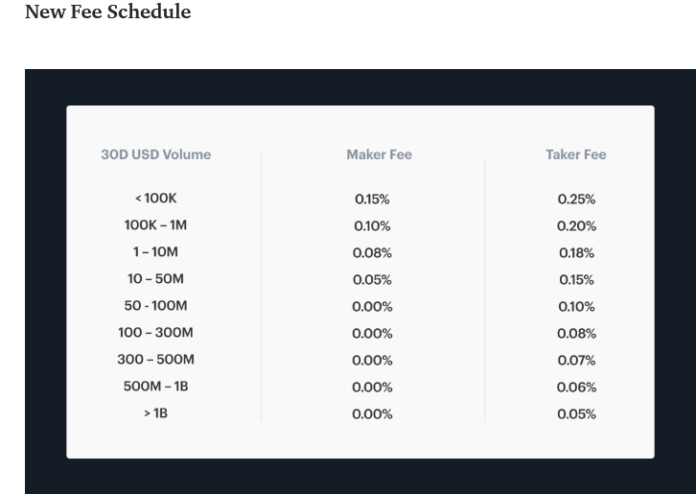

Going forward, traders posting limit orders will have to pay a 0.15 percent make fee for trade volumes below $100k. However, the percentage—like in all exchanges, will drop to zero as average monthly trade volumes increase. At the same time, ETC-USD, ETC-EUR, ETC-GBP, LTC-BTC, ETC-BTC tick sizes will decrease and the deprecation of stop market orders will start from Mar 22, 2019. To that end, the exchange will be offline from 6:00 pm PDT to 6:30 pm PDT on Mar 22 as these changes are effected.

Will CoinBase Pro Suffer?

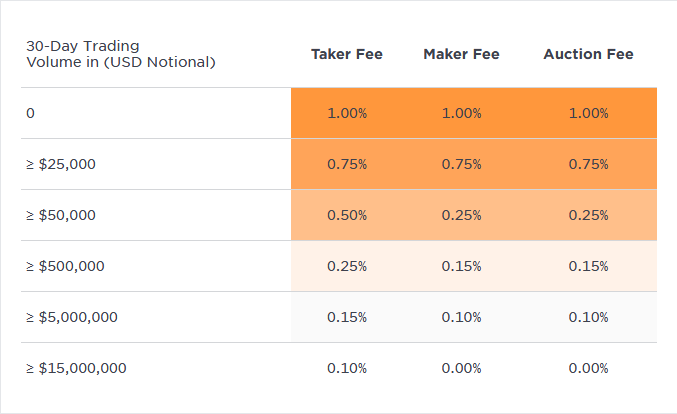

As expected, users were not happy with the move. From a neutral point of view, this was a move necessitated by business demands. However, the 0.15 percent maker fees are lower when compared to Gemini—which is charging a massive one percent.

The decentralized nature of blockchains mean liquidity is a big obstacles. As a result, the argument is, the zero-fee maker fee model was attractive, encouraging customers to place limit orders boosting liquidity.

Besides, considering the number of CoinBase users, the exchange could still turn in a profit from taker fees which range from 0.05 percent to 0.25 percent down from 0.30 percent. The introduction of maker fees will therefore discourage participation, reducing liquidity in the process. Moreover, it is worse with the removal of stop orders.

Not many will be comfortable with open orders with no stops

on market trades. It is likely that customers will bail to other exchanges with

better offerings and liquidity as Liquid and Binance. At their peak in 2017,

Bittrex did the same thing, eliminating market orders and asserting for

liquidity creating limit orders and the result was catastrophic for the

exchange as liquidity tanked thanks to the mass migration.

[ad_2]

Source link