[ad_1]

Elon Musk is the tech billionaire that many people from Wall Street to Hollywood (e.g., Johnny Depp) love to hate. At a time when investors should be celebrating the Tesla CEO for the release of the Model Y, an electric SUV crossover, analysts are instead pouncing on Musk and TSLA shares amid renewed regulatory and key man fears, among other things.

JPMorgan strategists and analysts are targeting Musk and Tesla in recent reports considering the stock continues to trade on headwinds rather than tailwinds, suggesting there is more volatility ahead. The Tesla chief isn’t doing himself any favors by displaying what a JPMorgan report describes as “ongoing public belligerence” toward the U.S. securities watchdog, which strategists suggest could be his undoing as CEO.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

JPMorgan: Buy TSLA Puts

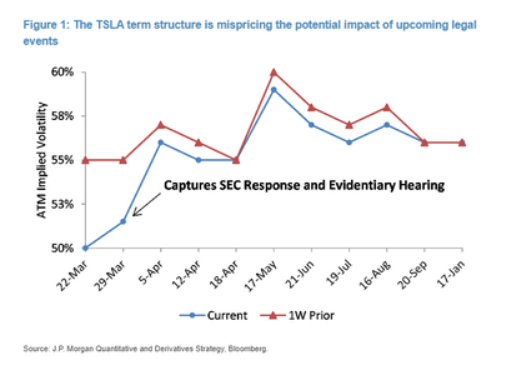

JPMorgan believes they have spotted an opportunity in the implied volatility in TSLA shares tied to “upcoming legal events” surrounding an ongoing dispute with U.S. regulators. The analyst firm suggests that the options market isn’t adequately pricing in risks surrounding TSLA shares.

For instance, Musk, who boasts 25 million Twitter followers, was sued by the U.S. Securities and Exchange Commission for recklessly using his social media platform to suggest he had secured funding to take Tesla private, which ultimately cost him his Chairman title and tens of millions of dollars in fines.

Musk is also synonymous with the electric vehicle company he founded, which makes him a “key man” whose leadership of the company cannot easily be replaced. This is another fear cited by the JPMorgan strategists, who suggest that “another [regulatory] slap on the wrist (i.e. a larger fine) appears unlikely” for Musk this time around. For options investors, JPMorgan advises purchasing TSLA puts that expire next month to capitalize on what they deem to be a mispriced stock, Bloomberg cites the JPMorgan report, which states:

“The option market is embedding no volatility premium for upcoming legal events in the case of SEC v. Elon Musk. Surprising given these fears previously caused a significant decline in Tesla shares and a surge in volatility to multi-year highs.”

There is no love lost on either side of the SEC/Musk relationship, but the fact that he has managed to hold onto CEO status thus far suggests that he has made it through the woods.

Model Y-awn

Meanwhile, Tesla’s Model-Y debut turned out to be a yawner on Wall Street, failing to drum up excitement in the stock despite Musk’s prediction that it will outsell Tesla’s Model S, Model X, and Model 3 altogether. JPMorgan’s Tesla analyst is underweight TSLA shares and has a $230 price target attached. The firm’s strategist stated:

“The once impenetrable Tesla narrative appears to be eroding. Tesla remains a story of vision, steered, for better or for worse, by Elon Musk.”

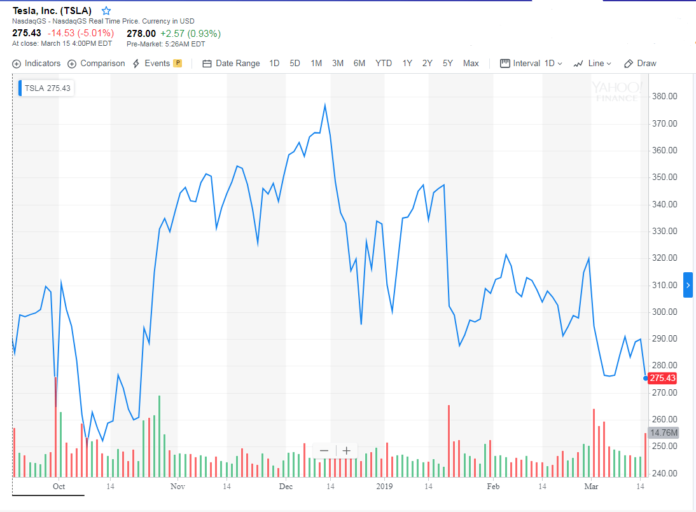

TSLA shares are down by double-digits both in March and over the past 12-month period.

Musk’s Not Losing Sleep

Musk, however, doesn’t appear the least bit worried. Perhaps it’s because Tesla is only one of several futuristic companies of which he is at the helm. He also co-founded SpaceX, which makes rockets and spacecraft and that has set its sight on populating Mars.

Most recently, the company’s Starship rocket has completed successful heatshield tests that rival the temperatures that NASA space shuttles can handle. He engaged with his Twitter followers, revealing that he is in discussions with regulators in Texas and Florida for launch.

Working on regulatory approval for both Boca Chica, Texas, and Cape Kennedy, Florida. Will also be building Starship & Super Heavy simultaneously in both locations.

— Elon Musk (@elonmusk) March 17, 2019

If space doesn’t work out for Musk, there’s always bitcoin, of which he appears to be cut from a similar mold and whose community would seemingly welcome him with open arms.

[ad_2]

Source link