[ad_1]

By CCN: The Dow and broader U.S. stock market traded mixed-to-lower on Wednesday, though downside risks were contained amid reports that the Trump administration was looking to finalize a new trade deal with China by next month.

Dow on the Edge; Healthcare Sinks S&P 500

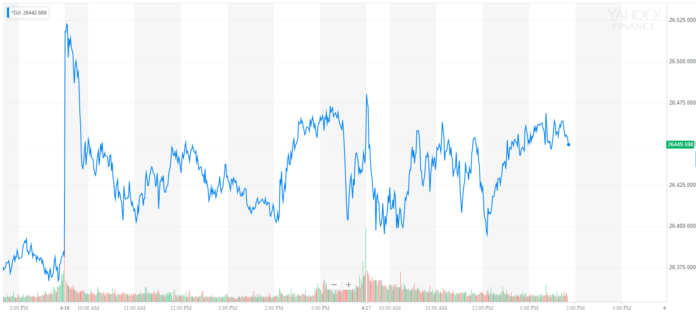

The Dow Jones Industrial Average traded within a relatively narrow range on Wednesday, reflecting a tepid pre-market for U.S. stock futures. At last check, the blue-chip index was trading flat at 26,449.21.

Dow Jones Industrial Average flat-lines as attention shifts to trade. | Chart via Yahoo Finance.

The broad S&P 500 Index slipped 0.2% to 2,900.58 as health stocks plunged 2.8% as a sector. The much smaller real estate component also traded firmly lower. Losses in the sectors offset steady gains in technology, energy, and consumer staples.

Meanwhile, the technology-focused Nasdaq Composite Index slipped 0.1% to 7,993.40.

U.S.-China Trade Deal in the Works

The Trump administration is eyeing an imminent trade deal with China. | Source: AP Photo / Tony Gutierrez

The Wall Street Journal reported Wednesday that the United States and China have scheduled a new round of face-to-face meetings to hammer out a trade agreement in the next month or so. Under the proposed schedule, negotiators are aiming for a signing ceremony by the end of next month or in early June at the latest.

U.S. Trade Representative Robert Lighthizer is planning to travel to Beijing in the week of April 29 to resume negotiations with Chinese officials. Beijing will then send an envoy to Washington the following week.

The world’s largest superpowers have made notable progress on a number of thorny issues involving intellectual property, Chinese industrial subsidies, and Washington’s burgeoning trade deficit. Both the Trump administration and China’s state-run news agencies have talked up the prospect of an imminent trade deal over the past few months.

The Chinese economy held up better than expected in the first quarter, with gross domestic product (GDP) expanding 6.4% annually, the National Bureau of Statistics reported Wednesday. Analysts in a median estimate had called for growth to slow to 6.3%. In March, China reported a sharp pick-up in industrial production and retail sales compared with a year earlier. Fixed-asset investment also improved, according to the latest figures.

[ad_2]

Source link