[ad_1]

The Dow and broader US stock market surged into recovery mode on Tuesday while the Trump administration geared up for a new assault on an old nemesis: the Affordable Care Act (ACA), better known as Obamacare.

Dow Races to 175 Point Recovery on Tuesday

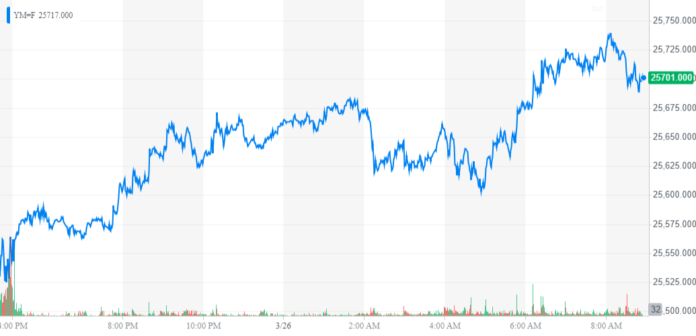

Shortly before Tuesday’s opening bell, Dow Jones Industrial Average futures had raced to gains of 134 points or 0.52 percent, implying a 175.17 point surge. S&P 500 and Nasdaq futures also pointed to gains, with the former climbing 0.45 percent and the latter leaping 0.51 percent.

The Dow heads into the US trading session on solid footing to mount a significant rally. | Source: Yahoo Finance

On Monday, the US stock market endured a rocky trading session as traders wrestled with the conclusion of Special Counsel Robert Mueller’s investigation into the 2016 Trump campaign, as well as a historic plunge in Chinese equities.

The Dow closed the day with a 14.51 point gain, recovering from earlier losses to rise 0.06 percent. The Nasdaq dropped 5.13 points or 0.07 percent to end in the red, as did the S&P 500, whose 2.35 point or 0.08 percent loss thrust the index below the critical 2,800 mark to 2,798.36.

Trump Administration Renews Fight to Exterminate Obamacare

This morning, Wall Street must grapple with the Trump administration’s stunning about-face on federal health care policy.

After President Trump and congressional Republicans had tried – and failed – to repeal the Affordable Care Act, the Jeff Sessions-led Justice Department had conceded that the fight to strike down Obamacare faced a losing battle in the courts as well.

However, perhaps emboldened by the Mueller probe’s conclusion, the Trump administration – now sans Jeff Sessions – filed a motion seeking to invalidate the entire ACA and strip former President Barack Obama of his signature legislative accomplishment.

“The Department of Justice has determined that the [Texas] district court’s comprehensive opinion [that Obamacare is unconstitutional] came to the correct conclusion and will support it on appeal,” said Kerri Kupec, spokesperson for the Justice Department.

Most US adults have a favorable opinion of Obamacare, a data point that won’t be lost on Trump’s Democratic foes heading into the 2020 presidential election. | Source: Kaiser Family Foundation

Now devoid of the Trump-Putin collusion narrative, Democratic presidential candidates were quick to pounce on Trump’s assault on Obamacare, which according to the Kaiser Family Foundation retains a favorability rating of around 50 percent.

“Trump and his administration are trying to take health care away from tens of millions of Americans — again,” US Senator Kamala Harris (D-CA) wrote on Twitter. “We must fight back again with everything we’ve got. And in 2020, we need to elect a president who will make health care a right.”

Trump and his administration are trying to take health care away from tens of millions of Americans — again.

We must fight back again with everything we’ve got. And in 2020, we need to elect a president who will make health care a right.https://t.co/O3gLYa7Yzy

— Kamala Harris (@KamalaHarris) March 26, 2019

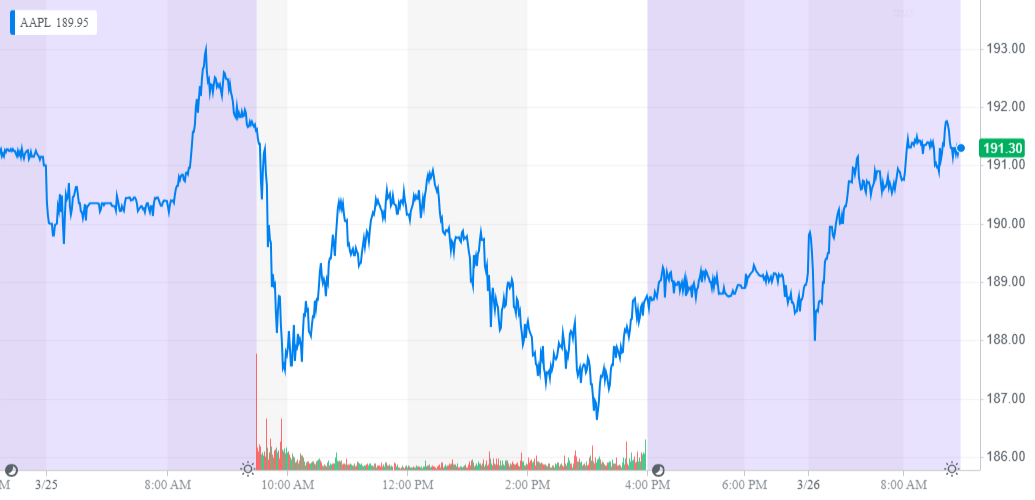

Apple Stock Recovers Despite Disappointing Launch Event

Alongside the Trump administration’s renewed focus on health care, the Dow received a boost from Apple, which climbed 1.3 percent in pre-market trading following Monday’s disappointing launch event in Cupertino – and subsequent AAPL share price decline.

However, analysts remain skeptical that the Apple Card and other gimmicky services will distract investors from major issues with its core business, namely slumping iPhone sales.

“Apple’s services reveal was materially different than we had anticipated,” said Goldman Sachs analyst Rod Hall in remarks cited by CNBC. “With small calculated impacts from these, ‘other services’, we expect the focus to return to the slowing iPhone business post this event,” Hall added.

Analyst: S&P 500 Poised to Plunge 10 Percent after Falling Below 2,800

Meanwhile, traders are watching the S&P 500 to determine whether it will recover comfortably back above the 2,800 resistance level or slump back into corrective territory.

Bearish technical analysts expect the S&P 500 to plunge as much as 10 percent from its present level. | Source: Kobeissi Letter via MarketWatch

Adam Kobeissi, founder and editor of The Kobeissi Newsletter, predicts that the S&P 500 will take a major step down, most likely within the range of 7 to 10 percent.

“We watch 2,760-2,785 as the next major technical level which will lead to a gap lower to 2,700 if broken. Overall, a 7-10 percent drop from today’s close is highly likely for the S&P 500,” he warned in an interview with MarketWatch.

[ad_2]

Source link