[ad_1]

By CCN.com: The US stock market is well on its way to posting its second consecutive advance, as the Dow prepares for a jump of more than 150 points at the opening bell the morning after President Trump delivered a withering assault on his political opponents at a Michigan rally that marked a turning point for his 2020 reelection campaign.

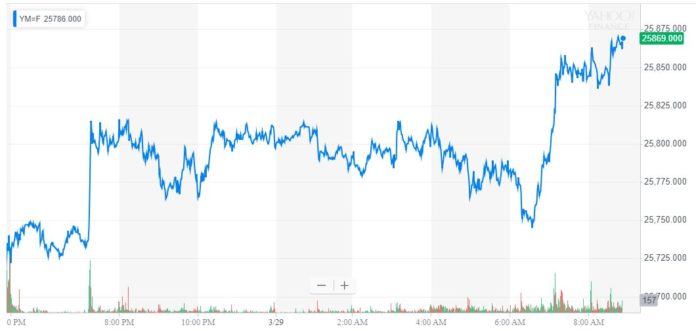

Dow Prepares to Shoot 150 Points Higher

Shortly before the opening bell, Dow Jones Industrial Average futures had surged 144 points or 0.56 percent, implying a 151.54 point jump. S&P 500 futures rose 0.51 percent, and Nasdaq futures added 0.57 percent to round out a positive pre-market session.

On Thursday, the Dow managed a 91.87 point gain following another volatile trading session, rising 0.36 percent to close at 25,717.46. The S&P 500 climbed 10.07 points or 0.36 percent to 2,815.44, and the Nasdaq closed at 7,669.17 following a gain of 25.79 points or 0.34 percent.

Trump Treasury Secretary Pumps Trade War Progress

This morning, the US stock market is digesting the latest development to emerge from the trade war teeter-totter.

US Treasury Secretary Steven Mnuchin said that he and Trade Representative Robert Lighthizer had held “constructive” discussions with Chinese negotiators in Beijing and that the Trump administration looked forward to continuing them in Washington next with Chinese Vice Premier Liu He.

.@USTradeRep and I concluded constructive trade talks in Beijing. I look forward to welcoming China’s Vice Premier Liu He to continue these important discussions in Washington next week. #USEmbassyChina pic.twitter.com/ikfcDZ10IL

— Steven Mnuchin (@stevenmnuchin1) March 29, 2019

Mnuchin’s positive comment followed an even more significant report that China had agreed to “unprecedented” concessions related to forced technology transfer, news that was clouded by White House economic adviser Larry Kudlow’s subsequent comment that it could be “months” until the world’s two largest economies arrived at a formal agreement.

Trump Unleashes Uncensored Rant on ‘Collusion Delusion’ at Michigan Rally

Thursday also brought Wall Street its first look at Donald Trump’s post-Mueller investigation 2020 campaign strategy.

Hours after unleashing a savage tweetstorm targeting opponents – both foreign and domestic – ranging from Jussie Smollett to OPEC to House Intelligence Chairman Adam Schiff, an unfettered Trump took the stage in Michigan and delivered a withering, uncensored critique of his political enemies who in his words, defrauded American votes with the “Russia…collusion delusion” – the “single greatest political hoax in the history of our country.”

“The Democrats have to now decide whether they will continue defrauding the public with ridiculous bullsh*t, partisan investigations, or whether they will apologize to the American people and join us to rebuild our crumbling infrastructure, bring down the cost of health care and prescription drugs … help us fix our broken trade deals,” Trump ranted.

The president gloated that despite “three years of lies and smears and slander,” he – not his Democratic opponents – emerged from the Mueller probe victorious.

“And guess what?,” Trump said as the MAGA faithful roared their approval. “We won.”

Bitcoin Price Tests Critical Resistance Line

Meanwhile, the cryptocurrency market continues to edge higher, even as the bulls appear too skittish to mount a major charge at bitcoin’s $4,200 resistance line.

On Friday, the bitcoin price enters the US trading session at $4,074 on Bitstamp, slightly down from its intraday high of $4,102, which marked the flagship cryptocurrency’s highest level in more than a month.

The bitcoin price may have escaped its long-term descending trendline, but it must rise another ~$500 before it challenges its 200-day moving average. | Source: eToro

According to eToro Senior Market Analyst Mati Greenspan, bitcoin has arguably broken above its long-term descending trendline (depicted in yellow). Still, most analysts would be hesitant to call a bull market until the bitcoin price punches through the $4,200 resistance line and makes a strong push toward its 200-day moving average (blue), which currently waits around $4,650.

Now that bitcoin has begun to once again test $4,200, it seems certain that a breakout is imminent. The only question is whether the bulls have enough momentum to smash through that wall before the volume dries up – and the bears exact their revenge.

Altogether, the cryptocurrency market cap stands at $143.4 billion, representing a single-day gain of about $700 million. Bitcoin dominance – an indicator that measures its market share – continues to hold at 50.4 percent.

[ad_2]

Source link