[ad_1]

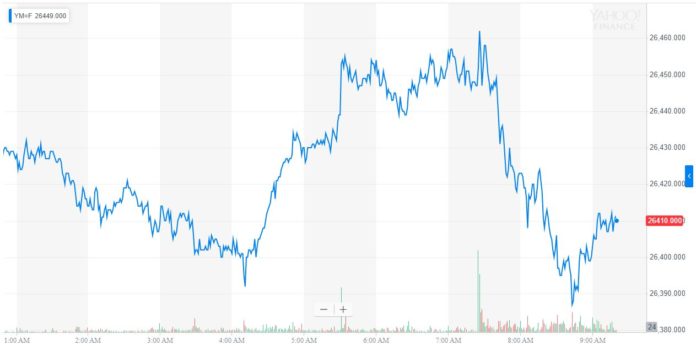

The Dow slid back into the red on Monday, diving below the 26,400 mark as investor sentiment on corporate earnings whipsawed back into bearish territory. Meanwhile, President Trump provided embattled aerospace giant Boeing with some cringeworthy advice about how to cure its ailing performance.

Dow Dives Below 26,400 as Earnings Bite Back

US stock futures had spent much of the pre-market session flirting with a positive open, but the Dow Jones Industrial Average flashed red at the bell. By 9:45 am ET, the DJIA had lost 50.61 points or 0.19 percent to trade at 26,361.69. The S&P 500 declined 0.09 percent but continued to hold above 2,900, while the Nasdaq managed gains of 4.67 points or 0.06 percent.

On Friday, the Dow concluded an otherwise-disappointing week with a banner performance, surging 269.25 points or 1.03 percent to close at 26,412.30. The S&P 500 rose 0.66 percent to 2,907.41, and the Nasdaq climbed 0.46 percent to 7,984.16 as Wall Street brushed off concerns of a looming earnings recession.

This morning, Wall Street approached earnings seasons with a bit more caution.

Banking giant Goldman Sachs published its first-quarter report ahead of the bell, disclosing better-than-expected profit ($5.71 per share) but also a sharp 13 percent drop in revenue ($8.81 billion).

Goldman’s mixed results complicate what – led by JPMorgan’s record performance – had initially appeared to be a surprisingly positive earnings season. However, that hype likely had more to do with how low analysts had set their expectations than how bullish the earnings actually were.

Trump Auditions for Top Boeing Job

What do I know about branding, maybe nothing (but I did become President!), but if I were Boeing, I would FIX the Boeing 737 MAX, add some additional great features, & REBRAND the plane with a new name.

No product has suffered like this one. But again, what the hell do I know?— Donald J. Trump (@realDonaldTrump) April 15, 2019

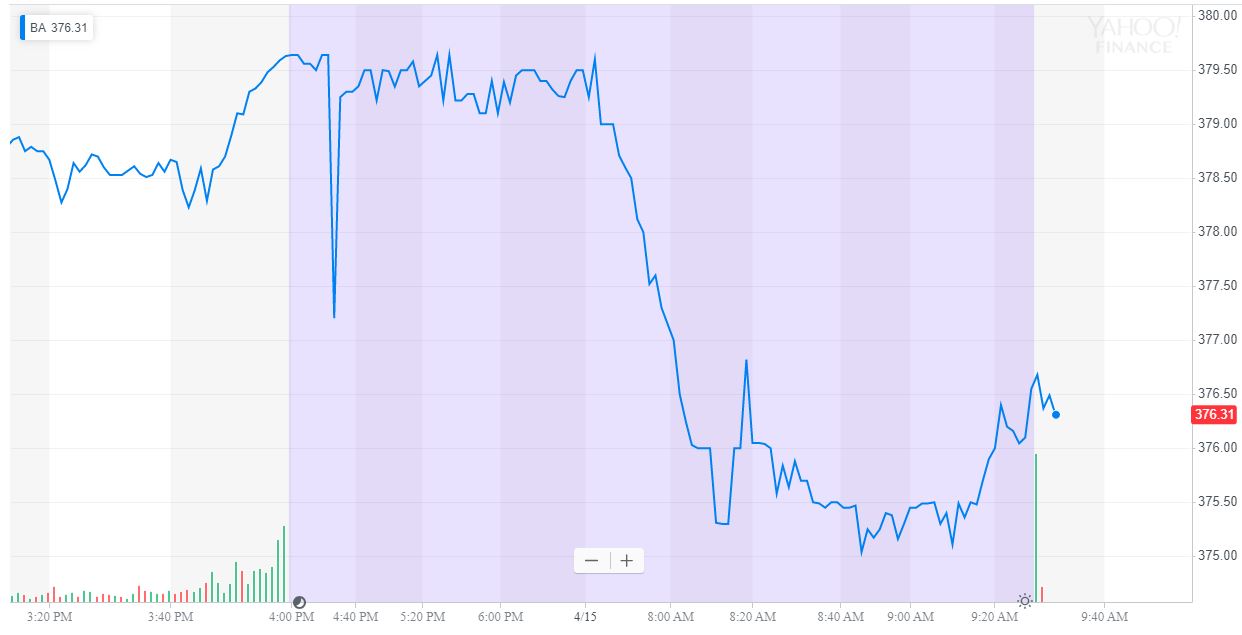

Meanwhile, US President Donald Trump dished out some cringeworthy business advice to the Dow’s largest component, Boeing.

Writing on Twitter, Trump advised the embattled $215 billion aerospace giant to – wait for it – “FIX the Boeing 737 MAX,” which has suffered under an avalanche of controversy due to two tragic crashes within the past six months.

“What do I know about branding, maybe nothing (but I did become President!), but if I were Boeing, I would FIX the Boeing 737 MAX, add some additional great features, & REBRAND the plane with a new name. No product has suffered like this one. But again, what the hell do I know?”

While I’m not privy to closed-door discussions held among Boeing’s senior management, I imagine fixing the faulty software that allegedly contributed to those crashes has factored into the agenda.

Trump’s fool-proof business advice didn’t inspire Boeing investors on Monday. | Source: Yahoo Finance

But wait – that’s not all! Trump revealed that Boeing should add “some additional great features” to the 737 MAX. He stopped short of explaining what those “great features” should be or how the company could rush them to market without causing the aircraft line to remain grounded even longer than the six to nine months analysts have already previewed.

Finally, Trump told Boeing that it should rebrand the 737 MAX, as if that would remove the stigma associated with flying on the aircraft model associated with 346 deaths.

If this tweet was an audition to succeed Dennis Muilenburg as CEO of Boeing following his presidency, the former “Apprentice” star should probably avoid getting his hopes up.

Goldman Sachs: Trump on Track to Win 2020 Election

Goldman Sachs believes the strong performance of the Dow and broader US stock market will help Donald Trump win a narrow victory in 2020. | Source: Nicholas Kamm / AFP

Luckily for Trump, it increasingly looks like he will have at least another four years before he needs to start preparing for his post-presidency swan song.

According to economists at Goldman Sachs, the “advantage of first-term incumbency and the relatively strong economic performance” will allow Trump to eke out a victory in a “close call” election.

“President Trump is more likely to win a second term than the eventual Democratic candidate is to defeat him,” Goldman economists wrote.

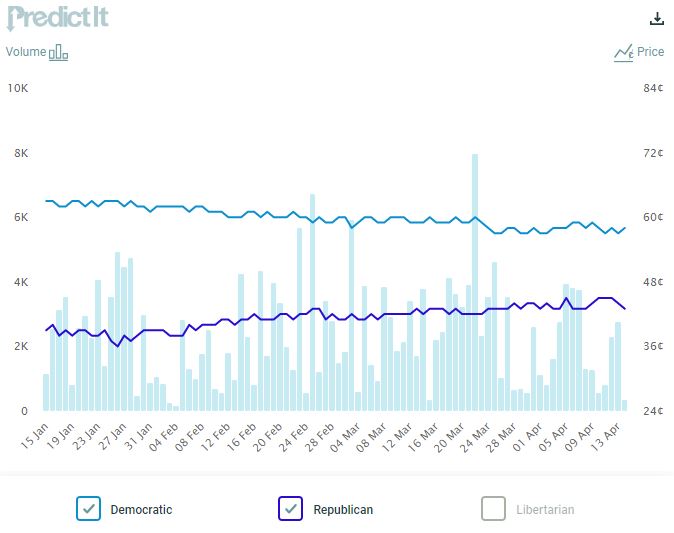

Betting markets still favor a generic Democratic candidate over a generic Republican one, but Goldman Sachs believes Donald Trump will score a narrow victory. | Source: PredictIt

The firm noted that betting markets still favor a generic Democratic candidate over a generic Republican candidate.

“While we believe the majority of market participants expect President Trump to win a second term, we note that prediction markets point in the opposite direction and imply that the Democratic candidate has a 56% probability of winning and the Republican candidate has a 44% chance.’

However, with an increasingly crowded field, the eventual Democratic nominee could emerge from the primary bloodied, providing Trump with the edge he needs to score an electoral victory even if he once again loses the popular vote.

[ad_2]

Source link