[ad_1]

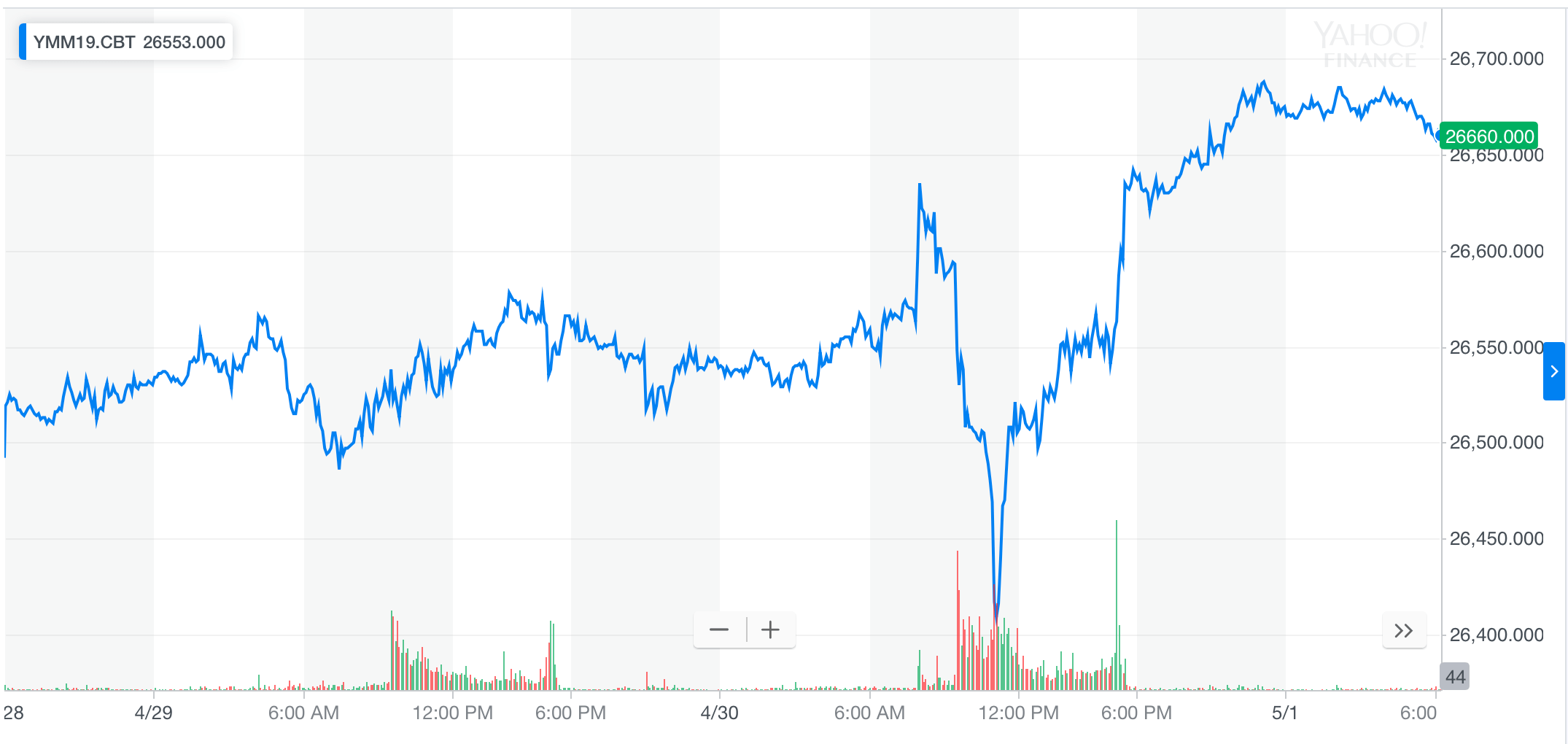

By CCN.com: The Dow Jones Industrial Average looks set to open in positive territory on Wednesday after a strong earnings report at Apple last night. Dow futures are up 81 points (0.3 percent), putting the DJIA in touching distance of its record high of 26,828.

Despite a crushing 17 percent fall in iPhone revenue, Apple beat Wall Street estimates with a record-breaking quarter in its services department. Tim Cook also announced a $75 billion share buy buy-back program. Apple stock is up six percent in pre-market trading.

Apple’s Tuesday night earnings beat sends the stock back towards its 2018 highs. Source: Yahoo Finance

As one of the heaviest-weighted companies in the DJIA, Apple’s six percent gain is pulling up the rest of the market.

Apple: Falling iPhone sales don’t faze investors

In Tuesday’s nights earnings call, Tim Cook revealed that iPhone revenue slumped 17 percent year-on-year. This was widely expected after reports of slowing demand in China.

The iPhone remains Apple’s biggest cash cow, but its share of company revenue is falling. Per this quarter’s report, iPhone sales now account for 53.5 percent of Apple’s revenue, down from 61 percent last quarter.

The iPhone is becoming less important to Apple’s total sales, as the tech company highlights growth in services and wearables in its second-quarter results. https://t.co/JNMb0LAag6 pic.twitter.com/SVOA4p7ILk

— CNBC International (@CNBCi) May 1, 2019

Despite that, Tim Cook promised quarterly revenue would come in between $52.5 billion to $54.5 billion, beating analyst expectations. It confirms what CCN previously reported: Apple is executing a perfect transition to services.

Apple services and wearables sky-rocket

Services like Apple Music, iCloud and App Store help reduce Apple’s reliance on hardware. This arm of Apple’s business shot up last quarter:

“It was our best quarter ever for services, with revenue reaching $11.5 billion” – Tim Cook.

The timing couldn’t be better as Apple readies its Netflix-rival streaming service Apple+.

Tim Cook also boasted strong growth in its Wearables division which includes AirPods, Apple Watch, and Beats headphones. Although Apple doesn’t break down the exact numbers, Cook said Wearables grew 50 percent this quarter.

Apple ignites Dow Jones towards record highs

As one of the largest-weighted company in the Dow Jones Industrial Average, Apple has huge sway over market movements. With Apple rising 5 percent in pre-market trading, Dow futures are pushing higher in response.

The DJIA is now back within touching distance of record highs, a feat achieved by the S&P 500 and NASDAQ in recent sessions.

Apple’s earnings beat should give traders a shot in the arm after worrying numbers at Google earlier in the week. As CCN reported, Google parent company Alphabet stock crashed 8 percent as growth in advertising revenue slowed. FANG stocks shed $10 billion in value after Google’s shocker.

Last night’s earnings at Apple thankfully suggest Google’s fail was just a hiccup in this storming tech rally.

[ad_2]

Source link