[ad_1]

The Dow rallied more than 100 points on Monday after the Trump White House whipsawed on the ongoing US-China trade war, providing the US stock market with a jolt of optimism that the two countries would arrive at a deal within the near future. Bitcoin, meanwhile, maintained its recent gains throughout the weekend but needs to see further growth to confirm that market headwinds truly have shifted.

Dow Mounts Triple-Digit Rally

Futures tracking the Dow Jones Industrial Average (blue), S&P 500 (red), and Nasdaq (orange) all climbed on Monday morning.

As of 9:01 am ET, Dow Jones Industrial Average futures had gained 101 points or 0.4 percent, implying a rise of just under 100 points at the opening bell. S&P 500 futures gained 0.32 percent, and Nasdaq futures climbed 0.44 percent to round out a solid pre-bell session for the US stock market.

Today’s pre-market jump came in response to an Axios report that US President Donald Trump and Chinese President Xi Jinping might hold a summit to iron out sticking points that have prevented the two countries from reaching a new trade agreement. The meeting, which would likely take place at Trump’s Mar-a-Lago resort, could take place as soon as next month.

Last week, Trump battered the stock market when he confirmed that he would not meet with President Xi before new tariffs took effect at the beginning of March. While the summit would not take place before that deadline, Trump could delay the new tariffs until after the meeting to provide a greater incentive to strike a formal deal.

Meanwhile, US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will attend a new round of trade negotiations in China this week. The world’s two largest economies have reportedly failed to even produce a draft agreement that outlines specific areas of common ground and disagreement, an important procedural step toward striking a formal deal.

Bitcoin Price Maintains Gains, But This Bear Market isn’t Over Yet

The cryptocurrency market, meanwhile, clung to minor gains at the beginning of the US trading session as investors waited to see whether the bitcoin price would extend last week’s recovery or slip back into the red.

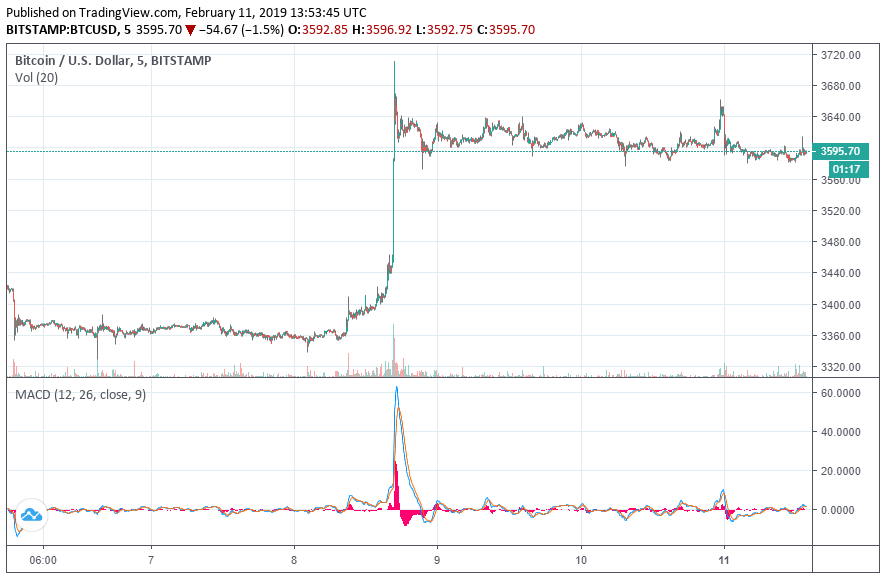

As CCN reported, the bitcoin price — which many analysts said was at risk of dropping as low as $2,270 — jumped as high as $3,700 last Friday before settling down to the ~$3,600 level at which it held throughout the weekend. Litecoin, meanwhile, has climbed more than 30 percent over the past week.

“It was a relatively sudden jump, and, of course, positive news for those holding Bitcoin,” said Nigel Green, CEO at financial consultancy deVere Group. “However, the price only reached the top of the trading range and investors should not be popping champagne corks just yet.”

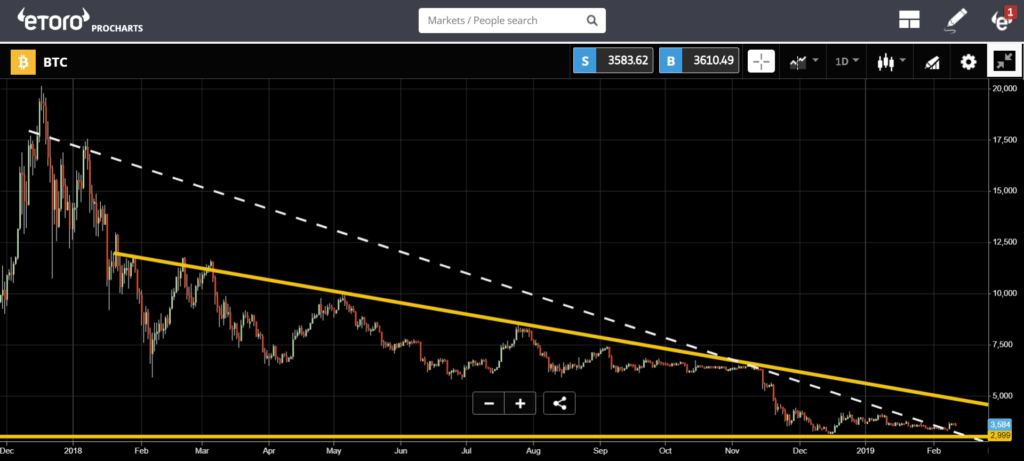

Writing in daily market commentary made available to CCN, Mati Greenspan provided similar analysis. The eToro senior market analyst cautioned that while last week’s price movements were “very encouraging,” the crypto market hasn’t given any “real signs that the bear market is over.”

Still, he said that one “encouraging sign is that the [bitcoin price] resistance level that we’ve been tracking for bitcoin (dotted white line) seems to have been broken.”

“Of course, each technical analyst will draw their lines a bit differently, he added. “So now that one resistance has been broken we need to draw a less aggressive line. The upper yellow line in the graph above is about as conservative a line as we can possibly draw.”

Greenspan said that the bitcoin price needs to make a strong break above psychological resistance at $5,000 before he would feel comfortable concluding that the flagship cryptocurrency’s longest-ever bear market had come to a close.

For now, bitcoin is trading at $3,597 on Bitstamp, up approximately one-quarter-of-one percent over its previous-day level. Ethereum and binance coin are the large-cap index’s top performers, with each having climbed more than 3.5 percent since Sunday. Altogether, the cryptocurrency market cap added $1 billion to reach a present value of $121.4 billion.

Donald Trump Image from Shutterstock. Price Charts from TradingView.

[ad_2]

Source link