[ad_1]

Neither Dow futures nor the bitcoin price showed much conviction ahead of Wednesday’s US stock market open, as Wall Street pined for a dovish FOMC statement on interest rates and crypto traders waited for BTC to make its next major push.

Dow Futures Hover Near Tuesday Close

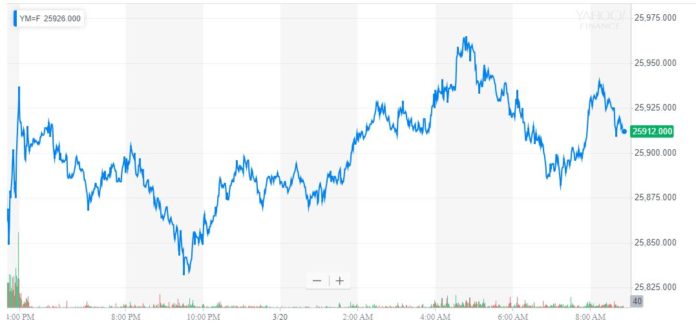

As of 9:05 am ET, Dow Jones Industrial Average futures had lost 14 points or 0.05 percent, implying a loss of 25.38 points at the open. S&P 500 and Nasdaq futures also slipped into the red, dropping 0.04 percent and 0.02 percent, respectively. Futures tracking all three indices had traded higher earlier in the day.

Dow futures bounced around Tuesday’s index close ahead of Wednesday’s opening bell. | Source: Yahoo Finance

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

On Tuesday, the stock market opened to sharp gains but bled lower throughout the day. By session close, the Dow had lost 26.72 points or 0.1 percent, while the S&P 500 ticked down by 0.37 points or 0.01 percent. The Nasdaq, despite giving up earlier gains, managed to close at 7,723.95 for a session increase of 9.47 points or 0.12 percent.

The afternoon sell-off was partially driven by China, which reportedly yanked key trade concessions, including removing the controversial Boeing 737 MAX 8 from the draft list of American products that it would buy to help the US reduce its trade deficit.

Stock Market Confident of Dovish FOMC Statement

This morning, US stock futures are bouncing around index close prices as Wall Street awaits the Federal Open Market Committee (FOMC) interest rate decision, which will be published within the Federal Reserve’s policy statement this afternoon at 2 pm ET.

As CCN reported, Fed Fund futures imply a staggering 98.7 percent chance that the Federal Reserve will not change interest rates, with the remaining 1.3 percent hedging against the outside chance that the Fed lowers rates more quickly than expected. Futures suggest there is virtually no chance that the central bank will raise rates in 2019.

“The more interesting development will be what the ‘dot plot’ signals about their intentions for the rest of the year,” JPMorgan economist Michael Feroli wrote in a note on Friday. “We suspect the median dot moves down from the two hikes they signaled in December to either no hikes or one hike for this year. We see somewhat higher odds of zero than one.”

Clearly, a dovish FOMC announcement has already been priced in, but that doesn’t mean the Dow and S&P 500 won’t bounce when the Fed sets that decision in stone.

Dow Recovery Under Pressure from Global Slowdown

Still, analysts continue to warn that a global economic slowdown could thwart the stock market’s ongoing recovery, particularly as a possible recession takes root in China.

On Tuesday, package delivery giant FedEx reported weaker-than-expected earnings and slashed its annual guidance target. The company blamed “slowing…macroeconomic conditions,” partially the result of trade disputes including the one between the US and China.

“Slowing international macroeconomic conditions and weaker global trade growth trends continue, as seen in the year-over-year decline in our FedEx Express international revenue,” Alan B. Graf, Jr., FedEx Corp. executive vice president and chief financial officer, said in statement.

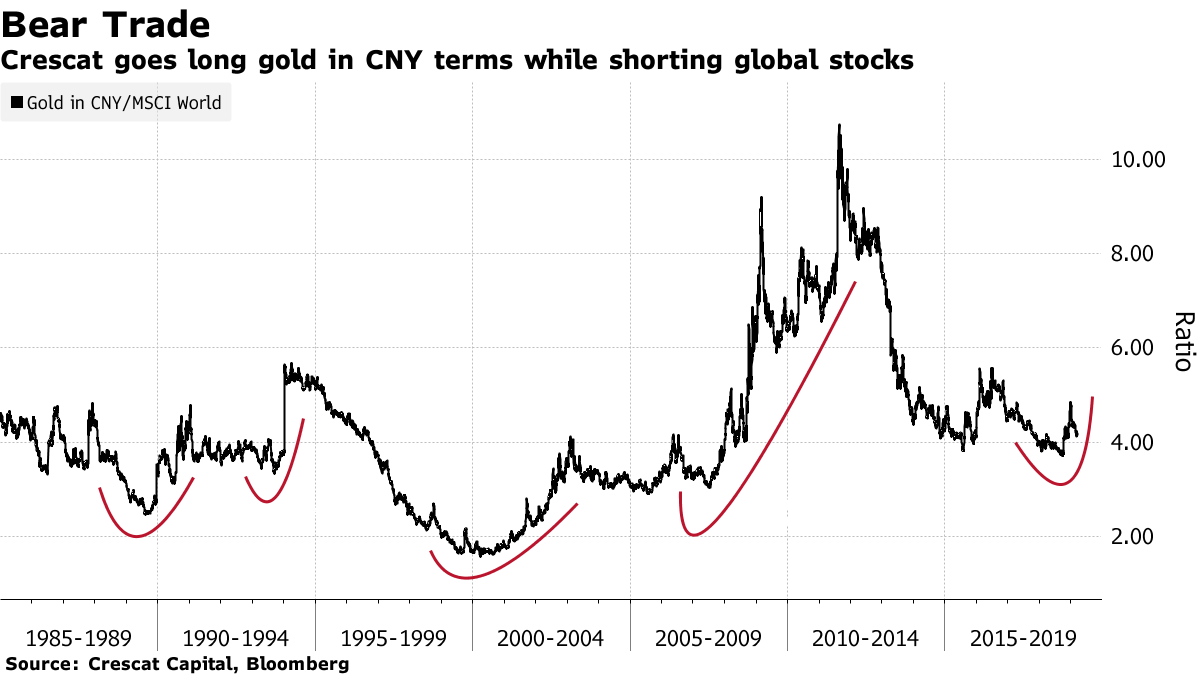

Fearing that an imminent recession will catch the US by surprise, bearish hedge fund Crescat Capital – one of 2018’s top-performing funds – has initiated what it boasts is the “trade of the century.”

Speaking with Bloomberg, Crescat Global Macro Analyst Tavi Costa explained that the $50 million hedge fund is buying gold and shorting the stock market, which it believes is stuck in a “bear market rally” and will soon capitulate to the economic slowdown.

“Soon the buy-the-dip mentality and bull-market greed will turn to fear. Selling will beget more selling. That’s how bear markets work,” Crescat wrote in a note. “There is so much more ahead to profit from the short side of the market. The bear-market rally is running out of steam!”

Has Bitcoin Entered a Bull Market?

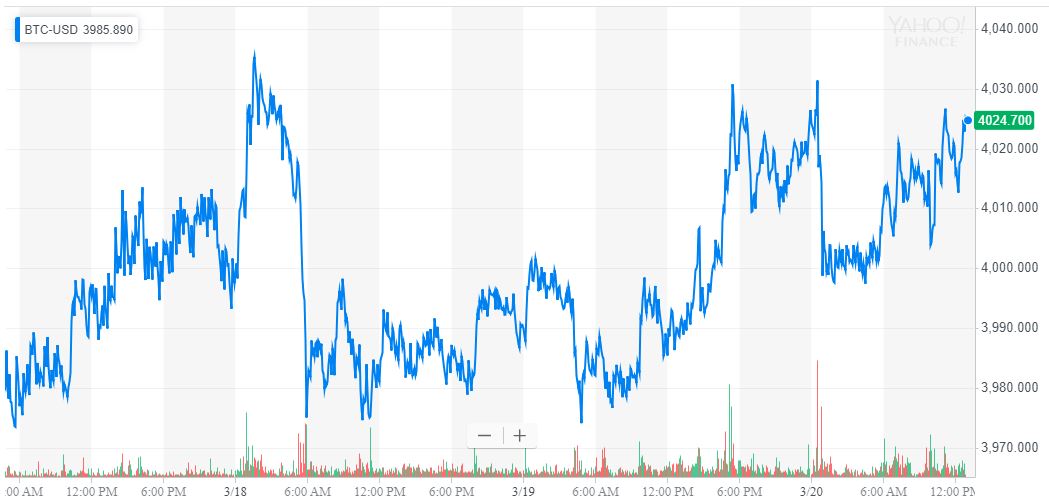

The bitcoin price continues to trade in an extremely tight range around the $4,000 mark. | Source: Yahoo Finance

Meanwhile, the bitcoin price continues to hold near the crucial $4,000 mark as cryptocurrency investors cross their fingers and hope that the embattled asset class has finally turned a corner and begun to creep into a bull market.

Strategy firm Fundstrat recently published analysis indicating that bitcoin – as a high-risk asset – is closely tracking with the performance of emerging markets stocks. In late 2018, EM “pulled down” bitcoin, forcing the cryptocurrency to yearly lows. However, emerging markets are outperforming in 2019, suggesting that bitcoin could have plenty of upside.

CRYPTO (1/2): earlier this year, we noted the “macro” factors such as rally in risk assets plus USD no longer surging are tailwinds 4 $BTC #bitcoin

Chart shows EM in 2018 pulled down $BTC. Notice especially how #bitcoin tried to diverge in late 2018 but ultimately succumbed. pic.twitter.com/kWoPXYctOf

— Thomas Lee (@fundstrat) March 17, 2019

Unless, of course, the EM rally reverses, which is precisely what TS Lombard strategists say is likely to happen in the near-term.

Crypto broker BitOoda warned clients on Tuesday that plunging bitcoin futures volumes portend that BTC could make a “false-break out” toward resistance at $4,200 and that traders who FOMO-buy into that rally would end up taking heavy losses as sell pressure returned to the market.

ThinkMarkets UK CHief Market Analyst Naeem Aslam, on the other hand, said that bitcoin’s recent push past its 200-week moving average, coupled with the end to its longest-ever monthly losing streak, indicated that the market was turning bullish and could set bitcoin on a path well past its current all-time high.

Right now, bitcoin is trading at $3,996 on Bitstamp, representing a 24-hour decline of 0.16 percent. Most other large-cap cryptocurrencies have demonstrated similar single-day stability, as the overall crypto market cap has shifted just $140 million since Tuesday.

[ad_2]

Source link