[ad_1]

By CCN: The Dow floundered on Thursday as the US stock market struggled to mount a convincing recovery from Wednesday’s triple-digit pullback. Meanwhile, the Federal Reserve continues to flex its independence, with Chair Jerome Powell refusing to bow to President Trump’s presumptuous demand that he cut interest rates.

Dow Quakes After Fed Defies Trump Rate Cut Demand

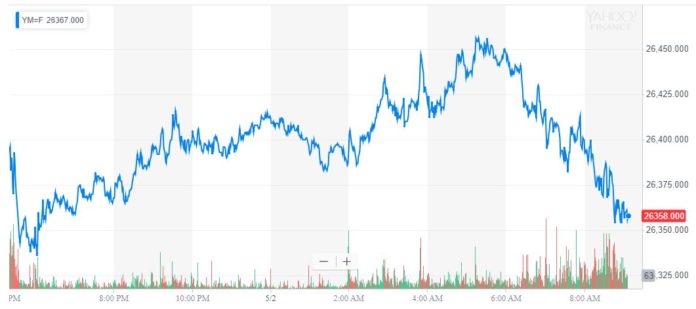

Powell’s move rattled the stock market and continued to weigh on major indices on Thursday morning. As of 9:37 am ET, the Dow Jones Industrial Average had lost 29.81 points or 0.11%; the DJIA last traded at 26,400.33. The S&P 500 traded sideways, while the Nasdaq rose 0.09% to 8,054.52.

The Dow failed to recover after Fed Chair Powell shocked the stock market by defying Trump’s rate cut demands. | Source: Yahoo Finance

On Wednesday, the US stock market took a significant step down during the afternoon session. The Dow slid by 162.77 points or 0.61% to 26,430.14. The Nasdaq dropped 0.57% to 8,049.64. The S&P 500 fared worst, sinking 0.75% to 2,923.73.

Today, Wall Street remains on edge following the latest Federal Open Market Committee (FOMC) meeting, after which Fed Chair Powell clapped back at the assertion that lagging inflation would force the Federal Reserve to initiate interest rate cuts.

“We suspect transitory factors may be at work,” Powell said. “If we did see inflation running persistently below, that is something the committee would be concerned about and something we would take into account when setting policy.”

Donald Trump and his advisors had placed severe pressure on the Fed to cut rates. Earlier this week, the president tweeted that the economy could “go up like a rocket” and set “major records” if the Fed would reverse the rate hikes it implemented earlier in his administration.

China is adding great stimulus to its economy while at the same time keeping interest rates low. Our Federal Reserve has incessantly lifted interest rates, even though inflation is very low, and instituted a very big dose of quantitative tightening. We have the potential to go…

— Donald J. Trump (@realDonaldTrump) April 30, 2019

….up like a rocket if we did some lowering of rates, like one point, and some quantitative easing. Yes, we are doing very well at 3.2% GDP, but with our wonderfully low inflation, we could be setting major records &, at the same time, make our National Debt start to look small!

— Donald J. Trump (@realDonaldTrump) April 30, 2019

Many on Wall Street expected the Fed to cave to Trump’s wishes, much as it seemed to do in late 2018 following the rapid stock market sell-off that wiped the Dow and its sister indices off their all-time highs.

Thus Powell’s power move shocked the markets, sending the previously-buoyant Dow into a tailspin ahead of the closing bell on Wednesday.

How Will Trump Respond?

Trump has not yet commented on the Fed’s analysis that low inflation is “transitory” and should not trigger near-term rate cuts. However, it’s unlikely that the surprise announcement will do much to improve his contentious relationship with the bank or its current chair – a man that, lest we forget, he appointed.

It’s no secret that Trump desperately desires to expend every effort to pump the stock market even further into record territory ahead of the 2020 election, irrespective of the long-term fallout from those economic policies.

Donald Trump appointed Jerome Powell as Fed chair, and he’s regretted it ever since. | Source: REUTERS / Carlos Barria

Unable to pressure Powell into doing his bidding, Trump will almost definitely amp up his attacks on the Fed, which he has frequently used as a scapegoat when the economy has failed to reflect positively on him. That much won’t be surprising.

However, could Trump, enraged at Powell, resurrect his fantasies about booting the Fed chair from office? It’s not like he hasn’t pondered it before, at least according to reports from late 2018.

Firing Powell would be an unprecedented move, but Trump’s an unprecedented president. Does he loathe the Fed chief enough to initiate a constitutional crisis – and potentially rattle the stock market during a heated reelection campaign – by attempting to replace him?

We’ll soon find out.

Click here for a real-time Dow Jones Industrial Average price chart.

[ad_2]

Source link