[ad_1]

By CCN.com: The Dow and broader U.S. stock market pulled ahead Thursday afternoon, but not before a series of volatile swings threatened to unwind three months of runaway growth. A weakening domestic economy and turmoil on the U.S.-China trade front were the main factors weighing on investors’ sentiment.

Dow Ends on a High Note; S&P 500, Nasdaq Follow

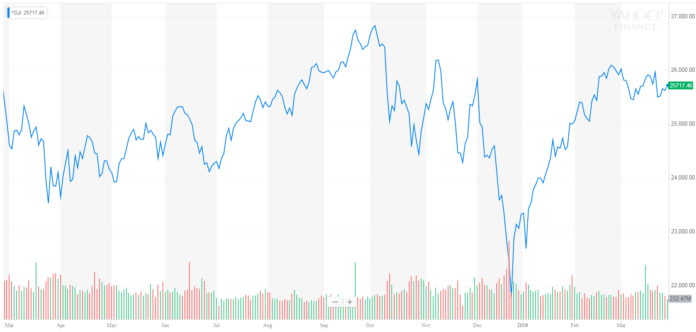

All of Wall Street’s major indexes reported gains Thursday afternoon, but not before initial turbulence. The Dow Jones Industrial Average closed up 91.87 points, or 0.4%, at 25,717.47. The blue-chip index fluctuated within a 167-point range, reflecting a tepid pre-market for Dow futures.

Among the Dow‘s 30 index members, Nike Inc. (NKE) was the top performer, gaining 1.2%. Shares of JPMorgan Chase & Co (JPM) rallied 1.1%.

The broad S&P 500 Index of large-cap stocks gained 0.4% to 2,815.44 after briefly trading below 2,800 earlier. Hacked.com explains why that’s a big deal: Does this Chart Spell Doom for the S&P 500 Index?

A majority of the S&P 500’s 11 primary sectors traded higher, led by a 1% increase for materials stocks. Industrials and financials each reported gains of 0.8%.

The technology-focused Nasdaq Composite Index advanced 0.3% to 7,669.17.

U.S. Economy Portends Future Weakness

The Dow and wider US stock market must grapple with bearish economic data, which shows that GDP grew more slowly than initially reported last quarter. | Source: AFP PHOTO / Brendan SMIALOWSKI

The U.S. economy slowed more than previously reported last quarter, sending a strong signal that the Trump-inspired recovery was losing momentum.

Gross domestic product (GDP), the value of all goods and services produced in the economy, expanded at an annual rate of 2.2% in the fourth quarter, the Commerce Department said Thursday in a revised estimate. That’s well below the preliminary reading, which showed fourth-quarter growth at 2.6% year-over-year.

The downward revision was largely attributed to a slowdown in spending by consumers, businesses, and local governments. It was the second consecutive quarter of weaker expansion after President Trump’s tax cuts produced an annual growth rate of 4.2% in Q2 2018.

Although the U.S. economy is nowhere near recession levels, activity in the bond markets suggests investors are already planning for the worst. On Friday, a closely-watched yield curve inverted for the first time since 2007, a move that economists say accurately foretells recession.

In other data, U.S. initial jobless claims fell by 5,000 last week to a seasonally adjusted 211,000, the Labor Department said. Analysts had called for a modest uptick to 225,000.

[ad_2]

Source link