[ad_1]

By CCN: The United States and China have spent months laboring over a new trade agreement, one that President Trump says will solve longstanding disagreements between the world’s two largest economies.

Wall Street has been just as meticulous in its obsession with the minutiae of the negotiations, seeking to glean how they will impact the stock market.

Almost forgotten is that Trump struck another major trade deal last year, one that – once ratified – could provide the Dow Jones Industrial Average and its peers with a major boost.

Analysts: Trump’s NAFTA Deal Will Add $68 Billion to US Economy

The ITC said that manufacturing will receive the largest boost from the USMCA, which should provide the Dow with some more fuel as it eyes new all-time highs. | Source: Shutterstock

On Thursday, the US International Trade Commission quietly released a nearly 400-page report on the United States Mexico Canada Agreement (USMCA), which fundamentally revises the North American Free Trade Agreement (NAFTA).

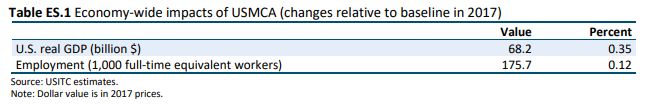

According to the ITC, the USMCA would cause the real US gross domestic product to jump by $68.2 billion or 0.35 percent. Employment, which by some metrics is close to a five-decade high, would jump by another 176,000 jobs or 0.12 percent.

Trump’s revised NAFTA agreement should add more than $68 billion to real US gross domestic product. | Source: ITC

The deal would also bolster the United States’ balance of trade. US exports to Canada and Mexico would increase by 5.9 percent and 6.7 percent, respectively, while imports would rise by 4.8 percent and 3.8 percent.

All in all, the revised NAFTA agreement should promote growth within all sectors of the US economy, which in turn should bolster the Dow and S&P 500 as they seek to extend their decade-long bull markets.

From the report:

“The model estimates that the agreement would likely have a positive impact on all broad industry sectors within the U.S. economy. Manufacturing would experience the largest percentage gains in output, exports, wages, and employment, while in absolute terms, services would experience the largest gains in output and employment.”

Nevertheless, critics pounced on the ITC study, seeking to downplay its impact on GDP growth.

“The miniscule projected gains in this long-awaited official government assessment of the revised NAFTA contradict Donald Trump’s grandiose claims that it will lead to ‘cash and jobs pouring into the U.S.’ and reinforces congressional Democrats’ views that absent more improvements, the revised deal won’t stop NAFTA’s ongoing damage,” Lori Wallach, director of Public Citizen’s Global Trade Watch, said in a statement to CNBC.

The USMCA & the Growing Dow Jones Snowball

The Dow Jones Industrial Average has surged throughout Donald Trump’s presidency. | Source: Yahoo Finance

But while perhaps not as large as Trump had promised when he set out to reshape NAFTA (Let’s be real – Trump was likely a carnival barker in a past life), $68 billion is not a bump that investors should ignore, particularly as perma-bears like David Rosenberg allege that the US is on the brink of recession.

I often stated, “One way or the other, Mexico is going to pay for the Wall.” This has never changed. Our new deal with Mexico (and Canada), the USMCA, is so much better than the old, very costly & anti-USA NAFTA deal, that just by the money we save, MEXICO IS PAYING FOR THE WALL!

— Donald J. Trump (@realDonaldTrump) December 13, 2018

In addition to staving off a brutal recession, a strong economy heading into the 2020 election season could have a snowball effect. Conventional wisdom says that a booming Dow Jones Industrial Average reinforces Trump’s reelection bid. Trump could pound the table – and debate podium – on that point throughout the campaign, all the more if the Democrats nominate a business-hostile candidate like “Crazy Bernie Sanders.”

And while a Trump victory would not be welcomed by much of blue-state New York, it would likely spur a collective sigh of relief on Wall Street. Indeed, Nobel laureate Robert Shiller – who as recently as January predicted that the Dow would sink into a bear market – predicted that a Trump win would prime the stock market for continued growth.

Of course, Congress must still ratify USMCA before the economy can enjoy that $68 billion bump. And with Democrats in control of the House of Representatives until at least the 2020 election, his political opponents could slow-walk that process to deny the president a win.

[ad_2]

Source link