[ad_1]

After a week most bulls would love to forget, the Dow finally looks ready to shake off its slump. The trigger? A cocktail of bullish earnings, a streaming price war, and wildly positive economic data out of China.

Dow Surges Nearly 250 Points

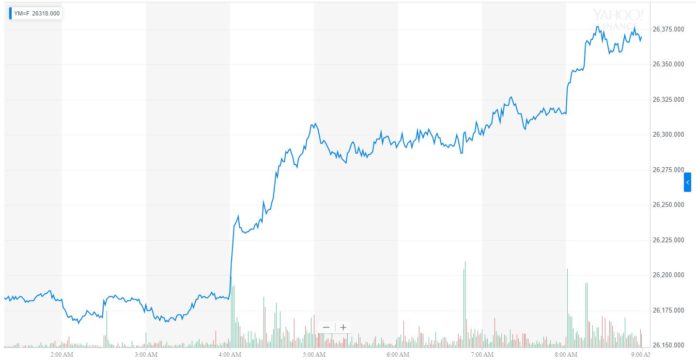

Shortly before the opening bell, Dow Jones Industrial Average futures had surged by 240 points or 0.92 percent, coiling the index for a 232.95 point bounce at the open. S&P 500 futures rose 0.62 percent, and Nasdaq futures climbed 0.44 percent to round out a solid pre-market session.

On Thursday, two of the US stock market’s three major indices posted declines. The Dow lost 14.11 points or 0.05 percent to close at 26,143.05, while the Nasdaq lost 16.89 points or 0.21 percent to drop to 7,947.36. The S&P 500 was unchanged at 2,888.32.

Dow Booms on Bullish Earnings, Disney Magic

This morning, Dow futures boomed after JPMorgan reported first-quarter earnings that smashed analyst estimates and set new records for the investment banking giant.

“We had record revenue and net income, strong performance across each of our major businesses and a more constructive environment,” CEO Jamie Dimon boasted, gushing that the US economy is “healthy” and strong. “Even amid some global geopolitical uncertainty, the U.S. economy continues to grow, employment and wages are going up, inflation is moderate, financial markets are healthy and consumer and business confidence remains strong.”

Though not one of the Dow’s 30 index members itself, Wells Fargo’s earnings beat also contributed to the rally because it clapped back at bearish portents of a “brutal” corporate earnings season – one that threatened to snap the wind out of the sails of the stock market’s 2019 recovery.

JPMorgan’s earnings beat could help quell fears of a looming earnings recession. | Source: Yahoo Finance

So has Wall Street escaped that earnings recession?

We’ll find out soon. On Monday, UnitedHealth Group – the Dow’s second-largest component after embattled aerospace stock Boeing – will report its earnings. UnitedHealth stock plunged more than 4.3 percent on Wednesday, likely due to concerns over the anticipated earnings bloodbath.

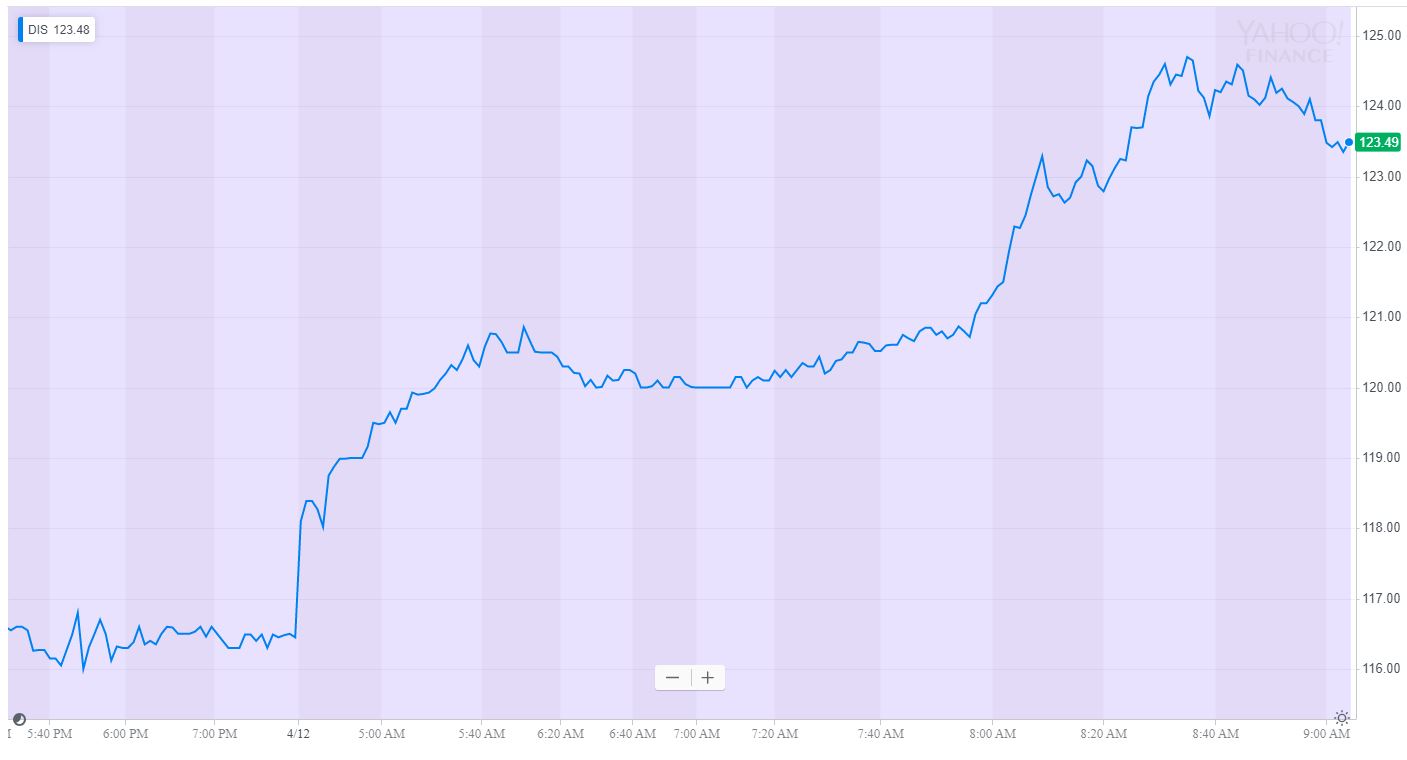

While not earnings related, the Dow received another major boost from Walt Disney Co, which unveiled the blockbuster details of its long-awaited streaming service, Disney+. Most notably, Disney CEO Bob Iger revealed that the firm’s “Netflix killer” would cost just $6.99 per month – a full $2.00 per month cheaper than Netflix’s cheapest subscription.

Disney stock surged by 6.5 percent in pre-market trading, while Netflix shares dropped by 2.48 percent on the news.

Disney stock surged higher after Bob Iger unveiled the details about its Disney+ streaming service. | Source: Yahoo Finance

China’s Economy Bounces Back

Other market analysts attributed the Dow’s Friday boom to positive economic data out of China, which has struggled to brush off recession warnings amid an ongoing slowdown. Year-over-year Chinese exports surged by 14.2% in March, just one month after February’s shocking decline. Beijing’s trade surplus also rebounded sharply to $32.64 billion from just $4.12 billion the previous month.

“Chinese data looks to be the main driver of the gains on Friday. While we shouldn’t get too carried away with the numbers – February’s data is a clear reminder how volatile they can be this time of year – they are encouraging,” Craig Erlam, senior market analyst at Oanda told MarketWatch.

China’s economic bounce, coupled with US Treasury Secretary Steven Mnuchin’s claim that the world’s two largest economies had cleared a key trade deal hurdle, should fuel the narrative that the equities bull market has more room to run.

[ad_2]

Source link