[ad_1]

A few household names dominate streaming: Amazon, Hulu, and Netflix are among the industry leaders. Disney has decided that a 60 percent ownership share in Hulu isn’t enough, so they’ve launched a Disney streaming service called “Disney+.”

Disney has earned more than $35 billion at the Box Office for movies produced over the last 12 years. Meanwhile, Netflix paid $100 million to AT&T, TimeWarner for one year of exclusive rights to stream “Friends” in December of 2018. Disney is looking to extend their earning potential into the streaming market, but UBS analyst John Hodulik worries they may lose money by revoking licenses from other streaming services. When compared against Netflix stock in terms of performance, Disney is up 17 percent year-to-date (YTD), compared to Netflix, which is up over 32 percent YTD.

Head of Marvel, Kevin Feige said:

“The Marvel series will connect directly to the cinematic universe and to each other. An animated series called “What If” will also be available on Disney+. It will explore hypothetical questions like: what would have happened if Peggy Carter had been given the super serum instead of Steve Rogers?”

How Did The Announcement Affect Disney Shares?

Disney+ will come with 18 of Pixar’s 21 movies (e.g., Monsters Inc.), most Marvel films, 30 seasons of Simpsons episodes, the Disney movie catalog (Mulan, Snow White, Lion King, etc.), recent Disney movies (Moana, Frozen, etc.), 5,000 episodes of Disney Channel shows and 100 Disney Channel original movies, and a lot more all out of the box.

Other favorites Disney hopes that by reclaiming their content from other streaming services and continuing to produce more content with the same, beloved characters, they can reach 60-90 million users by 2024. For example, Monsters Inc. being expanded into series’ like “Monsters at Work” to better engage fans. Success in reaching this goal can provide a strong upside potential

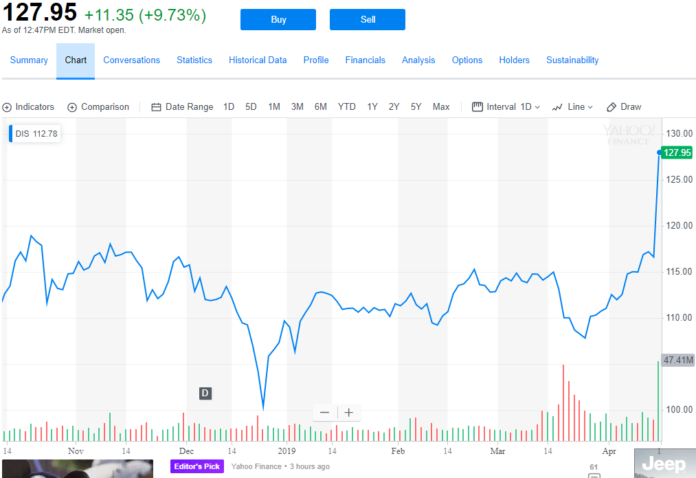

Disney+ will be available to customers for $6.99/month or $69.99/year ($5.83/month.) Since the price announcement, Disney (NYSE: DIS) shares have risen more than 9.5 percent, setting the stage for the best single day for Disney shareholders since May 2009.

Disney stock climbs more than 9% following Disney+ streaming price announcement. Chart: Yahoo Finance

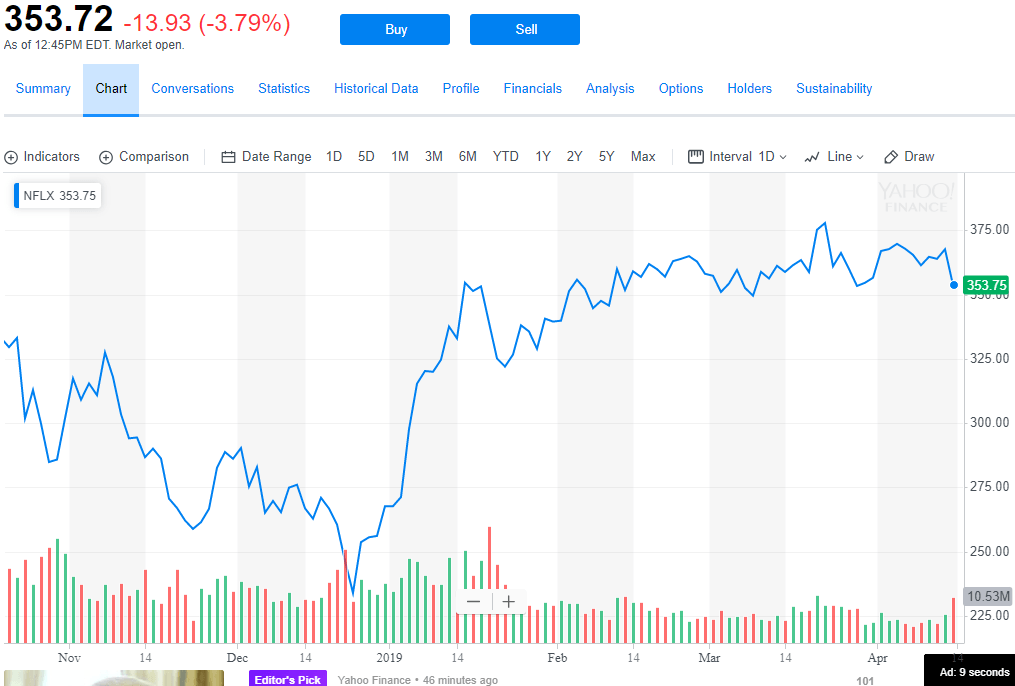

Netflix stock (NSDQ: NFLX) has taken a fall as of the time of writing, down 3.5 percent.

Netflix stock tanks by over 3.5 percent following Disney streaming price announcement. Is Apple playing a role in the decline? Chart: Yahoo Finance

Why do people want another streaming service?

Many streaming niches are already saturated. Disney streaming offers a low-cost option for kids’ shows and movies. Some parents may watch content like The Simpsons with or without their kids. Most content on Disney+ targets children. The underserved kids market offers Disney+ strong upside potential.

Any of the content on Disney+ will be downloadable, meaning kids can take their favorite content anywhere without costly phone service fees—something parents will appreciate.

Disney now owns Fox Media and all of its subsidiaries, ESPN, A&E (a 50 percent share), and all of their catalogs. Disney recently purchased the Marvel catalog, Star Wars, and more. They will be expanding these series with live action and animated series.

It remains to be seen if Disney streaming can kill Netflix. Without adding more adult content and risking dilution of the platform, Disney+ May not be able to take market share away from Netflix, but they can certainly eek out advantage with their combined controlling share in Hulu and a kids’ specific streaming platform when it launches in November 2019.

[ad_2]

Source link