[ad_1]

A total of $38.06 billion have entered the emerging cryptocurrency economy in the past week.

The cryptocurrency market cap, which combines the worth of all crypto assets in circulation, shot up towards circa $185.62 billion this Monday, up 28.58-percent from its weekly low. The surge began when dominant crypto asset bitcoin settled for a volatile upside action on April 2. The asset’s 23-percent rise provoked a similar bullish sentiment across the board.

One day after the bitcoin rally, Bitcoin Cash, the seventh largest cryptocurrency, rose as much as 100-percent in a week. At the same time, Litecoin closed above its 2019’s high by surging more than 50-percent. EOS, XRP, Ethereum, Stellar and Cardano also noted double-digit percentage gains in their respective markets.

Trump Calls for Expansionary Policy

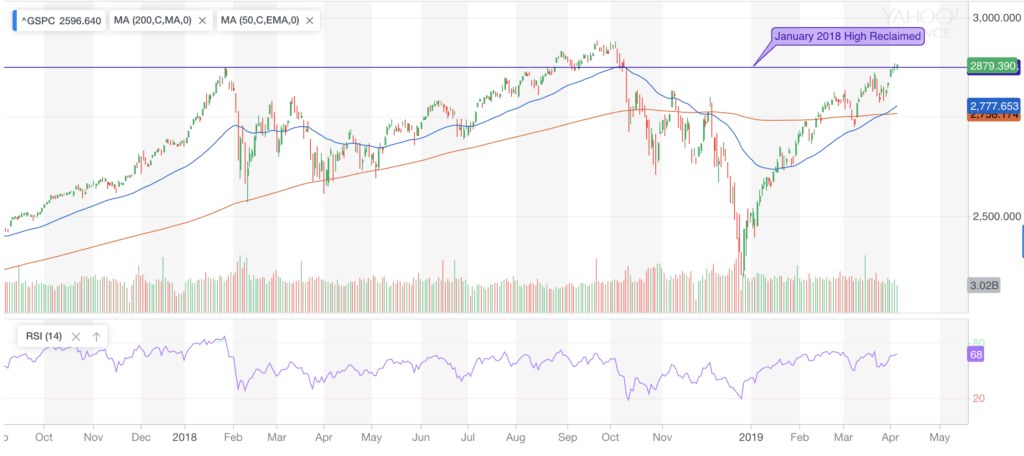

The crypto rally matched shoulders with the stock market performance in the mainstream. The S&P 500 Index last week reclaimed its January 2018 highs. Though the S&P 500 and the cryptocurrency market do not correlate directly, both the markets lately reacted to what was happening in the US economic space.

US President Donald Trump on Friday blamed the Federal Reserve for the stock market’s dismissal performance in 2018. The Fed raised interest rates four times last year, in a range between 2- and 2.25-percent, leading to investors jumping from US stocks to more comfortable fiat assets like the US dollar. But the Fed lately announced that it would pause its rate hikes in the face of global and domestic economic turmoil and demand from the US President.

“Well, I personally think the Fed should drop rates,” Mr. Trump said. “I think they really slowed us down. There’s no inflation. I would say – in terms of quantitative tightening – it should actually now be quantitative easing. Very little if any inflation. And I think they should drop rates, and they should get rid of quantitative tightening. You would see a rocket ship. Despite that, we’re doing very well.”

#Bitcoin sentiment… pic.twitter.com/FQmO19h2Hb

— Callum Thomas (@Callum_Thomas) April 7, 2019

A potential QE program typically leads to a stock market pump. Market participants like the thought of more dollars coming into the economy, which leads them to offload them into stocks with bullish sentiments. That also means that investors could look beyond conventional financial instruments, like bitcoin, to distribute their portfolio risks. As a result, more money flows into the emerging cryptocurrency space.

[ad_2]

Source link