[ad_1]

Cryptocurrency prime dealer SFOX released its monthly volatility report this week, and while it is not all plain sailing for the crypto market the indicator clearly affirms that this week’s massive Bitcoin price rally was built on a firm foundation.

SFOX: Low Volatility and Rising Investment Bolster Crypto’s Bull Case

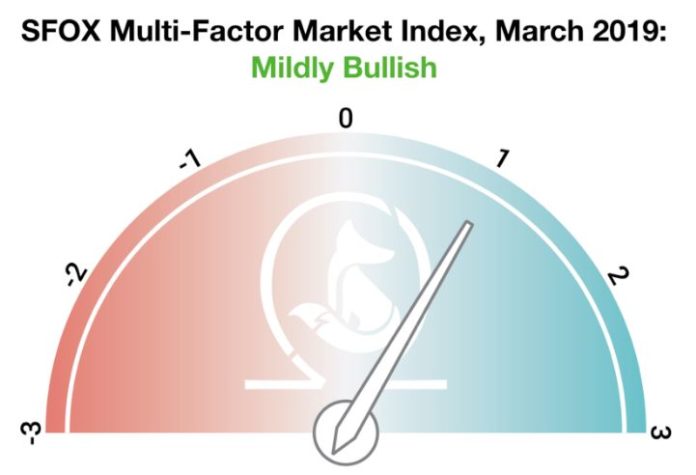

According to SFOX, the crypto market remained “mildly bullish” heading into April. In March, the main fundamentals were low volatility and increasing investment. Similar to February’s report, SFOX was encouraged by the continuing investment in cryptocurrency infrastructure despite Bitcoin’s sideways trend.

“At the same time that crypto volatility was decreasing, reports told of major companies like Visa and Facebook investing in crypto technologies. This reinforces the narrative that the industry as a whole is continuing to mature, attracting the attention of more institutions as infrastructure improves.”

Maturity is a big deal for an asset class that wants to become a widespread medium of exchange. Of the two corporations mentioned, the involvement of Visa is possibly the most interesting. Naturally, they have the most to lose from not evolving to the threat from Bitcoin. If Visa sees applications for cryptocurrency, this is a tremendous affirmation of the “usefulness” case argument.

Bitcoin Cash, Litecoin, and Ethereum Classic Are Decoupling From Bitcoin

Moving away from Bitcoin for a second, SFOX says that it appears that Litecoin, Bitcoin Cash, and Ethereum Classic are starting to move independently from BTC/USD.

“LTC, BCH, and ETC all showed noteworthy volatility movements that weren’t obviously related to BTC, suggesting that the industry at large may be growing beyond BTC.”

One of the strongest arguments against trading altcoins was the incredibly strong correlation between Bitcoin and its offspring. How can you diversify a portfolio when it simply rises and falls as BTC does? If SFOX is correct, a decoupling would certainly make speculation in these smaller market cap coins more interesting – and possibly more secure. It will be curious to see if these dynamics hold up as Bitcoin regains a bit of its trademark volatility.

Bitcoin Cash Rally Questioned Over Fears of Fake Volume

SFOX warns that the Bitcoin Cash rally accompanied suspicious trading volume. | Source: CoinMarketCap

After its incredible surge over the last few days, Bitcoin Cash has been back in the limelight. While the price action hasn’t looked terribly “organic” (to put it politely), there has been some increased interest in BCH. Unfortunately for BCH enthusiasts, SFOX does raise major concerns about the validity of the trading volumes. Spoof volume could call into question the positive price action they saw last month.

“BCH’s trading volume was also led by LBank — an exchange that was recently highlighted in a report of exchanges that may potentially be faking a large portion of their alleged trade volume. It’s possible, therefore, that this March BCH rally may have been one of those spooky ‘rallies’ that wasn’t grounded by anything fundamental.”

Regardless, the amount of money that continues to flow into blockchain and cryptocurrency applications is definitely encouraging. SFOX’s “mildly” bullish outlook has already been confirmed by Bitcoin’s jump over $5,000 this week. Crypto bulls will be hoping that in next month’s report, there won’t be any need for the adverb.

[ad_2]

Source link