[ad_1]

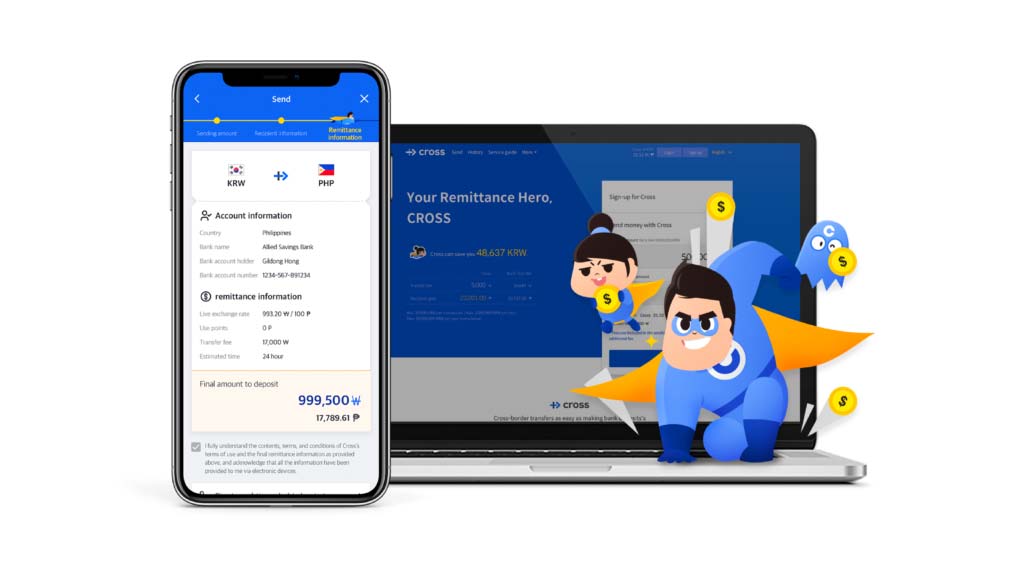

This month Coinone Transfer, a payments business and a subsidiary of Coinone, introduced South Korea’s first blockchain-powered remittance mobile app and web service called Cross — offering faster, lower cost payments to Thailand and the Philippines.

Unlike other remittance options in South Korea, Cross does not rely on traditional banking rails. Rather, it provides a safe alternative for those with or without a bank account, and the increased payment transparency and reliability inherent to Ripple’s advanced blockchain technology.

With plans to aggressively expand across the region over the coming months, Coinone Transfer quickly rolled out the service through new financial institutions using RippleNet — connections formed with Siam Commercial Bank (SCB) in Thailand and Cebuana Lhuillier in the Philippines.

Coinone Transfer’s partnership with SCB also will soon offer Cross customers a direct link to PromptPay, which enables any recipient with a bank account in Thailand to receive a payment directly and instantly.

Growing Demand in the South Korean Market

With an estimated two million immigrant workers living in South Korea — more than 3.4% of the overall population — the need for improved remittance services like Cross has never been greater.

According to a 2017 government report, Thai immigrant workers number more than 153,000 and are the third-largest immigrant population in the country. The Filipino immigrant population is not far behind with approximately 58,000 people working in South Korea today.

Not surprisingly, the rate of remittances into and out of the country is skyrocketing — with the World Bank estimating approximately $17 billion in remittance last year alone.

Addressing Real Customer Pain Points

In the past, remittance options in South Korea were limited. For those sending smaller sums of money overseas, the cost of sending a payment was often too high to justify. Tracing payment history was extremely complex — customers didn’t know the exact date or time for the delivery of the funds nor were they able to cancel a payment request once it was in progress.

In July 2017, the South Korean government began offering Global Remittance Licenses to non-bank businesses operating remittance services in the country. This combined with the introduction of the new Cross service finally provides these customers with a better way to send money abroad — options that are less costly, faster and more reliable than traditional options.

One of the primary benefits of RippleNet is that it enables banks and payment providers to join together and provide a better experience for all their end users.

Helping Solve A Global Problem

Friction in global payments is felt universally — from people who want to send money to loved ones but face high costs and slow times, to growing businesses that need to send payments internationally in order scale.

This is particularly true in countries across the Association of South Eastern Asian Nations (ASEAN) region that lack a reliable and comprehensive network of correspondent banks, and therefore, face extreme inefficiencies and costs for cross-border payments.

In the past year, RippleNet has helped enable a multitude of new services aimed at addressing this problem, including a new “multi-hop” feature on RippleNet pioneered by SCB, access to Latam and Europe for InstaReM’s remittance customers across the region and The Japan Bank Consortium’s MoneyTap mobile app.

While the market opportunity for these industry innovators is huge, the value of services and technology they’re deploying is is even greater — it has the potential to change lives for millions of people working and living abroad in ASEAN.

[ad_2]

Source link