[ad_1]

By CCN.com: According to Zirui Zhang, the head of business development at Neutral Project, a stablecoin backed by Sequoia Capital, a major venture capital firm with $1.4 trillion of market value, some crypto exchanges in China has listed Bitfinex token futures contracts.

Latest: some exchanges in China already listed #bfx token’s futures contract… people are trading over there based on the assumption that there’s not enough evidence and court will delay its decisions… 🤔 #USDT #Tether pic.twitter.com/qHipAaqKv1

— Zirui 🧜🏻♀️ (@zirui_z) May 2, 2019

On April 30, CCN reported that Dong Zhao, a billionaire investor in Bitfinex, disclosed the plan of the exchange to create an exchange-based token following the $900 million Tether scandal.

At the time, Zhang said that some big whale investors in Asia reserved $300 million in allocations for the proposed token distribution.

As extensively reported by CCN, on April 25, the office of the New York Attorney General Letitia James sued iFinex, the company that oversees Tether and Bitfinex, alleging Bitfinex of mismanaging $900 million of Tether’s cash reserves in an attempt to “cover-up” its $850 million loss.

The Attorney General alleged that Bitfinex sent $850 million to a Panama-based “bank” called Crypto Capital to process payments but failed to recoup the funds.

The document released by the Attorney General’s office read:

In order to fill the gap, executives of Bitfinex and Tether engaged in a series of conflicted corporate transactions whereby Bitfinex gave itself access to up to $900 million of Tether’s cash reserves, which Tether for years repeatedly told investors fully backed the tether virtual currency ‘1-to-1,’” the official document released by the Attorney General’s office read.

To recover the $900 million Bitfinex borrowed from Tether, which sparked controversy because the firm did not disclose the dealing to the users of the exchange, Bitfinex reportedly has been considering distributing an exchange-based token that most likely would represent ownership in the exchange.

Why are crypto exchanges already listing bitfinex futures?

Zhang has said that a few small crypto exchanges based in China have already listed futures contracts for the Bitfinex token.

“Bitfinex will use the unfrozen funds in the future to buy back the tokens they are yet to issue, and burn them, to increase the value of the yet to be issued,” she explained.

Small crypto exchanges have suffered throughout the past 17 months due to an overall decline in real trading volume and the presence of dominant players in the sector such as Binance, Coinbase, Kraken, and Bitfinex that represent the majority of the legitimate bitcoin volume.

5/ Only 10 exchanges have >$1M real daily bitcoin trade volume. @binance, @bitfinex, @krakenfx, @Bitstamp, @coinbase, @bitFlyerUSA, @Gemini, @itBit, @BittrexExchange, @Poloniex / @circlepay

You can see the daily BTC trade volume on these exchanges at: https://t.co/MQ4CD3K9hz pic.twitter.com/yLFiL8kQNn

— Bitwise (@BitwiseInvest) March 22, 2019

Some exchanges may consider the potential launch of the Bitfinex token as an opportunity to generate traction in the near-term, assuming that the Bitfinex court case would possibly go on for years before a settlement is reached.

Will the market remain unaffected?

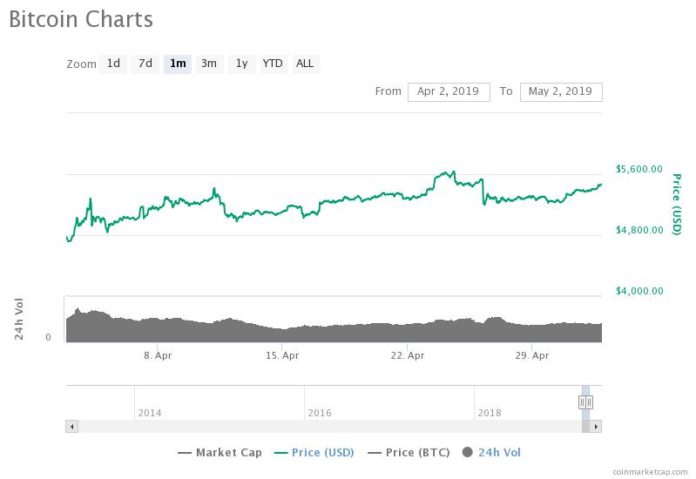

Initially, when the Tether scandal emerged in late April, the bitcoin price crashed quite violently in most major markets, dipping to as low as $5,089 on Coinbase.

The bitcoin price crashed by around 7 percent following the Tether scandal (source: coinmarketcap.com)

Since then, the bitcoin price has recovered to $5,351, demonstrating fairly strong momentum in the past week.

Although other stablecoins like Circle’s USDC and Paxos’ PAX are trading with a premium over Tether at around $1.02, a steep sell-off of Tether like many investors expected did not occur.

“The market just doesn’t care. This community has an immense tolerance for pain,” a crypto trader asking for anonymity due to the sensitivity of the topic told the WSJ.

But, some experts have expressed concerns over the magnitude of the case and what the case could potentially evolve into in the future.

Preston Byrne, a lawyer at Byrne & Storm, P.C., said:

In my view, this [iFinex case] will turn out to be the most consequential regulatory intervention in the crypto-sphere, anywhere in the world, of the last 3 years.

[ad_2]

Source link