[ad_1]

A Chinese government report has outlined a plan to kill bitcoin mining within its borders. The report, issued by the National Development and Reform Commission (NDRC), lists cryptocurrency mining as an industry that should be eliminated with immediate effect.

While the report is currently in a development stage, if enacted it could stop the recent bitcoin rally in its tracks. Bitcoin surged 27% in the last week to hit a 2019 high, holding above the $5,000 barrier. The proposed crypto mining ban in China, however, could have a negative effect on bitcoin’s value and market capitalization.

Bitcoin’s recent price surge could be crushed after news that China plans to ba crypto mining. Source: CoinMarketCap

China’s Proposed Bitcoin Mining Ban, Explained

The NDRC report outlines 450 activities it believes China should encourage, limit, or ban completely. Specifically, it highlights industrial activities that infringe upon laws and regulations or have a negative impact on the environment.

The report will be open to public comments until the May 7th. At which time, the report will be finalized and put into practice.

The NDRC is a branch of the State Council, a cabinet level authority and part of the Central People’s government.

Bitcoin Mining Ban: Effect on Crypto Prices?

Needless to say, the proposed mining ban would almost certainly have a negative short-term effect on the bitcoin price.

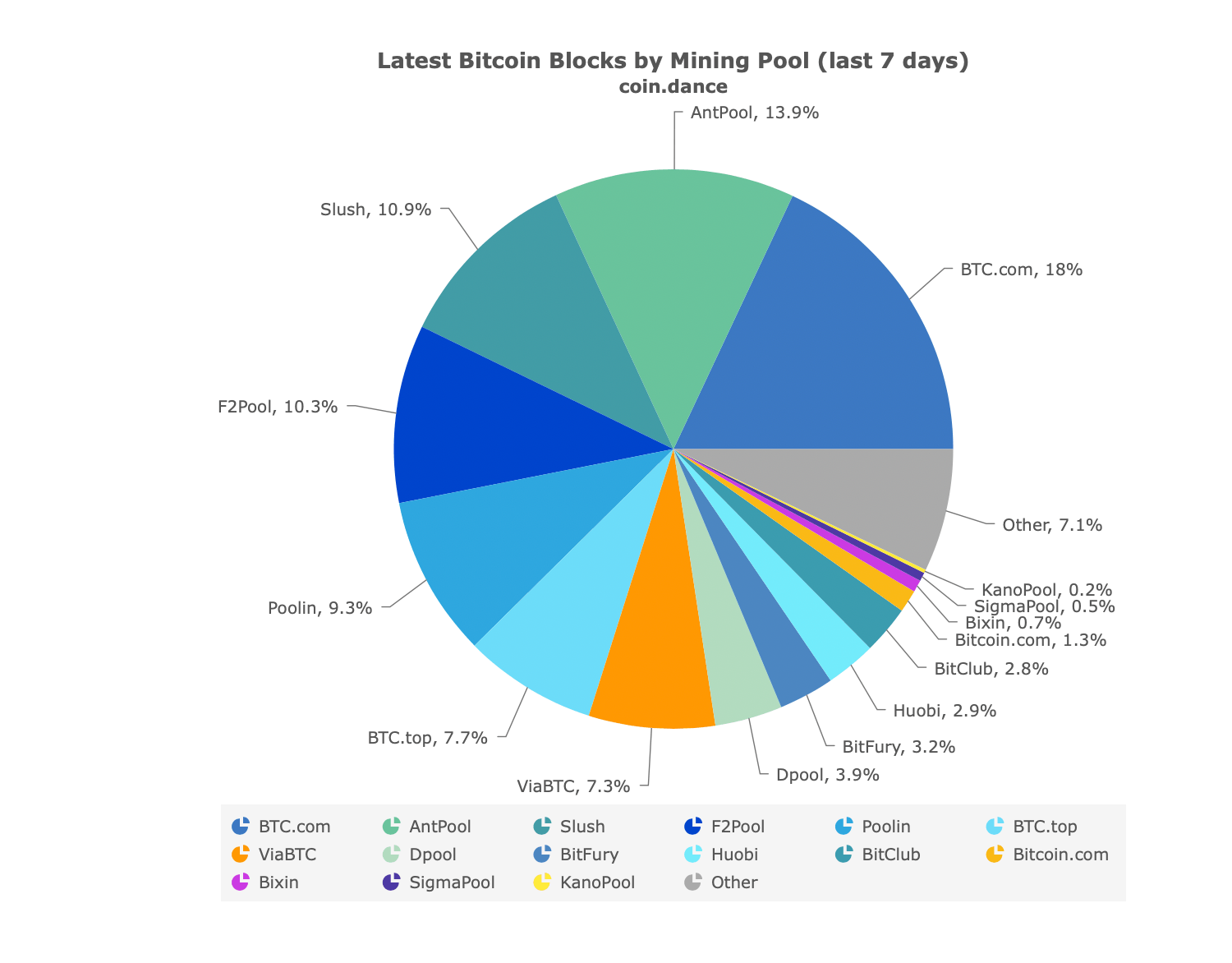

China plays host to four of the five largest bitcoin mining pools on the planet, including BTC.com, Antpool, F2Pool, and Poolin. In the last seven days, these four Chinese-based pools commanded more than 50 percent of the total bitcoin mining hash rate.

At its peak, Chinese mining firms may command up to 70 percent of bitcoin’s hash rate. If these pools were suddenly halted, the bitcoin network would lose significant hash power, causing transactions to slow down.

Crypto Prices Would Recover

After a short-term price shock, it’s likely that prices would stabilize and recover. Bitcoin mining activity would inevitably shift out of China to other locations. Other pools, such as Slush Pool in the Czech Republic and Bitfury in Georgia would pick up the slack.

Even major Chinese crypto miners appear to have seen this coming, moving some of their operations out of China. Bitmain, for example, now has operations in the US.

China’s Crusade Against Crypto

This is by no means the first time China has clamped down on bitcoin activity. In 2017, it outlawed all initial coin offerings (ICOs). It also closed down crypto exchanges, forcing companies like Binance to shift operations to Malta.

China continues to deliver blows to the cryptocurrency industry, but it is unlikely to kill it for good. As we have seen, the bitcoin ecosystem will simply flock to other regions. This time will be no different.

[ad_2]

Source link