[ad_1]

“Don’t Let The [Bitcoin] Price Distract You”

Ardent Bitcoin advocate Anthony Pompliano, better known as “Pomp” in the cryptosphere, recently took to his well-followed Twitter soapbox to tout the fact that in spite of BTC’s price decline, the fundamentals of the network backing the asset are undoubtedly booming.

Bitcoin’s fundamentals are strengthening. Don’t let the price distract you.

The best performing asset in the last 10 years isn’t going anywhere.https://t.co/avY2WrA1q0

— Pomp 🌪 (@APompliano) November 30, 2018

Citing a recent installment of Off The Chain, a well-respected, crypto-centric newsletter headed by Pomp, the former Facebook and Snapchat employee simply put that “Bitcoin has become stronger,” while BTC itself has fallen from an all-time high at $20,000 to $4,100 today (80% decline).

Pomp added that even while mainstream media outlets have prematurely proclaimed that “cryptocurrency is dead!” and/or a Ponzi scheme, these cries for a Bitcoin death throe are nothing more than a surface level observation, rather than logical analysis. As put by the Morgan Creek Digital partner, well-known in the cryptosphere for his anti-bank, pro-crypto rhetoric:

Fortunately, nothing could be further from the truth. The fundamental drivers of the decentralized technology network are actually growing.

Bitcoin Tx Fees Fall, As Transaction Count Booms

Compiling and aggregating a list of “key data points,” the industry insider drew attention to pertinent indicators that signal that the underlying fabric of Bitcoin is swelling, rather than shrinking in correlation with prices.

The number of users on Blockchain.com, for one, has exploded from 10 million in late-2016 to 32 million today, a staggering growth rate, even for the most innovative industries. And as the number of wallets has swelled, so has the total Bitcoin transaction count, growing by 33% in the past year alone. This, of course, can be attributed to the adoption of the asset for payment and speculative purposes, along with the rise in popularity of Segwit, which facilitates higher tx/s limits.

Pomp also drew attention to the rapidly growing “number of transactions excluding popular addresses (exchanges mostly),” indicating that Bitcoin has found itself used actively in innovative systems or via payment networks.

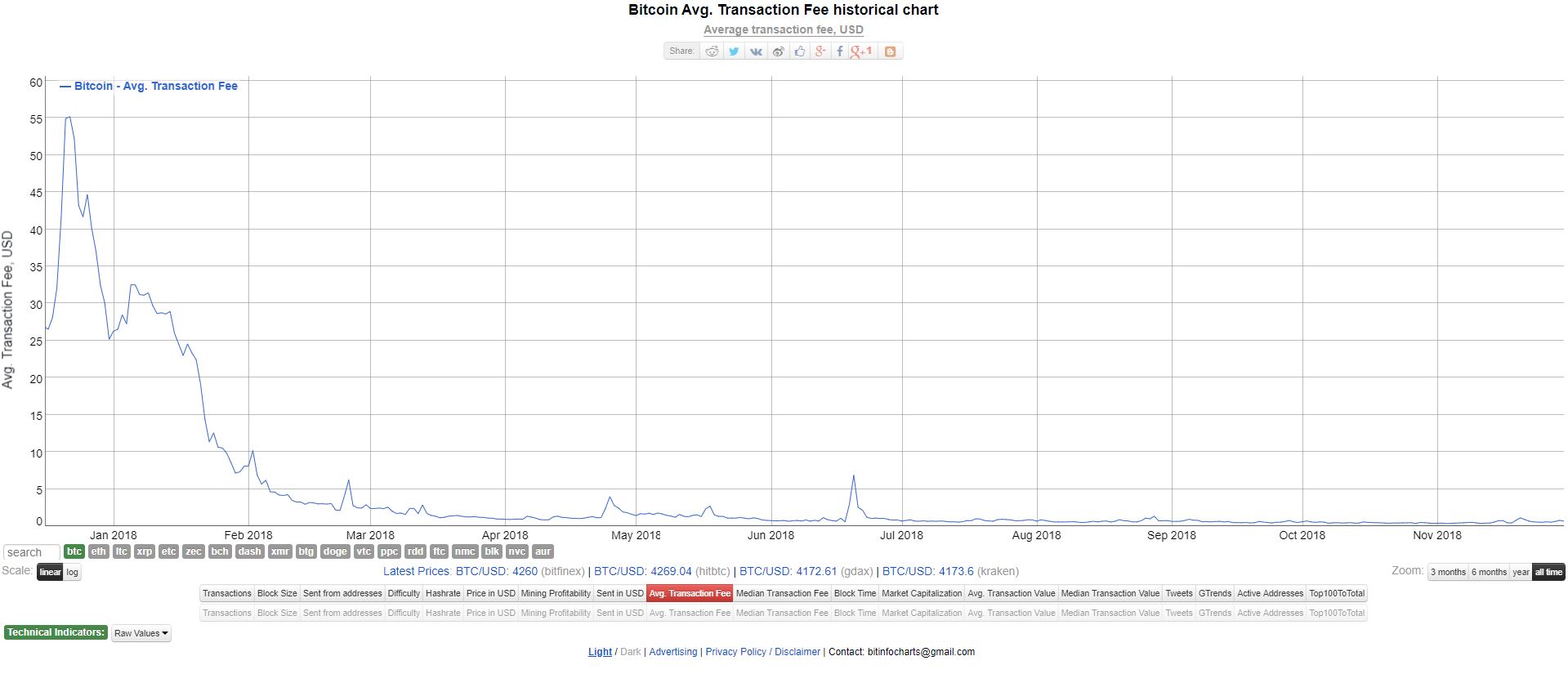

And contrary to popular belief, through all this adoption, the average BTC transaction fee has continued to fall, with BitInfo indicating this statistic has fallen from $52 in late-December 2017 to just $0.6 today. As noted in a recent Ethereum World News report, a ‘whale’ recently sent over $600 million for $7 in fees (he/she/they overpaid).

In reality, however, the already cheap fees are actually a lot smaller, with blockchain.com currently citing a $0.06 fee for transactions through its service, a fee that is near-negligible except in microtransactions.

Mining, Node Ecosystem Remains Strong

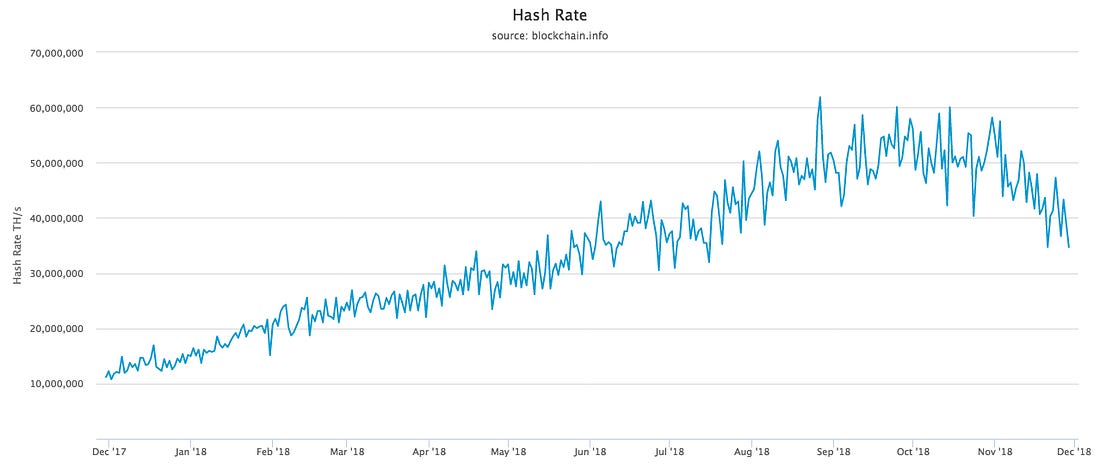

Despite the recent hashrate decline seen on the Bitcoin Network, from a long-term perspective, everything is all fine and dandy, pointing out that hashrate has quadrupled in the past year alone. Moreover, from a logarithmic chart view, the recent decline is just a drop in the bucket.

Closing off his analysis, drawing attention to a lesser-known indicator, Pomp brought up the number of active Bitcoin nodes, pointing out that this figure has risen by 98% in the past two years to 10,510.

And keeping all this in mind, Pomp explained that this innovation isn’t going anywhere, adding that traders shouldn’t be distracted by the noise (price), instead focusing on the fundamentals. In short, as Pomp noted:

While it (BTC price) is important, it is not an important measurement of future value. The underlying fundamentals for the blockchain appear to be growing stronger despite the decline in the current price… Bitcoin isn’t going anywhere.

Pomp Lauds Crypto On CNBC

This most recent advocacy for this nascent industry comes just days after Pomp took to CNBC’s Squawk Box, a much-watched financial markets segment, to bash critics of Bitcoin.

The Morgan Creek representative exclaimed that at its core, Bitcoin is the world’s most secure transaction settlement layer, so value in BTC will always exist. He added that cryptocurrencies as a whole are the best performing asset class in the past decade, even ousting the U.S. equities market, which has been on its longest and most notable bull run in decades.

Title Image Courtesy of Marco Verch Via Flickr