[ad_1]

On BitMEX Crypto Trader Digest, BitMEX CEO Arthur Hayes reaffirmed his prediction for bitcoin, foreseeing the dominant cryptocurrency achieving $10,000 in price by the end of 2019.

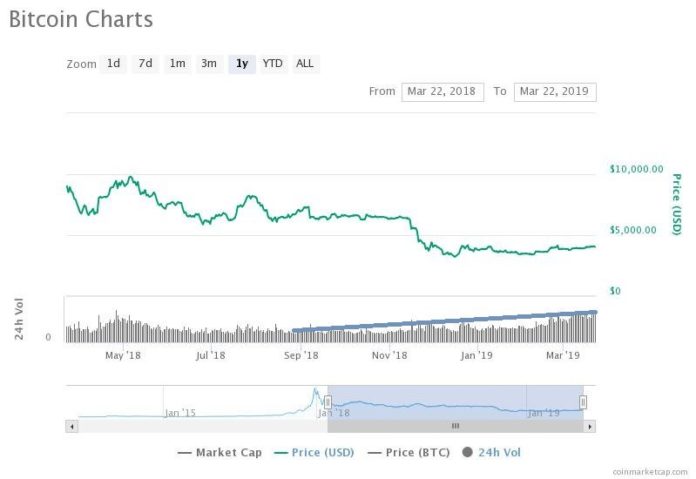

Previously, in mid-2018, when the sentiment around bitcoin was still generally optimistic, Hayes said that the asset had not found its bottom and is likely to fall below $5,000.

Now, a newsletter sent from the desk of Hayes read:

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Green shoots will begin to appear in early Q4. Free money and collective amnesia are powerful drugs. Also after two years of wage cucking, punters should have a few sheckles to rub together.

The 2019 chop will be intense, but the markets will claw back to $10,000. That is a very significant psychological barrier. It’s a nice round sexy number. $20,000 is the ultimate recovery. However, it took 11 months from $1,000 to $10,000, but less than one month from $10,000 to $20,000 back to $10,000.

Melissa Lee peep this. $10,000 is my number, and I’m stickin’ to it.

At the time of writing, the bitcoin price just remains above $4,000.

Why $10,000 Bitcoin By 2019?

Even before bitcoin reached its all-time high at $20,000 in late 2017, the $10,000 level was considered a psychological barrier by many cryptocurrency analysts.

As soon as bitcoin broke the $10,000 level for the first time, it experienced an exponential increase in price to an all-time high at $20,000.

Considering the 15-month correction the cryptocurrency market has gone through, analysts and industry executives including Hayes do not expect bitcoin to complete the “ultimate recovery” to $20,000 by the year’s end.

Hayes emphasized that no asset goes up or down in a straight line and that the level of volatility of cryptocurrencies could remain low throughout the upcoming months.

But, Hayes said that the asset could begin to recover by the year’s end, as it approaches the two-year mark since the beginning of its correction in early 2018.

“All is not lost; nothing goes up or down in a straight line. 2019 will be boring, but green shoots will appear towards year end. The mighty central bank printing presses paused for a while, but economic sophists could not resist the siren call of free money,” Hayes wrote.

An optimistic long-term forecast of bitcoin by Hayes could be considered a positive indicator of recovery because as Hayes noted in the past, BitMEX does not necessarily need the price of bitcoin to sustain its revenues.

As a cryptocurrency trading platform with margin trading options, BitMEX benefits from any kind of volatility and it is of less importance whether bitcoin drops or rises in price in the short-term.

Various Fundamental Catalysts

In recent months, as reported by CCN, the daily volume of bitcoin and the rest of the cryptocurrency market has increased substantially, suggesting an overall increase in trading activity in the cryptocurrency market.

Bitcoin-focused businesses in the likes of Bakkt have been able to either expand their ventures rapidly or secure large valuations amidst arguably the worst bear market in the history of the cryptocurrency market on paper.

On Thursday, according to a report by The Block, ICE’s Bakkt, which is set to launch a bitcoin futures market by mid-2019, secured a $740 million valuation.

Bakkt securing a $740 million valuation without having opened a bitcoin futures market shows that investors are confident the volumes of Bakkt, when launched, would be able to generate sufficient revenues.

The Bitcoin network is also approaching a block reward halving in 2020 and historically, bitcoin has tended to see an increase in price a year before a having occurred.

A decline in the block reward leads to an increase in the price of bitcoin because it reduces the rate in which new bitcoin is generated, declining the available supply in the exchange market.

[ad_2]

Source link