[ad_1]

Poor business decisions and a prolonged bear market may have knocked it off its pedestal, but the world’s most valuable cryptocurrency is going to be alright.

That’s according to a new report from BitMEX Research, which aims to provide a sober analysis on bitcoin mining giant Bitmain’s planned initial public offering (IPO), which will reportedly take place in the near future.

Bitmain Likely Seeing ‘Significant’ Losses

That IPO has been shrouded in mystery, with some reports alleging it could raise $18 billion and vault Bitmain’s market cap as high as $50 billion by the end of the year, and others claiming it will raise just $3 billion at a market cap close to its present $14 to $15 billion valuation.

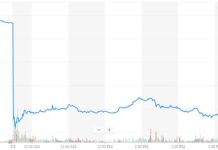

Those lower figures had come amid reports that Bitmain has lost hundreds of millions of dollars due to risky bets placed on bitcoin cash, which is currently down 88 percent from its all-time high, and that the firm, which once controlled 85 percent of the cryptocurrency ASIC market, has lost its competitive edge in terms of technical development. They were also accompanied by public denials from Tencent and Softbank that they had participated in Bitmain’s latest funding round.

BitMEX Research says that those claims are largely accurate. The report estimates that Bitmain may have lost $328 million due to its BCH investment, eating into its massive profit figures from the first quarter, which seemingly placed it on par with decades-old chipmaking giant Nvidia.

Perhaps more seriously, the report states that three successive generations of Bitmain chips have failed, costing the firm hundreds of millions of dollars. In the meantime, competitors have released miners that outpace Bitmain’s flagship Antminer S9 in performance, forcing the firm to slash prices on the S9 to maintain market share and maintain enough cash flow to keep ordering new chips from TSMC, which requires the company to make large prepayments. To make matters worse, the company’s former director of design — Dr. Yang Zuoxing — left to found a rival firm.

Bitmain is also sitting on as much as $1.2 billion in hardware, which the report says is “somewhat analogous to the typical behaviour of mining company management teams,” who in the precious metals industry are often tempted to “invest in high cost assets in bull markets and then fail to invest in quality low cost assets in bear markets.”

The report further speculates that Bitmain’s decision to go public is less a victory lap than a strategic move to prevent rivals Canaan Creative and Ebang Communication, both of whom plan to IPO soon, from obtaining a funding advantage.

Bitmain Still Has ‘Legendary’ Potential

Despite these challenges, BitMEX Research warns against drafting eulogies for Bitmain just yet. While cracks are forming in the China-based company’s market dominance, Bitmain still has the strongest position of any ASIC manufacturer. Moreover, while Bitmain’s cost-slashing strategy is likely causing it to bleed revenue, it is also placing “severe financial stress” on its competitors, who cannot afford to take similar measures.

The BitMEX Research team estimates that Bitmain’s current market position will guarantee it a several billion dollar raise from its IPO at a valuation likely north of $20 billion. If the firm, led by CEO Jihan Wu, can manage that capital well, it could cement its status as a “legendary crypto company.”

The report concludes:

“Bitmain can be a legendary crypto company, generating strong shareholder returns for decades to come, but in order to achieve this (and it’s a lot harder than it sounds) the Bitmain management team may need to improve their management of company resources. Once the company goes public, capital allocation decisions in this volatile and unpredictable market will be difficult enough, letting emotions impact too many investment decisions may not be tolerated.”

Bitmain ASIC chip image from Shutterstock

Follow us on Telegram or subscribe to our newsletter here.

• Join CCN’s crypto community for $9.99 per month, click here.

• Want exclusive analysis and crypto insights from Hacked.com? Click here.

• Open Positions at CCN: Full Time and Part Time Journalists Wanted.

[ad_2]

Source link