[ad_1]

According to Peter Brandt, an experienced and widely recognized technical analyst, major crypto assets such as bitcoin has recovered by more than 75 percent since 2018 lows.

Relative strength among major macro caps since Dec 2018 low pic.twitter.com/qxpXHZxuVC

— Peter Brandt (@PeterLBrandt) April 14, 2019

Bitcoin Cash and Litecoin have been the best performers in 2019, respectively rising by 383 percent and 350 percent against the U.S. dollar from last year’s lows.

While many factors are said to have triggered the recovery of major cryptocurrencies, both industry executives and technical analysts generally believe that a bottom for crypto was reached in late 2018.

Cautiously Optimistic Regarding Bitcoin

On Sunday, CCN reported that year-to-date, bitcoin has outperformed the S&P 500 and the Nasdaq 100 as one of the best-performing assets following an 80 percent decline in price in the previous year.

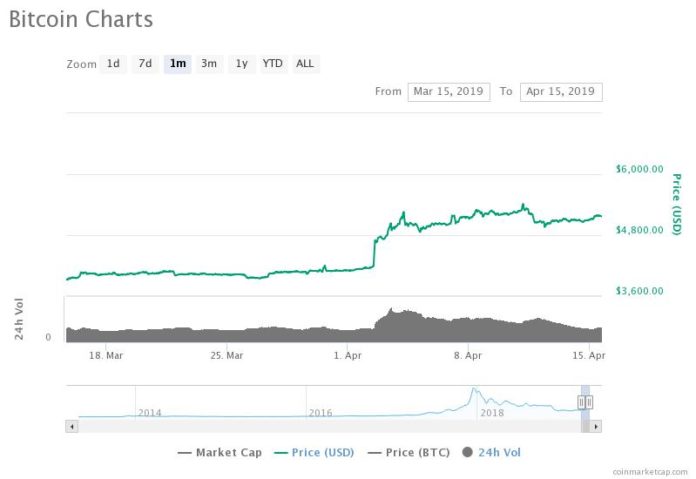

Throughout the past month, almost immediately after surpassing the $4,200 resistance level which bitcoin has struggled to test for over three months, bitcoin has demonstrated strong momentum that also translated to solid performances for alternative cryptocurrencies.

In the near-term, some technical analysts are positive that the dominant cryptocurrency would be able to sustain its momentum but remain cautious on its trajectory in a short time frame.

“I could be completely wrong and get stuck sitting by myself on the sidelines, but it’s my opinion we see another wipeout on alternative cryptocurrencies and BTC before we start trending onto new highs. Sitting mostly in fiat going into this week, waiting for opportunities to present themselves,” one analyst said.

But, others are more optimistic on the short-term price trend of bitcoin, expecting a similar movement as last week when BTC surpassed $5,400 to achieve a new high for 2019.

$BTC … the next move 🔥 pic.twitter.com/dfZbmEPPw7

— Satoshi Flipper (@SatoshiFlipper) April 14, 2019

One key metric investors could observe to evaluate the momentum of bitcoin is the real volume of BTC calculated by OnChainFX based on the findings released by Bitwise that found only 10 exchanges had legitimate volume above $1 million.

The daily spot volume of bitcoin is estimated to be around $270 million and throughout April, especially in the first week, the volume of BTC hovered above the $300 million level.

Another well-known trader in the cryptocurrency community said:

Bitcoin volume keeps holding reasonable levels and showing strength. In my opinion, we are on a channel continuation range and the next target (and hardest resistance) will be $6,000. But before I’m expecting a week or two of side range within the channel.

Generally, traders and technical analysts expect weakness in bitcoin in the upcoming days and a strong recovery over the next few weeks, demonstrating cautious optimism towards the asset.

So Was 2018 the Bottom?

Since dropping to $3,122, bitcoin has surged by 75 percent and alternative cryptocurrencies like Litecoin have recorded gains above 300 percent.

The bitcoin price has increased by more than 20 percent in the past month (source: coinmarketcap.com)

There exists a high probability that $3,122 was the bottom, at least in the medium-term, for bitcoin because of fundamental catalysts that await which could fuel the momentum of BTC.

In 2020 May, bitcoin is expected to experience a block reward halving that would reduce the rate in which new bitcoin is produced by 50 percent. If the demand for bitcoin rises or remains the same but the supply drops, it may cause the value of the asset to increase over the long run.

[ad_2]

Source link