[ad_1]

By CCN: Shares of Bitcoin Generation (BTGN), a little-known Bitcoin stock, last traded at 9 cents. They will remain there until at least May 10 while the Securities and Exchange Commission launches a probe into the Oklahoma-based company’s finances.

US Regulators Investigate Public Crypto Exchange

The Bartlesville, Oklahoma-headquartered company offers a regulated cryptocurrency exchange that supports Bitcoin, Bitcoin SV, Ethereum, Litecoin, XRP, and Monero.

It bills itself as the first “publicly traded cryptocurrency exchange.” This is debatable, of course, based on what one considers “public” trading.

Binance, for instance, is a privately-held company. However, Binance Coin – which does not represent company equity but provides holders with exposure to the exchange’s profits – has been in circulation for a couple of years now and relates heavily to demand and usage of the Binance exchange. Other “initial exchange offerings” have come and gone in the meantime, with far less success.

The SEC posted a note to its website, alleging that certain information about the company was being twisted in promotional materials, along with other concerns. Specifically, the one-page document says:

“The Commission temporarily suspended trading in the securities of BTGN due to concerns about the accuracy and adequacy of information in the marketplace about, among other things, (1) BTGN’s public statements regarding the viability and valuation of a bond that BTGN purportedly acquired from an entity based in the United Kingdom; (2) the amount of BTGN’s outstanding common stock; (3) stock promotional activity relating to BTGN and the market impact of such promotional activity; and (4) the accuracy and adequacy of current public information regarding BTGN’s financial condition.”

SEC Freezes Bitcoin Stock Until Further Notice

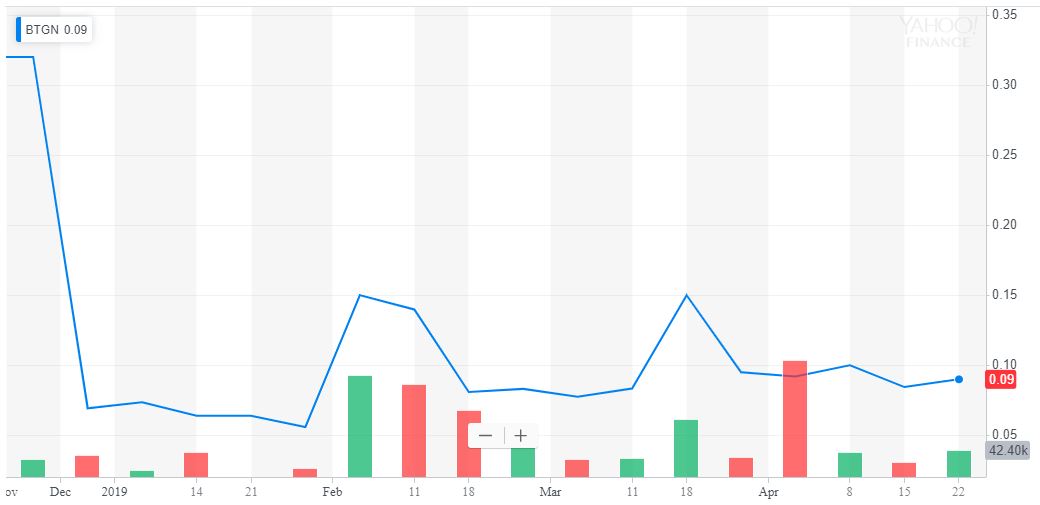

Bitcoin Generation stock hasn’t done shareholders any favor since its OTC listing. | Source: Yahoo Finance

The bit about the “bond” is most intriguing. According to a press release, roughly 20 million euros were raised by the company behind Bitcoin Generation in exchange for common stock and “Bitcoin Generation Coins,” a cryptocurrency about which we’ve found no further information. This lack of public data about BCGc may be part of the SEC’s concerns.

From the statement:

“The Bond was paid with the transfer of 20 million common shares of the company at a price of $0.15 for a partial payment of $3 million US, as well as 2,200,000 BCGc (Bitcoin Generation Coins.) at a price of $5.849236 for a partial payment of $12,868,320 US and 400 million BTA (Bitachon Coins) at a price of $0.0214472 for a partial payment of $8,578,880 US and for a total payment of $24,447,200 US.”

The SEC also warns that unless these concerns are alleviated, it’s illegal for anyone to trade in BTGN. The Bitcoin Generation exchange appears functional, although its volume metrics are not easily accessible.

The OTC stock had recently seen some downward pressure, pushing it back toward its current price of 9 cents. The price quoted in the bond press release is near the stock’s year-to-date-high of 16 cents. Since the stock’s launch a year ago, it’s gone as low as a penny, but in recent months was pushing back upward. The halt to trading puts a severe damper on the stock’s prospects.

Inolife Technologies, the company that owns Bitcoin Generation, has yet to release a public statement on the subject.

[ad_2]

Source link