[ad_1]

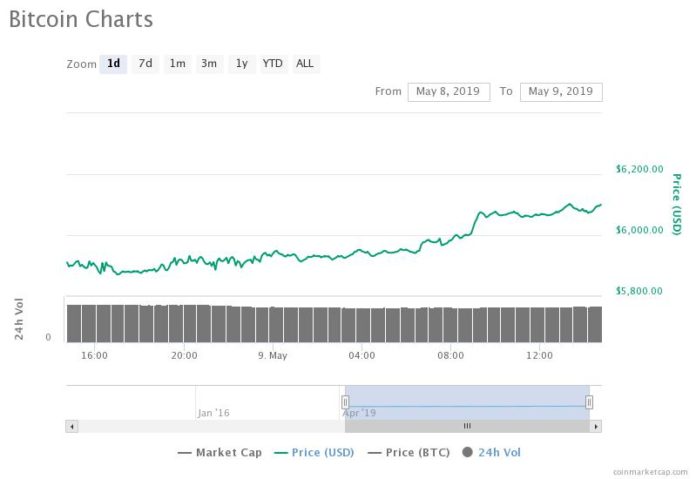

By CCN.com: The bitcoin price has increased by more than five percent in the past 24 hours from around $5,800 to $6,098, breaking out of the $6,000 resistance level for the first time in 2019.

The bitcoin price has increased by around 5 percent in the past 24 hours (source: coinmarketcap.com)

Following the high profile security breach of Binance, investors expected fear, uncertainty, and doubt (FUD) to drive the market down in the near-term.

However, the market swiftly recovered from an initial fall to around $5,500, ultimately recording a $600 gain on the day.

Can the Momentum of Bitcoin Price be Sustained?

Throughout the past month, technical analysts and traders have pointed toward the $6,200 to $6,400 range as the region that could rekindle the bull market of the dominant cryptocurrency.

On May 3, global markets analyst Alex Krüger said:

BTC now at $5,750, 2018 low prior to the November crash. – The 2018 bear trend ended once above $4,200. – Above $6,400, 2018’s most traded price, it’s a bull market.

Vinny Lingham, a general partner at Multicoin Capital, similarly said that if bitcoin surpasses $6,200, it would signal the start of another major bull run for bitcoin.

“That said, if we can break $6200 for BTC, it will likely mark the start of another major bull run and could run hot and high, but if it’s pure speculation and other assets benefit disproportionately to value created, it’s likely not going to end well again!” Lingham said in early April.

In the past week, the bitcoin price has surged by around 13.5 percent against the U.S. dollar, steadily climbing upwards despite the uncertainty around Tether, Bitfinex, and iFinex.

Due to the ongoing legal action against Bitfinex for allegedly mishandling $900 million of Tether’s cash reserves in an attempt to “hide” its loss of $850 million, many anticipated the Binance hack to add to the doubt of investors in the market.

Possibly because of Binance’s capability of covering the loss of 7,000 BTC, worth more than $41 million, with corporate funds, the hack had virtually no impact on the price of bitcoin.

Since July 2018, Binance has been allocating 10 percent of all trading fees, which account for the majority of the firm’s operating income, to the Secure Asset Fund for Users (SAFU), an insurance fund to be used in an unlikely case of a security breach.

“To protect the future interests of all users, Binance will create a Secure Asset Fund for Users (SAFU). Starting from 2018/07/14, we will allocate 10% of all trading fees received into SAFU to offer protection to our users and their funds in extreme cases. This fund will be stored in a separate cold wallet,” the Binance team said last year.

$BTC > $6000. Mission accomplished. Next level is $6400, the most traded price of 2018. pic.twitter.com/zikq5KYomI

— Alex Krüger (@krugermacro) May 9, 2019

With the market recovering from the incident fairly well, in the medium-term, traders are looking towards $6,400 as the next target of bitcoin.

Possible Roadblock

One trader said that bitcoin is likely to continue its upward movement until it hits a major resistance level that is too large for the asset to handle.

“I tend to think this BTC rally will continue to accelerate until we hit a resistance simply too big too handle. I’m keeping my longs open. Bear market over. Bull market in? – I want to see how we handle $6350. If we turn that into support – oof. Hope you bought the dip,” the trader said.

The $6,400 level presents a strong resistance level bitcoin would need to overcome to properly signal the start of a new upward rally and it remains unclear whether it could climb over key resistance levels in the days to come.

[ad_2]

Source link