[ad_1]

By CCN.com: In the past 24 hours, the bitcoin price has increased by 6 percent against the U.S. dollar as the real spot volume of the dominant cryptocurrency spiked to $800 million.

In the first week of March, the daily volume of bitcoin was estimated to be around $270 million. In less than a month, the spot volume of the asset surged 196 percent.

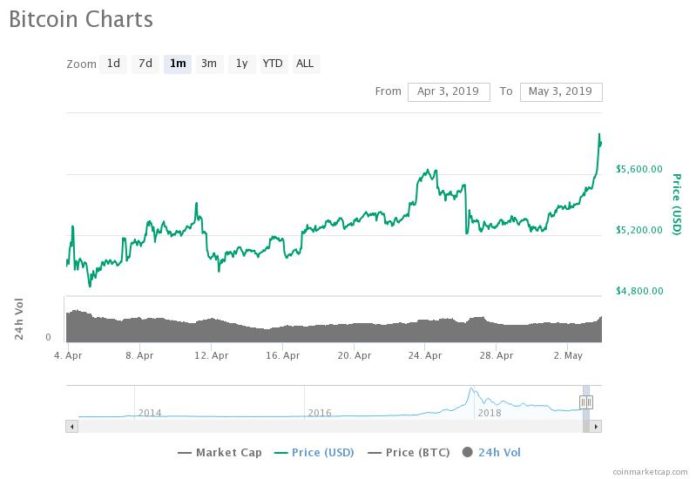

The bitcoin price has spiked from less than $4,900 to over $5,700 in the past month (source: coinmarketcap.com)

But, due to the controversy around Tether that has created a $300 to $400 premium, cryptocurrency trader DonAlt said that he expects bitcoin to fall below $5,000.

why bitcoin premium on bitfinex is bad news

As CCN extensively reported throughout the past week, the office of the New York Attorney General Letitia James alleged Bitfinex of mismanaging $900 million of Tether’s cash reserve to hide its $850 million loss.

The NYAG said that Bitfinex sent $850 million to a “bank” in Panama called Crypto Capital Corp and failed to get the money back, resulting in an $850 million loss.

Since the Tether scandal emerged, the bitcoin price has actually increased quite substantially against the U.S. dollar but it also led the premium on Bitfinex to spike.

Crazy to think the last time #bitcoin market cap crossed $100B, price ran to $20k in the next 3 weeks. $BTC

— Alex Saunders (@AlexSaundersAU) May 3, 2019

The premium on Bitfinex suggests that investors are buying bitcoin with Tether at a higher price to potentially withdraw bitcoin from the platform and move to other exchanges to change to fiat.

DonAlt said:

The Bitfinex premium is worrisome. I think we need to dump to get rid of it. A lot of people expect the same and are shorting. All of those are underwater and are paying humongous funding. Screams short squeeze to me. Once that’s done bears get their turn. Up first, down after.

No matter how high we go I expect sub 5k Bitcoin pretty soon. I’ll be selling most of the spot BTC I bought at 3.4k into the next spike up and hedge the rest. Bitfinex having a larger than $400 premium is not okay and, in my opinion, won’t end well. Sad state of affairs really.

The outlook of the near-term future of bitcoin by DonAlt is primarily driven by fundamental factors. But, technical indicators still suggest that upside momentum is expected in the upcoming days.

Earlier today, CCN reported that Peter Brandt, a widely recognized technical analyst, has said a technical indicator called Factor’s benchmark weekly moving average (MA) showed a structure that mimicked the formation demonstrated in 2015 before bitcoin moved up to $19,800.

“The last time Factor’s benchmark weekly MA was in the current profile of turning from down to up was in Nov 2015 just as $BTC began its move from $340 to $19,800,” Brandt said.

It remains unclear whether fundamental factors like the Tether controversy would lead to a decline in the momentum of bitcoin or if technical indicators would allow the cryptocurrency to push through and surpass key resistance levels.

the sentiment is on the rise

DonAlt emphasized that the Bitfinex premium is the main concern towards the current state of the crypto market and that if the premium subsides, the market could continue to recover.

“Squeeze them shorts! I’ll stay in Bitcoin as long as the Bitfinex premium doesn’t grow. As soon as it starts growing exponentially, if it does at all, I’ll be out of the market. A lot of early bears are getting punished here. Try to avoid being one of them,” the trader said.

Other than the Bitfinex scandal, as said by Fidelity Digital Assets, the inflow of institutional capital into the crypto market has increased in the past 12 months and it is expected to rise over the next five years, indicating a gradual recovery in the confidence of investors towards the long-term growth of the market.

[ad_2]

Source link