[ad_1]

By CCN.com: Whichever way you slice it the technical picture continues to look more and more bullish for Bitcoin. There is a distinct dip-buying pattern in BTC/USD, and the latest trough has been bought once again today. SFOX’s monthly cryptocurrency volatility outlook is here, and once more the fundamentals are bullish for the 4th straight month.

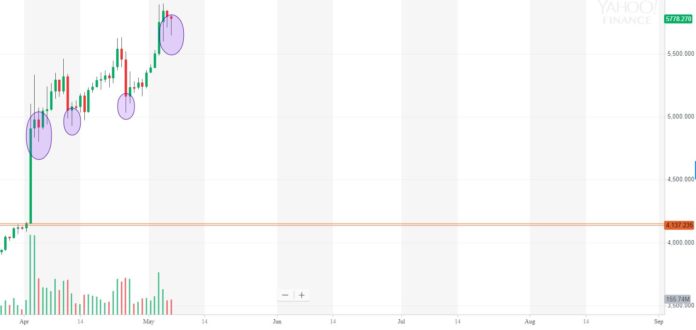

Clear dip-buying in play as Bitcoin’s rally nears $6000- Yahoo Finance

The three cornerstones of SFOX’s outlook are price momentum, sentiment and the advance of crypto as a sector. Their latest report sees strong evidence that based off of the performance of BTC, ETH, BCH, LTC, BSV, and ETC, things are still looking up for the cryptocurrency industry,

“The fundamentals-driven bullish signals we’ve seen — price momentum, infrastructure development, institutional interest, etc. — have been present for several months.”

Bitcoin’s Huge Bounce May Have Been a Single Massive Order

There is a note of caution. Rather than put April’s jump in Bitcoin down to long term factors, SFOX believes it may have been one isolated incident that caused the rally. The concept is that a considerable buy order significantly altered the supply/demand dynamics in the market,

“The beginning-of-April crypto rally, despite having injected the market with renewed volatility, appears to have primarily been driven by one large buy order rather than fundamentals, and the market appears to have largely normalized again at new levels post-rally.”

Things are once again looking up for Cryptocurrency markets -SFOX

On the fundamental news front, there was plenty to mull over last month. There was the story that Nike is making plans to dive headlong into cryptocurrency with their “CryptoKicks” project to reward users. Then there was Jaguar and Land Rover making plans to do something similar for their drivers. Perhaps the biggest news story was Facebook and their “Libra” plans, which have faced widespread opposition in the blockchain community due to their privacy record.

Bitcoin Correlation with ETH, BCH and LTC Has Normalized after Price Spike

SFOX also take a look at the correlations between the major coins and BTC. Typically, the movement of Bitcoin leads the market, and it appears that this was no different once more. Evidence from last month suggests that positive progress in BTC/USD increased the correlation before it gradually faded,

“ETH, BCH, and LTC were all highly correlated with BTC, suggesting that BTC’s movement was largely driving market activity. Near the end of the month, however, we saw all three of those correlations decrease along with overall trading volume, suggesting that the impact of BTC’s rally on the overall market had tapered somewhat.”

With mainstream financial companies like Fidelity and TD Ameritrade diving into Bitcoin trading, there is a tangible sense of optimism. Bull markets rally on good news and largely ignore the bad. During the crypto winter, we saw signs of increasing adoption ignored in favor of negativity. If this is now crypto spring, the summer should be here soon.

[ad_2]

Source link