[ad_1]

As the bitcoin price continues to hover in a tight range just below $4,000, crypto investors are breathlessly waiting to find out whether bitcoin price can punch through the resistance line that thwarted its most recent attempt to initiate a new bull market.

Below, we examine both the bull and bear case for bitcoin as traders position themselves to be on the right side of the crypto market’s next major move.

Bull Case: Bitcoin’s Losing Streak is Over, Could Rally to $400,000

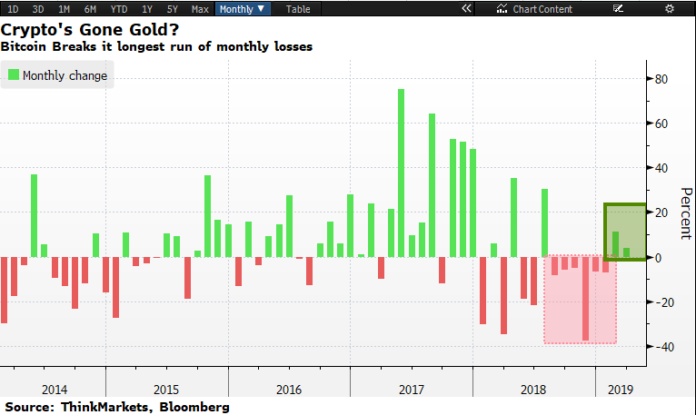

Writing at ThinkMarkets UK, Chief Market Analyst Naeem Aslam makes the case that the 15-month Crypto Winter is coming to an end and the first buds of a bitcoin bull market have begun to emerge.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Noting that bitcoin recently broke its longest streak of monthly losses, Aslam said that this was the “strongest signal” that the market temperature is climbing and that Crypto Winter is beginning to thaw.

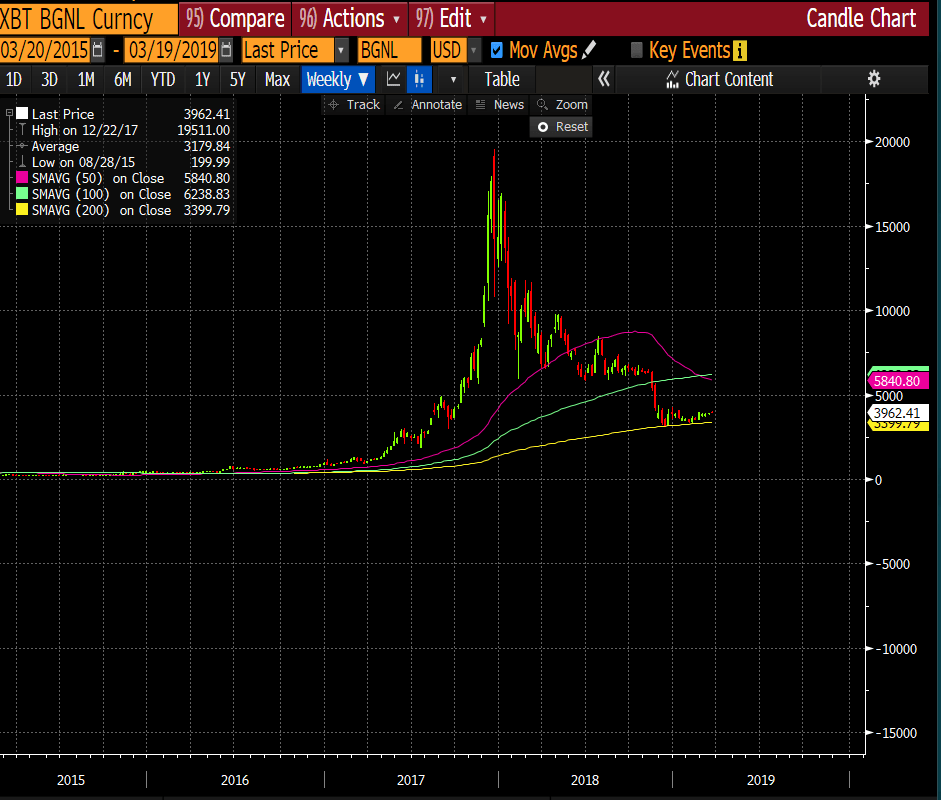

Further adding to the bull case, Aslam notes that the bitcoin price has crossed its 200-week moving average (yellow line on chart below), which is a significant technical indicator.

Now, bitcoin is moving closer to its 50-week moving average (pink line) as well. He claims that an upside break past this resistance line would be an undeniable sign that the cryptocurrency had entered a bull market, though he noted that it could take several months for BTC to get there.

Bitcoin jumped above its 200-week moving average. Could the 50-WMA be next? | Source: Think Markets UK

“Now, if the price kisses the 50-week moving average goodbye and moves above it at that stage, all bets would be in favour of the bulls….[W]hen the price breaks above the 50-week moving average, it sends the strongest bull signal and so far it has worked really well. But this is something that we would have to wait and see. It may take a couple of months for this to happen.”

How high could it go? According to Aslam, perhaps as high as $400,000, representing a staggering upside of nearly 10,000 percent from its current level.

“[T]here is a high chance that the next bull run has a minimum potential of pushing the price 5 times higher. That is over $100K. I personally believe that each Bitcoin can go up as much as $400K and if history repeats itself, this number is not a fool’s paradise.”

Bear Case: Bitcoin Heading Toward Fake Breakout on Plunging Futures Volumes

Not everyone is quite so bullish as Aslam, however, at least in the near term.

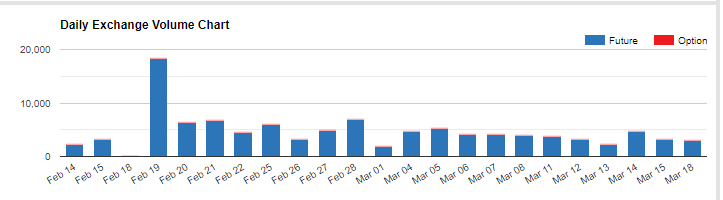

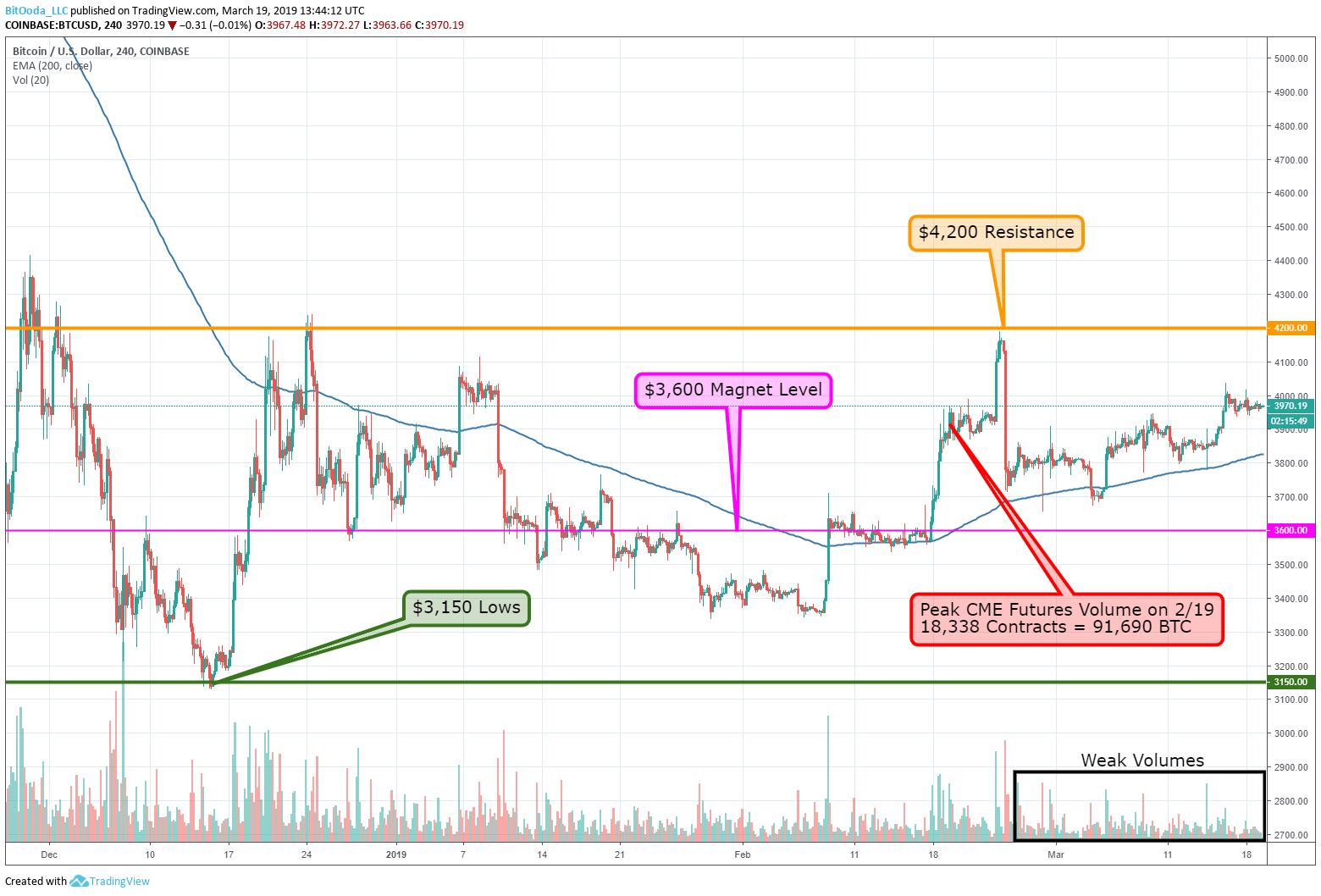

Writing in daily market commentary on Tuesday, crypto broker BitOoda warned clients that bitcoin futures volumes have plummeted throughout March and that unless “large buying volumes” suddenly enter the market, the bitcoin price is unlikely to do anything more than tepidly poke at the $4,200 resistance line.

Bitcoin futures volumes have plunged since peaking in late February when BTC/USD made its first charge at $4,200. | Source: BitOoda

“Since the recent highs on Feb 24th and quick reversal back into the range, the volumes have been quite awful. BTC’s feel at the very moment is that it wants to probe the recent highs and see how strong the resistance is sitting at the $4,200 level. Unless large buying volumes come into the market, probing is all we shall see at that resistance level. We believe it will take a serious force of buying to take those levels out to the upside.”

More worrisome is that traders could find themselves caught in a “false-break out trap,” which would see the bitcoin price test $4,200 amid low volumes. Traders would then FOMO-buy into the phantom rally, only to see it dashed and their long positions shattered as BTC careens back toward its “magnet level” at $3,600.

Bitcoin could challenge the $4,200 resistance line, but traders shouldn’t be fooled and FOMO into the phantom rally, BitOoda says. | Source: BitOoda

“If low volume persists, this technical pattern presents a potential false-break out trap; if traders see $4,200 being tested, they may not want to miss that major break out to 5k BTC and beyond causing them to buy into this false strength. If this market traps them and retraces back to that magnet level of $3,600, they will be forced to puke out and realize some pretty quick losses.”

The firm – which believes the crypto market has not yet bottomed – advised clients that the best way to secure exposure to a potential rally without putting themselves at risk of a false-break out is to purchase short-dated calls, which secure the holder the option to buy bitcoin at a particular price up until that date.

[ad_2]

Source link