[ad_1]

Despite the 82 percent drop in the valuation of the crypto market in the past year and the inability of bitcoin to recover beyond $4,000 in the past three months, one analyst sees the dominant cryptocurrency surpassing $150,000 by 2023.

Josh Rager, a cryptocurrency technical analyst and investor, said that based on the price trend of bitcoin since 2011 and the pattern of bitcoin rebounding from a correction following an all-time high, he sees bitcoin achieving a new peak price in 2,051 days, by 2023.

The next Bitcoin cycle should peak out in July 2023 and could reach a price at $150,000 or more per Bitcoin

Cycle Peak Prices:

2011: $31

2014: $1,177

2017: $19,764

2023: ??? ($150,000+ projected) pic.twitter.com/ikicZbJRhe— Josh Rager 📈 (@Josh_Rager) March 31, 2019

The long-term projection of Rager is particularly more notable because he has expressed his bearish view on the near-term price trend of bitcoin.

Can Bitcoin Avoid a Downturn and Continue to Move Up?

Many traders and technical analyst have similarly said in recent weeks that bitcoin could avoid a potential drop to its support level at $3,500 if it can sustain its momentum in the $4,000 region.

In the past three months, bitcoin has continuously tried to break out of the $4,200 resistance level, which is widely considered to be a key level for the asset to climb to meaningful ranges above $5,000 but has failed at every attempt.

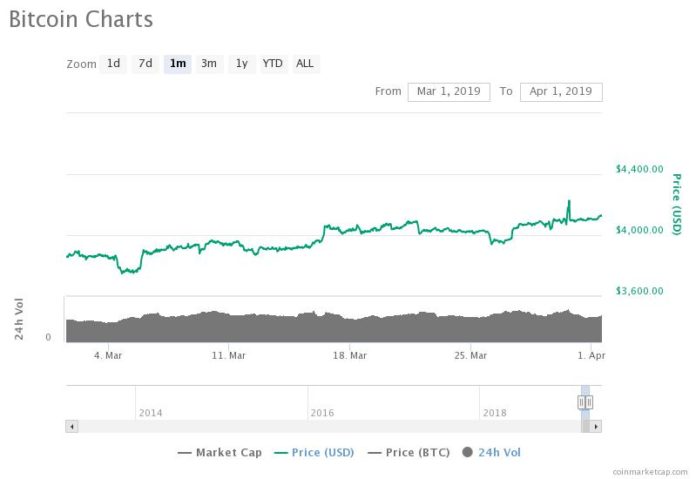

The bitcoin price has recovered fairly well in the past month, recording a slight increase in price (source: coinmarketcap.com)

On February 24, for instance, bitcoin did break out of $4,200 by achieving a price of $4,206 but failed to hold it and almost immediately fell to $3,700.

Rager noted this week that if bitcoin can breach $4,200 and hold above the key level, it will be able to prevent a further drop below the $4,000 mark and maintain its momentum throughout the months to come.

“[There are] multiple scenarios [for bitcoin]. Fact is, nobody knows the next move. It’s been a historically good idea to short or sell near $4,200 and buy or long near $3,500. A break, close and hold above $4,200 is bullish in the short term. Break of $3,500 is very bearish. Sideways [BTC movement] is great for alternative cryptocurrency pumps,” he explained.

At this phase of the cryptocurrency market wherein most projects are struggling to secure funding to expand their operations and resources are being focused on quality projects, it is difficult for industry executives to be optimistic about the future of the asset class.

Yet, throughout March, the vast majority of industry executives in crypto have expressed positivity towards the asset class and the level of activity in the industry amidst a 16-month bear market.

U.S. Dollar plunged 10% in value against bitcoin in Q1

— Barry Silbert (@barrysilbert) March 31, 2019

The general consensus of traders and technical analysts seem to be that the bottom of bitcoin and the cryptocurrency market has either been established or is close to being established, which may lay out the foundation for a gradual recovery period throughout 2019.

As seen in previous recoveries of bitcoin, analysts do not expect the price of bitcoin to experience a movement like the 2017 bull run in 2019 but rather a slow and a gradual climb to previous levels in an extended period of time.

Strong Sell Walls

On Monday, bitcoin pushed through a $22 million sell wall to surpass $4,100 and for it to move past the anticipated $4,200 resistance level, it would need to push through another $30 million in sell orders.

One technical analyst said that the market absorbing stacked sell orders at $4,100 in a short time frame could push the asset towards $4,300.

“Selloff getting immediately bought up sis very bullish, we’ll be testing $4,300 in no time,” he said.

Achieving $4,300 in the near-term by surpassing the $4,200 resistance level would alleviate significant pressure on the dominant cryptocurrency, which could enable the asset to potentially aim for higher resistance levels it has not been able to test since November 2018.

Click here for a real-time bitcoin price chart.

[ad_2]

Source link