[ad_1]

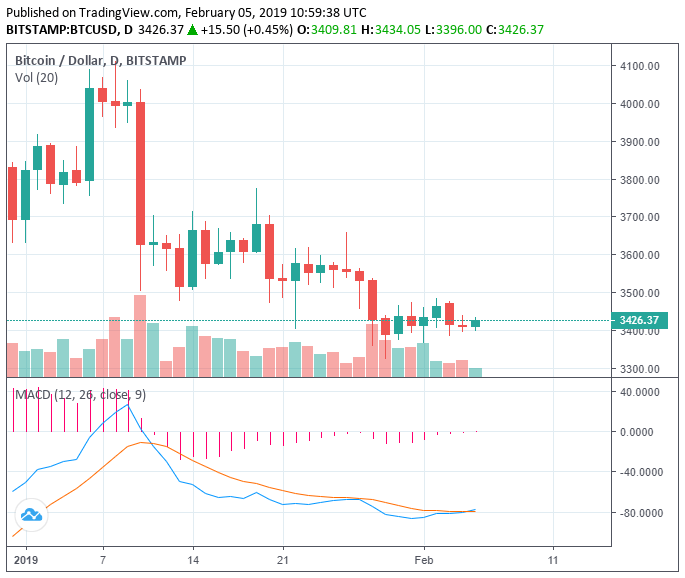

Throughout the past 4 days, since February 1, the crypto market has remained stable at around $114 billion as the Bitcoin price stabilized at $3,500.

Several analysts expected Bitcoin to recover beyond the $4,000 resistance level after rebounding from the low $3,300 region.

But, the dominant cryptocurrency has struggled to show signs of short-term recovery and has experienced three months of consecutive sell-offs.

$1,800 Per Bitcoin is Possible

A well-recognized cryptocurrency trader with an online alias “The Crypto Dog” stated that as the market reaches the final phase of the bear market, it may drop to lower levels.

The trader said that he would not be surprised by $1,800 BTC and $50 ETH, which presents a 50 percent decline from current prices.

“$1800 BTC and $50 ETH wouldn’t surprise me. I don’t know for any certainty we’ll see those prices, nor do I mind if we reach them or not. If you’re in BTC for the long haul, DCA. If you’re learning to trade, just survive. Keep your risk low, gains will be easier someday,” he stated.

Some traders have proposed the possibility of BTC dropping to as low as $1,200 as it fully retraces to the height of 2013.

But, in consideration of both technical and fundamental factors, an additional 65 percent drop after having suffered an 83 percent drop is highly unlikely.

As Dan Morehead, the CEO of Pantera Capital, the first billion-dollar hedge fund in crypto said, the fundamentals of the cryptocurrency sector have significantly improved over the past few years.

The largest financial institutions in the world in the likes of ICE, Nasdaq, and Fidelity are moving toward strengthening the infrastructure supporting the asset class.

Potential catalysts such as the possibility of institutional investors entering the cryptocurrency market in the latter half of 2019 through trusted custodians like Fidelity and Bakkt may prevent bears from pulling down BTC to 2013-14 levels.

Morehead noted:

People have been talking about years on the impending institutional wave of money coming into the markets and I think we now actually have the required conditions for that to happen. Institutional investors really want to have a custodian that is well-known and regulated, and we really haven’t had a global name that it would take to get institutional investors in.

In December, The Crypto Dog state that as long as Bitcoin remains in the wide range between $3,000 to $5,400, the cryptocurrency market is still in the last leg of the long-lasting bear market.

As traders like Mark Dow suggested, only when BTC breaks out of key resistance levels above the $6,000 mark can a trend reversal be confirmed.

Even after it establishes a proper bottom, BTC is expected to undergo several months of consolidation which may leave the asset relatively stable in a low price range until the second half of 2019.

It Will Take a Long Time

Historically, BTC has experienced longer bear markets as the asset class and the industry matured.

Industry experts and executives generally see crypto winter lasting 12 to 24 months, possibly until the year’s end.

Some, including Ethereum co-creator and Cardano founder Charles Hoskinson, previously said it may take over a decade for BTC to rebound to $20,000.

In the midst of bearish forecasts, a positive indicator of long-term growth is the high level of activity in the sector.

Less than two months in, a nine-figure deal has been completed in the cryptocurrency sector by Kraken on February 4. It acquired Crypto Facilities for over $100 million to offer futures and index products as a fully regulated operator in Europe.

Kraken launches futures trading via nine-figure deal, will soon close a fundraising round at $4B valuation, has 100 devs and growing, reveals consumer-friendly rebranding, and launches the first podcast to show juicy inner workings of a crypto company.https://t.co/WEIzjxzE8C

— Kraken Exchange (@krakenfx) February 4, 2019

The company is also set to raise a new round at a $4 billion valuation, officially becoming the second multi-billion dollar cryptocurrency exchange after Coinbase.

Binance is said to be valued at nearly $10 billion after achieving a net profit of $1 billion in the first quarter of 2018 but its official valuation remains undisclosed.

Click here for a real-time bitcoin price chart.

Featured Image from Shutterstock. Price Charts from TradingView.

[ad_2]

Source link