[ad_1]

Bitcoin perma-bull Tom Lee of Fundstrat tried to buttress his recent projection that the bitcoin price is due for a major rally soon.

On March 17, Lee tweeted that the “tailwinds” that had dragged bitcoin down during the current Crypto Winter are easing.

Specifically, Lee claims that “macro factors such as a rally in risk assets plus the US dollar no longer surging are tailwinds for BTC.”

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Lee: Emerging Markets Dragged Bitcoin Down

Lee then claimed that a plunge in the emerging markets had “pulled down” bitcoin during the past few months. A correlation between bitcoin’s performance and that of the emerging markets has not been established.

Lee: ‘Macro Tailwind’ Suggests Bitcoin Price Spike

Lee also noted that the recent rallies in the S&P 500 and small-cap stocks are greater than two standard deviations.

He then suggested that this means the bitcoin price would rise to $10,000 to $20,000 if BTC were to “catch up” to equities.

CRYTPO (2/2): natural question is how much implied upside #bitcoin to “catch up” to macro.

S&P 500+small-cap rally since 12/24 is >2 std dev.

1-std dev for $BTC is +185% gain. “Catching up” to equities implies $10k-$20k.

NOT OUR BASE CASE. Just highlighting macro tailwind. pic.twitter.com/p67FDNGmI3

— Thomas Lee (@fundstrat) March 17, 2019

Money Manager: No Correlation Between Bitcoin Price and Equity Markets

Meanwhile, many financial experts say there is no correlation between bitcoin’s price movements and the broader stock market.

“I like bitcoin because it’s not correlated with [the stock market],” said Bill Miller, the founder of Miller Value Partners.

“Bitcoin basically has no statistical correlation with stocks or bonds, which makes it an excellent diversifier.”

At this point, few in the crypto industry take bitcoin price predictions from anyone seriously, because even so-called experts have been way off amid the 2018 market crash.

Tom Lee’s Spotty Track Record

As it is, Tom Lee was wrong on his predictions numerous times last year, as CCN chronicled.

In April 2018, Lee insisted that bitcoin would rally big-time right after tax season. At the time, Lee attributed the drop in bitcoin’s price to mass sell-offs caused by investors trying to sell off their cryptocurrency holdings to avoid paying taxes on them.

“Selling pressure for bitcoin should be alleviated after April 15th,” Lee said.

That rally never happened.

On May 31, 2018, Tom Lee’s colleague at Fundstrat — Robert Sluymer, the head of technical strategy — predicted that bitcoin would spike soon because it had finally bottomed, and technical analysis said it would rise.

“We think bitcoin is starting to bottom off some very key support around $7,000,” Sluymer said. “And we think it’s going to start a recovery process here.”

That rebound never happened.

Lee Doubled-Down on Wrong Price Prediction

Then, in November 2018 — at the height of the crypto bear market — Lee doubled-down on his exuberant $15,000 year-end bitcoin price target. At the time, Lee called the Crypto Winter an “awkward transition” that would pass very soon.

As we all know, that comeback also never happened.

Doubling Down: Tom Lee Won’t Abandon $15,000 Year-End Bitcoin Price Forecast https://t.co/406hAEMi5i

— CCN.com (@CCNMarkets) November 20, 2018

In December 2018, a frustrated Lee said he was finished giving price predictions given his history of inaccuracy.

However, he said that bitcoin’s fair market value at the time was $13,800 to $14,800. At the time, bitcoin never topped $4,180.

Bitcoin’s Fair Market Price is $14,800, Says Cryptocurrency Bull Tom Lee https://t.co/VzNHbLU5LC

— CCN.com (@CCNMarkets) December 14, 2018

Twitter User: ‘Tom, You Have No Credibility’

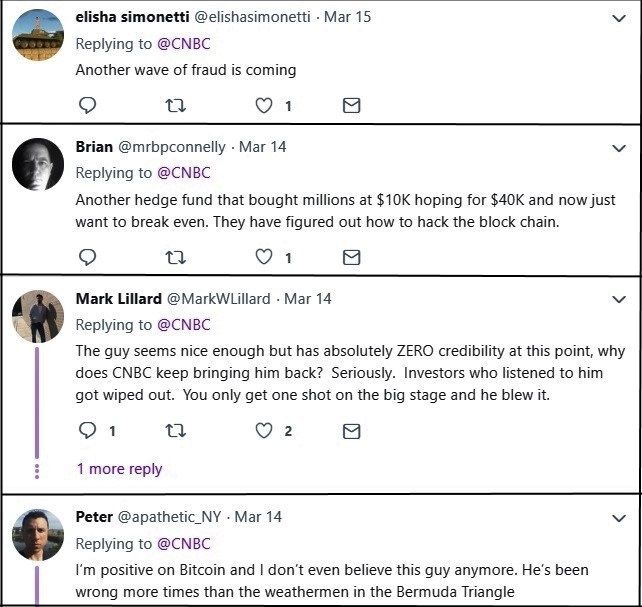

All these unreliable price projections have caused many in the cryptocurrency market to laugh off Tom Lee’s price predictions.

So when Lee once again insisted last week that a bull market lurks around the corner, many in the crypto-sphere couldn’t help but mock him.

One Twitter user remarked: “Is this the same Tom Lee that predicted Bitcoin to be $25,000 by end of 2018? Tom, you don’t have credibility in this space any longer.”

@CNBC uh. Is this the same Tom Lee that predicted Bitcoin to be 25k by end of 2018? Tom you dont have credibility in this space any longer. pic.twitter.com/3BzdgfXJG0

— BigLebowski (@ScottBuckyb1962) March 15, 2019

One user laughably recounted that Lee had set a whopping $100,000 bitcoin price target for 2018.

Before that he said 100k

— Sowrabh (@Sowrabh18) March 14, 2019

Still another crypto enthusiast quipped: “The guy seems nice enough but has absolutely ZERO credibility at this point. Why does CNBC keep bringing him back? Seriously. Investors who listened to him got wiped out. You only get one shot on the big stage and he blew it.”

Another remarked: “I’m positive on Bitcoin and I don’t even believe this guy anymore. He’s been wrong more times than the weathermen in the Bermuda Triangle.”

Bullishness Without Baloney

So the moral of the story seems to be this: You can be a bitcoin bull without looking like a shill if it doesn’t appear that you’re constantly pumping the market. That seems to rub even the most die-hard crypto fans the wrong way.

There are many smart people in the cryptocurrency industry who are confident that bitcoin will gain mainstream adoption and revolutionize the world. But revolutions take time, and progress is never linear. But the people who constantly talk it up are not doing true believers any favors.

Humanity Can’t Survive Digital Age Without Crypto: Circle CEO Jeremy Allaire https://t.co/A9ImFDflVu

— CCN.com (@CCNMarkets) January 24, 2019

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.

[ad_2]

Source link