[ad_1]

By CCN: According to Alex Krüger, an economist and a global markets analyst, the breakeven cost for efficient bitcoin mining operations currently hovers at around $3,550.

The bitcoin mining operational breakeven for efficient mining operations currently stands around $3550. pic.twitter.com/gQrNYBcvLH

— Alex Krüger (@krugermacro) April 21, 2019

Across major cryptocurrency markets, the bitcoin price is at $5,265, which for miners presents a substantial profit per every block mined considering the breakeven price of $3,550 and the potential appreciation of bitcoin.

Does it Mean the Start of a Bitcoin Bull Market?

While the analysis Krüger uses the rate of electricity at $0.055 per kWh, depending on the region miners are based, the rate could vary.

For instance, Krüger said that CoinGeek reported a rate of electricity at $0.073 per kWh to mine proof-of-work (PoW) cryptocurrencies like bitcoin in last December, which would raise the breakeven cost of bitcoin mining.

“CoinGeek is negotiating to sell its miners (62k units with 960k TH/s) and other assets (e.g. http://coingeek.com) for $45.5 million. Miners’ avg operational cost is $0.073 /kWh, resulting in $3580 operational breakeven (assuming used to mine BTC not BSV),” the analyst said in December.

Throughout the second half of 2018, particularly in the last several months of the year, the breakeven cost of bitcoin dropped below the actual price of BTC, leading miners to record net losses on their operations.

Many miners had to continue operating throughout the bear market because most operations secure long-term energy deals with electricity providers, acquire expensive ASIC equipment, and obtain long leases to operate large-scale bitcoin centers.

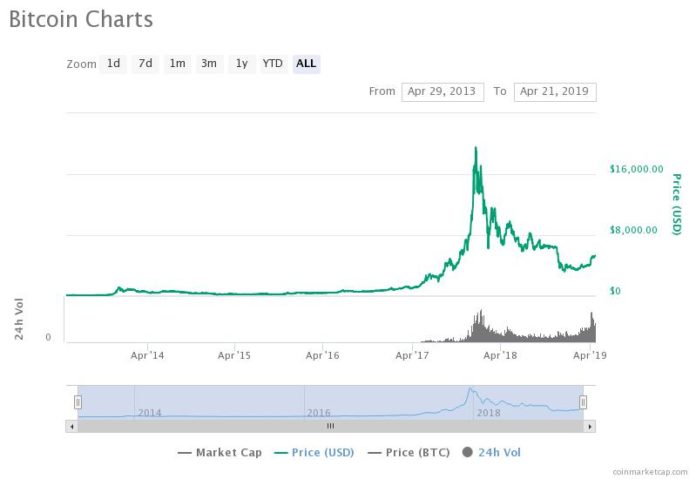

Bitcoin mining was largely unprofitable in the second half of 2018 due to the bitcoin price decline. | Source: coinmarketcap.com)

As Andreas Antonopoulos, a widely recognized cryptocurrency and security expert, said about the “death spiral” theory that argues bitcoin could seize to exist if all of the miners leave the protocol, it is difficult for miners to give up on all of their operations after their initial commitment to it.

Antonopoulos said:

“Part of the reason that’s unlikely to happen is that miners have a much more long-term perspective. Meaning that, they have existing investments in equipment and they usually purchase electricity on long-term plans, they don’t pay it by the week. And therefore, if they have to wait to become profitable another three months and they have the equipment in place, they’re not turning it off.”

As such, many miners continued to secure and protect the Bitcoin blockchain network through mining across the brutal 16-month bear market.

Now that bitcoin mining is profitable once again, assuming that the bitcoin price does not drop below the $4,000 mark in the near-term, more miners could enter the space to mine the dominant cryptocurrency prior to its block reward halving scheduled to occur in May 2020.

When a block halving gets executed, the rate at which new coins are produced by miners declines, resulting in lesser profits for miners.

But, because the bitcoin price normally goes up in the build-up of a block reward halving because it reduces the potential circulating supply of bitcoin on exchanges and other markets, miners often end up in a decent position.

Crypto Market Sentiment is Improving

Though not a guarantee that cryptocurrency has entered a bull market, bitcoin mining turning profitable is a positive sign. | Source: Shutterstock

It is difficult to conclusively state that the profitability of bitcoin mining can effectively signal the end of the correction of the cryptocurrency market.

But, considering that mining is a key sector for the sustainability of cryptocurrencies, a healthy mining ecosystem would boost the sentiment around both bitcoin and the rest of the cryptocurrency market, especially for proof-of-work blockchain networks.

More importantly, bitcoin has historically shown an upside movement a year prior to a block reward halving, a piece of data which miners may consider in the foreseeable future.

[ad_2]

Source link