[ad_1]

Bitcoin is now top of the list of trending keywords in the Baidu search engine, China’s equivalent to Google.

Due to the recent price surge, #bitcoin tops today’s Baidu hottest emerging keywords. (Baidu is like China’s Google) pic.twitter.com/AWtVw9aOzw

— cnLedger (@cnLedger) April 4, 2019

After plummeting from the all-time high in late December, Bitcoin reached a low of around $3,200 before surging in recent days above $5,000. The $5,000 line has proved itself to be a crucial battleground as a psychological market of support/resistance. At the time of writing, Bitcoin is testing resistance and trading at $4,997.95.

Understandably, the surge has led to a renewed interest in Bitcoin. The leading cryptocurrency is clearly a hot topic in the enormous Chinese market – Google also shows a major increase.

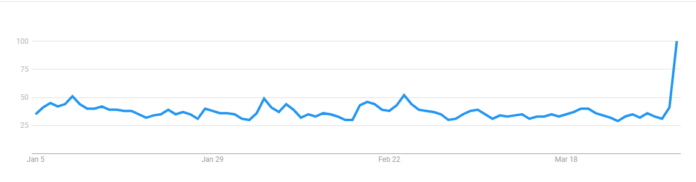

The following Google Trends search analysis shows a massive spike in Bitcoin searches in recent days. Bitcoin searches more than tripled from 31 to 100 since March 31.

Bitinfocharts.com shows that the number of tweets sent per day with the word “bitcoin” also spiked following the price surge.

Google search results and tweets per day are positively correlated with cryptocurrency price action according to a study by Yale University economists.

Importance of Baidu Results

Despite the nation’s status as a Bitcoin mining hub, China has been outspoken in its lack of support for Bitcoin as a currency. The Chinese government banned ICOs in 2017 and heavily regulated trading, with talks of a Bitcoin ban on many occasions. However, a Chinese civil court ruled that Bitcoin constitutes personal property and has the right to be legally protected as such.

With the country’s rocky relationship with Bitcoin, it’s surprising to see such a spike of interest. Interest in Bitcoin is now triple that of any other commodity according to Baidu search results with a reading of 9715 vs 2236.

Bitpay’s CCO, Sonny Singh, commented on the rising interest in Asian markets.

A lot of times these price spikes happen in America but now that it occurred when the markets closed, one can easily say that it shows how the Asian market is becoming. BTC trades 24/7 around the world and that has become evident. I don’t know what made the market move but my analysts had told me that once BTC breaks the $4300 mark, it will zoom on the price charts.

Bitcoin Surge

“You shouldn’t believe everything you read on the internet.”- Rachel McIntosh of @financemagnates knows what she’s talking about after April Fools article allegedly moved the market. Check out Rachel and @iWriteCrypto of @CCNMarkets discuss the news at: https://t.co/51sSH7GSUC pic.twitter.com/yyWynB5EmG

— BLOCKTV (@BLOCKTVnews) April 5, 2019

As Singh points out, the reason for the surge is a mystery. I appeared with Rachel McIntosh of Finance Magnates on BlockTV on April 05 to discuss market news, and Rachel’s recent work came up. Published on April Fool’s day, Rachel wrote an article stating that Bitcoin ETFs had received SEC approval.

Rachel declined to comment on this during our Block TV appearance, but coyly added that “you shouldn’t believe everything you read on the internet.”

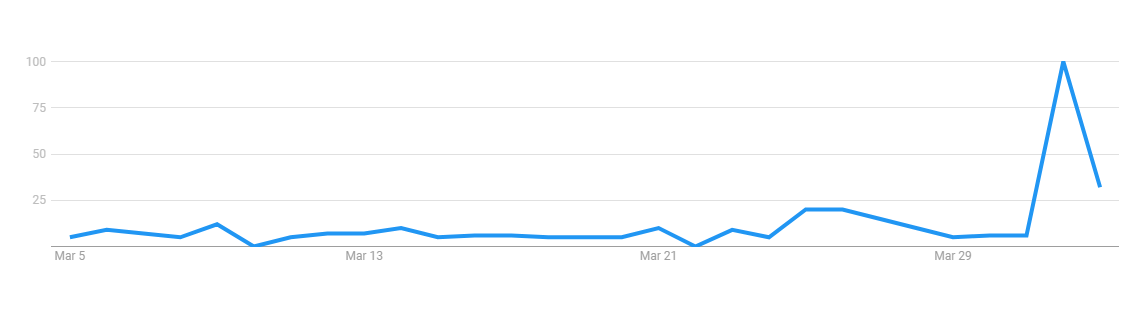

Google Trends for Bitcoin ETFs rose by 94% following the article.

[ad_2]

Source link