[ad_1]

The bitcoin cash (BCH) price endured a significant correction on Thursday as the fifth-largest cryptocurrency dropped 10.7-percent from its session high.

Top Cryptocurrencies Pull Back from Recent Highs

The BCH-to-dollar rate had surged around 100-percent since Monday morning, leaving its top rival bitcoin behind in terms of overall gains. The pair extended its rally towards $341.66 after the US market open yesterday. Later, it corrected to circa $280 in just two hours – its intraday low.

The next BCH flight was not much impressive, as it recovered a mere 8-percent against an overall 22-percent downside correction. As of 16:30 UTC, bitcoin cash was trading at $285.37.

Crypto exchanges posted BCH volumes worth about $3.89 billion, calculated in real-time per a 24-hour adjusted timeframe. Tether’s stablecoin USDT seized a majority of BCH spot trades, followed by South Korean Won and bitcoin.

Bitcoin Cash (BCH) Price Fundamentals

Bitcoin cash walked upwards with a few fundamentals by its side. First, there were reports about increasing BCH futures volume on UK-based Kraken subsidiary Crypto Facilities. Second, there was an announcement from the bitcoin cash project camp regarding the launch of their new Simple Ledger Protocol. But those developments didn’t justify a double jump in the BCH markets, despite their relevance in the long-term.

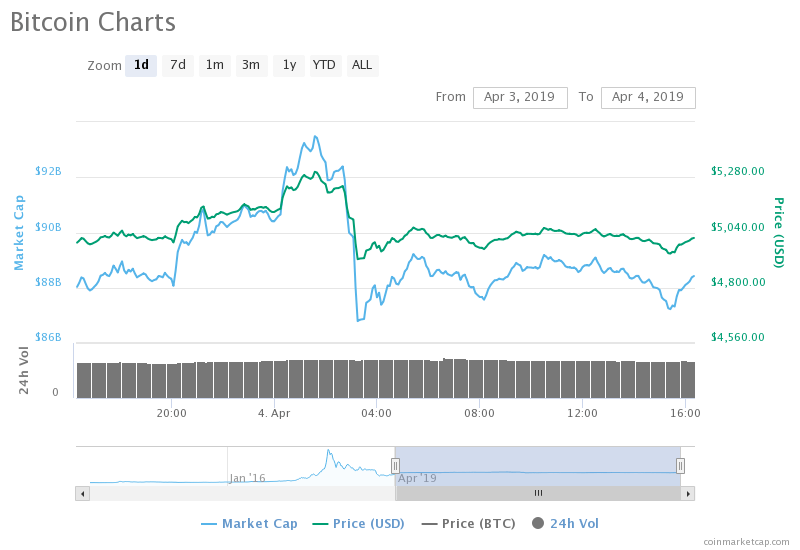

More likely, the bitcoin cash price action tailed the bitcoin market’s upward trend. Even today, BCH’s chart on CoinMarketCap looks strikingly similar to that of bitcoin (although BCH was more volatile).

What’s Next for the Fifth-Largest Cryptocurrency?

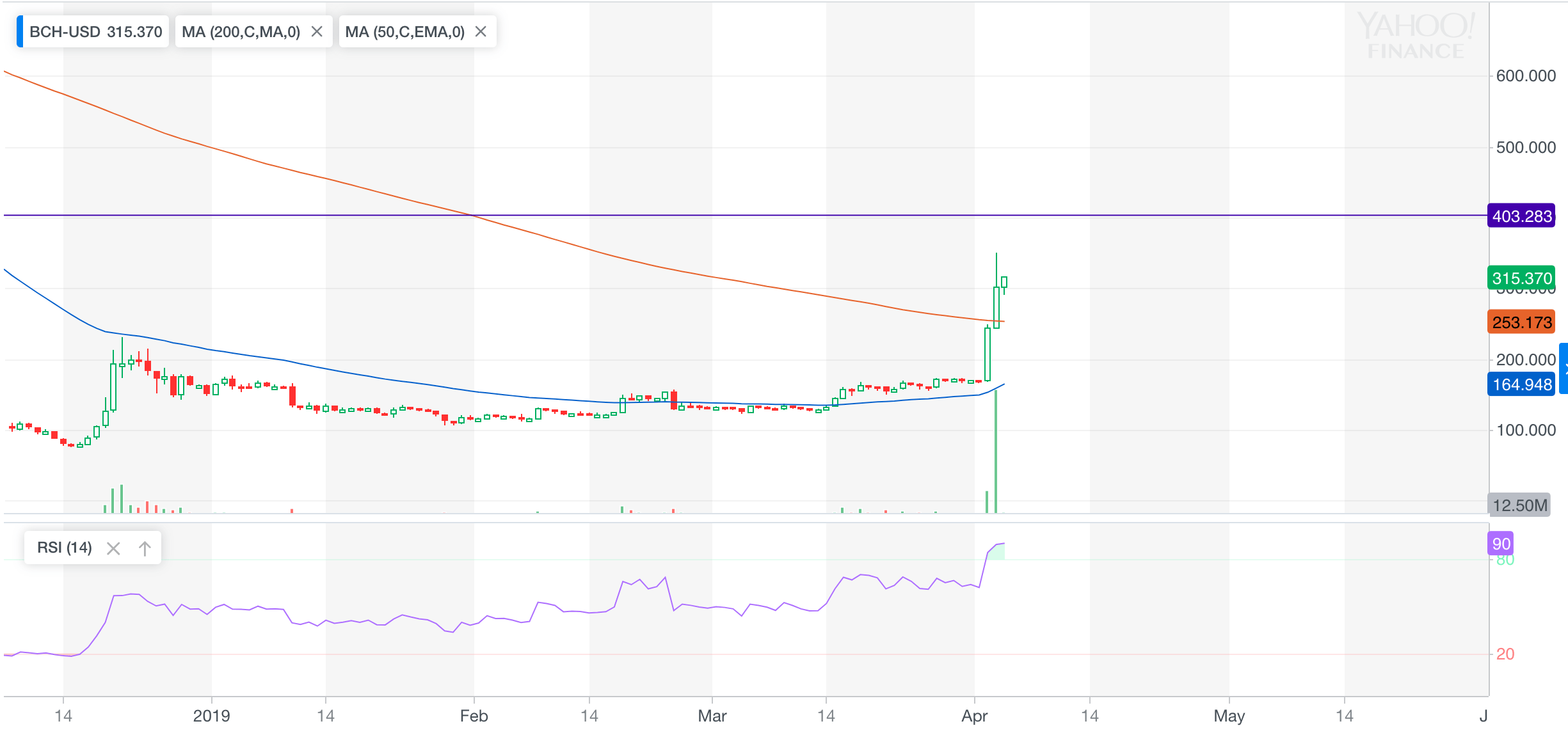

At first, the BCH-to-dollar rate was looking to extend its upside trend towards $400, which served as a support to BCH from September until October last year when it broke amid the contentious hard fork. Achieving the said level could confirm a medium-term bullish bias for the cryptocurrency.

However, the bitcoin cash price uptrend is appearing to slow. The RSI levels are overbought, with the trend’s head hinting a reversal from 90. It doesn’t mean there would be a dump, more likely a downside correction.

Should that happen, the BCH price could locate a potential bounce back level near the 200-period EMA right below (indicated via the red curve). Breaking below it would signal bulls’ exhaustion.

[ad_2]

Source link