[ad_1]

In the past seven days, the valuation of the crypto market has increased from $131 billion to $137 billion as the Bitcoin price slightly recovered to $3,960.

Bitcoin Stagnancy Shows No New Money Entering Crypto Market

The minor movement in the price of bitcoin despite the significant surge in the price of alternative cryptocurrencies suggest that existing money in the cryptocurrency market is moving – but new money is not flowing in.

Speaking to CCN, a cryptocurrency technical analyst known as DonAlt said that there exists a newfound optimism in the cryptocurrency market which may have been primarily triggered by the spike in the price of ethereum.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

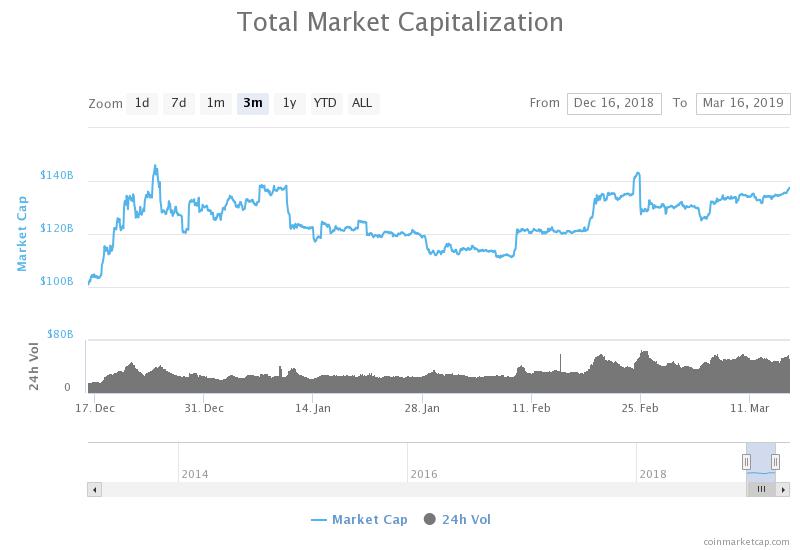

The bitcoin price has been relatively steady over most of the past three months. (Source: Coinmarketcap.com)

But, until bitcoin breaks $4,600 and makes its way towards $5,000 to $6,000, the trader said that it’s difficult to conclude the bear market is over.

Crypto Market Sentiment is Improving. Why is Bitcoin Stalling?

In recent weeks, prices of many crypto assets and tokens in the likes of litecoin and enjin coin have surged substantially against both bitcoin and the U.S. dollar, recording gains in the range of 20 to 100 percent.

Still, the price of bitcoin has remained in the tight $3,800 to $4,000 range, unable to cleanly break out of the key $4,000 resistance level for months.

While the volume of bitcoin has reached $11 billion in recent weeks and the overall trading activity in the cryptocurrency market increased, DonAlt told CCN that he is not particularly concerned about the volume.

Rather, the analyst explained that bitcoin breaking at least $4,600 is crucial to confirm the end of a 15-month bear market and that as of now, there is little inflow of capital.

He said:

“Volume isn’t what will convince me that the bear market is over, a bullish market structure along with a break of at least $4.6k (Favorably $6k) is. It’s interesting that we’ve had so many altcoin pumps while the general market cap hasn’t really changed. That makes me think there is very little new money coming in.

But, in spite of the stability of bitcoin, the analyst said that the two-fold surge in the price of ethereum from $80 to $160 created newfound optimism in the market, leading investors to become more confident in the alternative cryptocurrencies market.

The ethereum price has made a marked recovery since crashing below $100. (Source: Coinmarketcap.com)

“There definitely is a newfound optimism in the market ever since ETH managed to double from $80 to $160. That move raised confidence in the market for both traders and investors alike and that confidence is now seeping into the altcoin market. That optimism drives volume which we’ve seen increase in recent weeks,” the analyst added.

Macro Movement of Crypto Remains Bullish

In a grand scheme of things, the analyst explained that the cryptocurrency market seems to be turning towards a positive direction given the price movements of most cryptocurrencies in the market.

CBOE reportedly decided to drop bitcoin futures in the short-term due to lack of volumes, but analysts suggest that the decline in volumes is solely reflected on CBOE’s bitcoin futures, not necessarily other futures products.

“I’d say that’s just mostly caused by the lack of volume on those futures. Nothing too significant even though it’d be incredibly funny if the listing of the futures marked the top and the delisting marked the bottom. I’m personally very optimistic crypto on a macro scale in general, the market looks like it’s trying to turn direction. Might just take a while until it’s finally put in a good enough base to rally from,” the analyst said.

The cryptocurrency market has climbed gradually since December 2018 and if bitcoin, as the dominant cryptocurrency, leads a market to the upside, many traders expect the trend of the cryptocurrency market to turn.

[ad_2]

Source link