[ad_1]

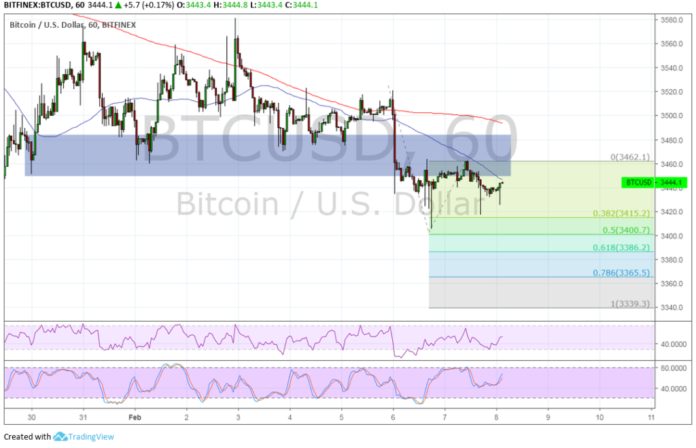

Bitcoin seems to have completed its pullback to the area of interest at the $3,460 area and could be ready to resume its slide. Price might aim for the Fibonacci retracement levels next.

The 100 SMA is still below the longer-term 200 SMA to indicate that the path of least resistance is to the downside. In addition, the 100 SMA is holding as dynamic resistance and is widening its gap with the 200 SMA to confirm the presence of selling pressure.

Price is closing in on the 38.2% Fib extension at the $3,420 level but might have room to dip to the 50% level at the $3,400 mark and swing low. Stronger selling pressure could drag it down to the 61.8% level at $3,386.20 or the 78.6% level at $3,365.50. The full extension is located at $3,339.30.

RSI is still pointing up to indicate that bullish momentum is present. This might still keep bitcoin in correction mode, possibly pulling up to the area of interest again or until the 200 SMA dynamic inflection point at the $3,500 level. Stochastic is pointing up to indicate that buyers are in control of price action, but the oscillator might be nearing the overbought level soon.

Weaker trading volumes on the Chinese New Year holidays are being blamed for the slow price action in bitcoin and other cryptocurrencies. Still, it’s worth noting how support levels are being defended by bulls buying on dips.

Volatility is expected to kick higher around the weekend and onto the following trading week as more traders return to their desks and price in the latest developments. There have been no big ones, though, apart from the more upbeat stance shared by a JPMorgan analyst regarding institutional investments.

This lines up with the anticipation for the launch of Fidelity’s institutional platform and bitcoin custody by March, which is expected to attract more funds from banks and big funds.

[ad_2]

Source link