[ad_1]

Bitcoin, Facebook Coin and JPM Coin could together usher in a crypto default for value transfer. And to help see why, there is a crypto adoption lesson from America’s utopian past.

Be it the internet of value trumpeted by Ripple or the peer-to-peer electronic cash of Satoshi Nakamoto’s bitcoin whitepaper, the premise that underlies crypto valuation assumptions is the notion that money will in time be brought into the digital age.

Just as Netflix makes watching what you want when you want possible in a way that the analogue TV networks couldn’t, or the iPod and then Spotify began to deliver similar instant gratification in the realm of music, so too will money get the consumer-first digital makeover.

The last week of February 2019 may in retrospect signal a pivotal moment in the history of, and revolution in, payments

The commodification of payments

It was the week in which a report by MoffettNathanson analyst Lisa Ellis predicted the possible commoditisation of current private payment systems as a direct result of inroads by crypto.

She didn’t mention, judging by the reports on her client note, the giant step towards this when Facebook’s coin launches in the next four months, assuming this week’s report in the New York Times is accurate.

As seems fairly certain, Facebook will turn on a crypto-based payments system for WhatsApp, and no doubt, in time, for its other properties. When it does the future that Ellis dwells upon as an “existential threat” to payment incumbents such as Visa, Mastercard and PayPal, determining that it “is unlikely to occur soon”, may in fact be much closer than she expects.

We don’t know exactly how Facebook’s coin will work but it seems likely it will be a stablecoin and perhaps using a delegated proof-of-stake consensus system, or it could go down the sharding road that Telegram is using in its Telegram Open Network (TON) protocol.

Facebook’s and other future distributed ledger systems may not be on blockchain at all.

They could use so-called post-blockchain approaches, such as hashgraph in which virtual voting establishes consensus; direct acyclic graph where a previous transaction validates a succeeding one; or Holochain-esque decentralised edge architecture, where nodes have their own chains and even unique consensus systems as well

Whichever direction Facebook goes in is of course dependent only partly on what is most convenient for the consumer and probably mostly on what is most profitable in the long run for the company. For the phrase “profitable in the long run” we might supplant with the word “controllable”.

Two Facebook coins to rule them all?

Facebook will be acutely aware of the danger of creating a system that competitors will be able to piggy back on, although if it is, as reported, looking at listing its cryptoasset on exchanges then perhaps it wants to see its stablecoin used beyond its ecosystem so that it can suck into its gravitational field the rest of the cryptoasset economy.

Or maybe it will create a free-floating coin alongside its putative stablecoin; one that will reward content creators or perhaps with a portion of supply given to its customers for a utility function in a new blockchain-based Facebook Connect ID verification system?

Although some might in the distant past have been fooled by Facebook’s supposed mission to do good in the world, or for that matter Google’s mission to forestall evil, that’s all for the birds. A payments system built by Facebook will necessarily limit the extent to which it is decentralised. However, if it is too centralised it would defeat the purpose of putting in place a decentralised architecture in the first place. So perhaps we should expect some sort of halfway house from Facebook.

However, although not the intention of whatever system emerges from Facebook, it could in fact come to be a necessary staging post on the road to “free money” by introducing the masses to crypto, an introduction from which there will be no turning back.

Bitcoin – commoditisation’s reserve currency

But where does bitcoin fit in? Well that’s where Ellis’s commoditisation thesis comes in.

Ellis thinks it is much less likely that the payment incumbents will be disintermediated. Instead she expects commoditisation but if those incumbents incorporate blockchain tech then they can protect and advance their positions (she has a buy recommendation on Visa, Mastercard and PayPal).

“Cryptocurrency systems (e.g., Bitcoin, Ethereum, Ripple) are potentially disruptive to private payment systems. Their core design characteristics – which are aimed at enabling ‘freedom of money’ – are in direct contrast to the characteristics of most traditional, private payment systems,” says Ellis, but how can we expect that to play out?

Commodification of payments means the feature differences between the offerings in the marketplace vanish, with competition reduced to price alone. Payments commodification in the age of crypto implies the reduction of all service providers to delivering over the cheapest and most efficient protocol.

Company-centric coins repeat Web 1.0 mistakes?

In a world that’s coming rapidly into view, where we could have a jumble of private money forms – from Facebook to JPM Coin, from BTC to XRP, from retail to wholesale, which one is likely to be the most useful and therefore most widespread?

It will surely be the one that has staked out the ground in such a way that it can speak to all others, not the one trying to define its own universe.

In a way, we’ve been here before. At the beginnings of the internet in the 1980s we had walled-garden worlds, courtesy of the likes of Compuserve and AOL , in which each tried to fashion its own corner of the internet that users had to pay to play in, but as there was nothing else useable around for the layperson it sort of worked for a bit (no pun intended).

But then came the Netscape web browser to make sense of the protocols of the public internet so that mere mortals were not required to know what transmission control protocol, internet protocol and hypertext transfer protocol meant or did.

Compuserve and the rest became redundant.

Returning to the world of value transmission, it is today possible to imagine an online universe where the interfacing between Facebook Coin, JPM Coin, TON, Amazon Coin (yes, Bezos might want to keep his value transfer options open) etc is not a void made passable only by fiat entries and exits, but by the internet of value’s ultimate reserve currency, bitcoin.

That doesn’t mean that fiat and its payment rails, including steps towards the non-crypto “omnichannel” combining offline point-of-sale and online, as PayPal is trying to do, will disappear, primarily because nation states and will not disappear.

Payments arms race is upon us

Facebook’s payments system is likely to be most successful, at least initially, in those parts of the world where the prevalence of current dominant payment networks are not as readily accessible to large swathes of the population that increasing need to move value about. But is won’t stop there, in adoption terms or regional presence.

Crypto payments also make sense in developed markets. Why transfer value in a fiat medium when you can achieve the same results more quickly and much more cheaply with crypto, be it Facebook Coin for consumers or JPM Coin for corporations? The genie won’t be rebottled.

Assuming Facebook makes a success of payments, which its dominant social network positioning means is likely, then it will trigger an arms race in payments, if it hasn’t already done so. And it should be noted that Facebook is playing catch up with Asia when it comes to mobile payments

The reality of a new payments landscape is dawning on Facebook’s big bank (some banks still don’t realise that they are competitors of Facebook) and big tech competitors. The credit card tie-up between Goldman Sachs and Apple is in some respects recognition of this, although there is no indication of a crypto angle as yet.

JPM Coin’s money grab: unpegged and retail-facing?

Of course, there is the danger that coins from big tech or more pertinently big banks, will actually be a roadblock to “real” crypto adoption and not a staging post en route to a better place.

Anthony “the pomp” Pompliano , co-founder at Morgan Creek Digital, sounding off in his Off The Chain podcast said as much when dissecting the implications of the JPM Coin birthing.

He forsees a future he doesn’t care for in which JPM Coin pivots from wholesale to retail.

As previously reported by EWN, JPMorgan Chase chief executive Jamie Dimon has already hinted that the coin could be openly traded.

According to Pompliano, as soon as JPM Coin is widely adopted in both institutional and retail domains JPMorgan Chase will forget about the dollar peg and just start issuing the coins without collateral restraint.

For those who came to crypto in search of a solution to debt-fuelled fiat devaluation JPM Coin lands us back where we started. The pomp issues a warning: “We should do everything in our power to prevent this from happening. The US government is already questioned quite aggressively about monetary policy decisions, so imagine if we had to trust a Wall Street bank that was previously charged with a felony.”

However, even if such a scenario were to come to pass, is it really to be feared as Pompliano imagines?

Wouldn’t it bolster the use case as store of value for mined crypto such as bitcoin, the granddaddy of them all? There could be an even stronger argument to say that it would enhance bitcoin’s claim to be the reserve currency of the digital age.

Co-founder of Apple Steve Wozniak may agree with that last point. Speaking to Bloomberg this past week, although he is not definitive on whether bitcoin will be the world currency he hopes it will, but he thinks it should be, claiming its inception far from destroying value as heralded “massive value creation”.

How private money could win this time – from time store to blockchain

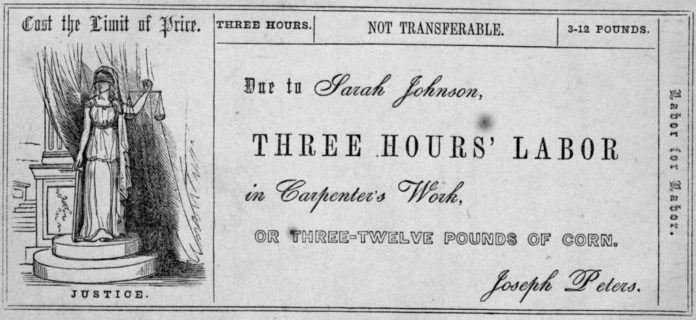

As a student of economic history, I was fascinated by the experiments of anarchist free-marketeer Josiah Warren in the nineteenth century US and his founding of the Cincinatti Time Store in 1827.

Deriving from the labour theory of value as expounded by the classical political economists such as Adam Smith, the time spent making or procuring a product or service determined its value. Warren’s “labour note” denominated in the time taken to produce a commodity was the medium of exchange at his time stores.

The experiment in its own terms was a success, with the time stores the most popular shops of their day in Cincinatti.

Warren went on to start communities based on his labour exchange ideas, fittingly named Utopia and Modern Times (later renamed Brentwood) but failed to remake the American economy in the image of his new order of ethical mutuality where none could exploit the labour of another.

There was one obvious problem with the labour notes – not all labour was of equal value and the utopian communities were not sealed off from the non-utopian outside world. To address this, a person could post their own rates, the standard of measure being corn.

As the wiki entry explains: “Although it goes back to 1827 though 1830, Josiah Warner’s ‘Cincinnati Time Store’, which sold merchandise in units of hours of work called ‘labour notes’ which resembled paper money, this was ‘[p]erhaps … the anticipator of all future’ Local exchange trading systems, and was even a precursor to modern cryptocurrency”.

Another more immediate problem was timing and how to spread the word about the success of the stores? There was no way of achieving the necessary dissemination at the scale required to compete with the growth of industrial capitalism which went into hyper-drive after the US Civil War. The days when freely associating individual landowners could subsist and thrive through their own labours were passing.

In an economy today characterised by instantaneous one-to-many communications and where the advent of blockchain technology means non-governmental digital money forms can be verified and trusted with mathematical certainty most effectively (currently) in mined systems, to the satisfaction of all market participants, such a money network could prosper and spread through dint of its use value as an exchange value.

Short of state prohibition, although even that would be of doubtful effectiveness given the impossibility of turning off the internet unless through the advent of a dystopian post-apocalyptic nuclear winter, the forward march of bitcoin, or a competing cryptoasset, may be unstoppable. Facebook and JPMorgan Chase, by getting the party started, could be the unlikely midwives.

[ad_2]

Source link