[ad_1]

On February 8, the crypto market experienced a strong $10 billion recovery from $111 billion to $121 billion, breaking out of a three-week stalemate.

With an overnight price movement, the crypto market nearly fully recovered to January levels at around $130 billion.

Several major crypto assets in the likes of Litecoin (LTC) and EOS (EOS) recorded gains in the 15 to 20 percent range against the U.S. dollar.

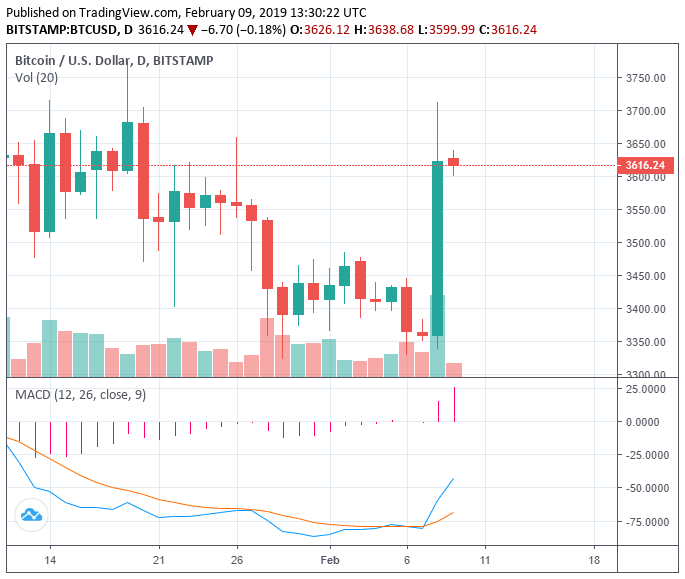

Bitcoin surged by 11 percent from $3,337 to $3,711. Although the dominant cryptocurrency slightly retraced to $3,616, it has shown strong momentum in the past 24 hours.

Traders Foresee Bullish Movement For Bitcoin and Crypto?

A properly established bottom for Bitcoin is not in just yet. The asset is still vulnerable to a short-term drop below the $3,000 support level.

Speaking to MarketWatch, Think Markets UK chief market analyst Naeem Aslam said:

“For the past few weeks, we have not seen any significant movement in the bitcoin price. We are stuck in a price range of $3,183 (17 December low) to $4,234 (Dec. 24 high), as long as we are not breaking out of this range, there is nothing new.”

Throughout February, many analysts have emphasized that Bitcoin has to recover to the $4,000 to $5,000 range to confirm a breakout above a key resistance level.

If the asset remains in the tight $3,500 to $4,000 range, there exists a low probability of BTC initiating a rally back to its all-time high at $20,000.

Given the uncertainty around the short-term performance of BTC and whether it could break into the mid-$4,000 region, traders expect the asset to demonstrate a sideways action.

Mayne, a cryptocurrency technical analyst, wrote:

Maybe the low is in and it’s an uptrend from here to ATH. Maybe we form a range and go sideways. If you are worried about missing the next bull run because of today, chill. The goal is to catch the majority of the move, few will buy at or near the low and hold to ATH.

Generally, traders have become more optimistic in the short-term future of BTC and the rest of the cryptocurrency market due to the strength shown by major crypto assets in the last 48 hours.

I’m not going to lie, it looks bullish and I re-longed it. Same stop.

— The Crypto Dog📈 (@TheCryptoDog) February 9, 2019

A case can be made that Bitcoin will not likely drop by a substantial margin in the weeks to come, bringing down the entire crypto market with it due to various technical and fundamental factors.

Earlier this week, Hsaka, a cryptocurrency trader, said that shorting Bitcoin at $3,300 is risky because of the resilience of its support levels that have been tested since December.

“Wouldn’t short this right now: sitting at daily support, consolidation (3340 -3480) lows taken, beginning to round off. If we do pump, interested to see how price reacts to the 3440-3450 zone,” the trader said.

Hence, while it cannot be confirmed whether a bottom is in at $3,122 for Bitcoin, analysts see BTC and the rest of the cryptocurrency market performing relatively well in the $120 to $140 billion range.

What Can Investors Expect From Crypto?

Cryptocurrencies with strong fundamentals, developer communities, and high transaction volumes have outperformed most digital assets in the space throughout the past four months.

This week, Litecoin and EOS were the best performing assets in the global cryptocurrency market and the two blockchain networks have seen significant progress in technology development and decentralized application (DApp) adoption.

As CCN reported, Litecoin is in the midst of fully integrating Confidential Transactions and Mimblewimble, two solutions that will improve the blockchain network’s privacy and scalability.

EOS, despite some controversy around the structure of its blockchain, has seen an increase in user activity on its DApps.

If the technical indicators continue to point toward a sustained corrective rally and are supported by fundamental factors, major cryptocurrencies are expected to maintain their momentum in the short-term.

[ad_2]

Source link