[ad_1]

By CCN.com: Binance Coin (BNB) is reasonably on the radar now for investors seeking bullish momentum.

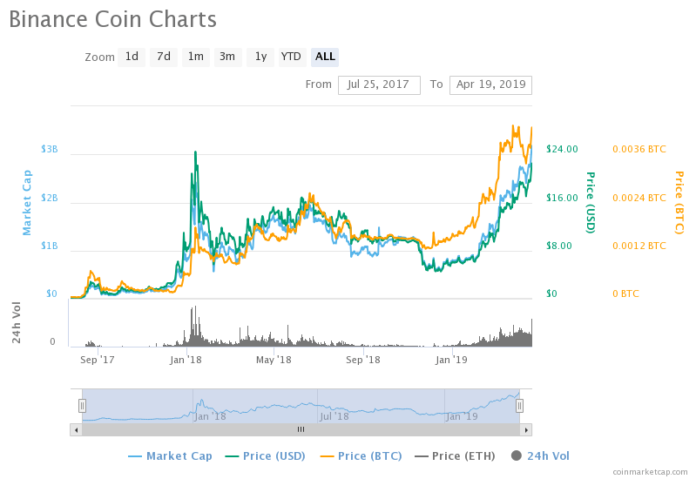

The Binance crypto exchange’s native token established a new 52-week high, up 81.49-percent from its 52-week low price of $4.19. The move prompted BNB to come closer to retesting its all-time high price of $24.91, which was accomplished during the January 12 trading session in 2018. But are there more gains in store for this crypto asset? Let’s take a quick look at its near-term market outlook to understand where it might head next.

Mainnet Launch in Focus

Binance on Thursday announced that it would launch Binance Chain, a public blockchain network which will support BNB tokens, on April 23. The exchange will soon integrate its decentralized exchange platform into the Binance Chain. At the same time, Binance will allow projects to issue new tokens on its chain, effectively enabling them to run initial coin offering rounds by raising funds in BNB.

.@Binance Chain launches its mainnet and plans to execute Mainnet Swap on Apr 23, 2019.

Please see the below link for further details on the actions that will occur along with the planned timings for them to do so. 👇👇👇https://t.co/32hjBwkUcX pic.twitter.com/X9qAoXxYmc

— Binance DEX (@Binance_DEX) April 18, 2019

Binance will earn a small fee from each trade on its decentralized exchange. The firm will also charge a listing fee from projects that issue their tokens on Binance Chain. According to CEO Changpeng Zhao, the listing fees could be as high as $100,000 based on the size of the project. Binance decentralized exchange will not hold custody of customers’ tokens. The service will most likely attract traders looking to retain the ownership of their private keys.

Binance confirmed that they would use a limited number of nodes to run the Binance Chain. It means that the custom blockchain will be less decentralized than that of Ethereum. On a positive side, it would be able to process “a couple thousand” transaction every second to ensure a smooth running of the decentralized exchange on it.

More Gains Ahead?

Binance Chain holds promises to attract more BNB adoption following its launch. On the other hand, Binance runs a token buyback event reduces its BNB supply every quarter. The economic outlook presents a bullish scenario for BNB investors in the long-term, boosted further by Binance’s impressive year-to-date performance in the market.

In our base scenario, BNB is valued at $106, which gives BNB a total value of 20 billion US dollars, exceeding possibly 15 billion valuation of Binance’s equity. @cz_binance @GBinance Look forward to hearing your comments. https://t.co/UqUs7HXMz5

— [email protected] (@skhashglobal1) April 19, 2019

Technically, a close above the all-time high accompanied by significant volume could see the BNB price shooting towards a roofless area.

[ad_2]

Source link