[ad_1]

Now that most industry observers and technical analysts are

in agreement that the bottom is in and trend could be reversing, they are

starting to look towards the next high points. There are many ways of attempting

to predict market cycles but looking back at previous ones is a good place to

start.

Previous Appreciation Waves May Be The Answer

Whether a final capitulation is forthcoming or not the

likelihood of Bitcoin ending this year a lot higher than it started it is very

strong. One analyst has taken the approach of looking at growth between

previous peak to peak cycles to try to predict the next one.

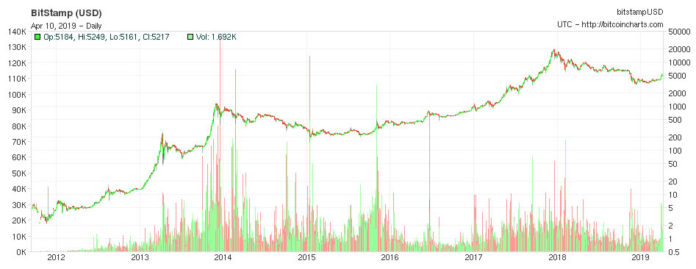

As reported by Seeking

Alpha, historical waves could give us the answer. The first one took

Bitcoin from $5 to $200 which was an appreciation of around 3900 percent. A

bear market followed and the second wave saw prices appreciate from $50 to

$1,200 which was approximately 2300 percent. Wave three, the most recent, saw

Bitcoin surge from $200 to almost $20,000 in an epic pump of 9800 percent.

Using the lowest appreciation of 2300 percent and taking

$3,200 as Bitcoin’s low point in the current market gives wave four a peak

price of $74,000. Taking an average appreciation 5333 percent from the three

waves the price at the peak could be as high as $170,000.

Peak to peak prices can also be used to attempt an

estimation of future prices. Peak one to two saw a 2750 percent gain from $7 to

$200, peak two to three was just below 500 percent from $200 to $1,150. The

latest peak at just below $20,000 was 1640 percent higher.

Again, using the lowest figure of 500 percent from the most recent all-time high gives a next peak value of around $100,000. So in conclusion the analyst, Victor Dergunov, concludes that the next bull run could take Bitcoin to a high of between $75k and $100k which is likely to take a couple of years to play out over its next growth cycle.

He adds that the driving factor for appreciation will be

simple. With an estimated 18 million people owning Bitcoin,

according to his own research, and over 3.2 billion people using the internet, the

penetration rate for BTC is just 0.56%. The remaining 99.44% may choose to get

more exposure to Bitcoin in the future. A comparison to the web monopolies such

as Amazon, Google and Facebook, that did not even exist a few years ago, server

as a good example of mass adoption.

The arguments are pretty convincing, on paper anyway, and

the renewed confidence in Bitcoin and crypto assets which are finally

making measurable moves upwards again could see markets on the way to their

next peak very soon.

[ad_2]

Source link