[ad_1]

By CCN: Billionaire Warren Buffett gave Amazon stock a jolt today after revealing that he owns AMZN shares and was “an idiot” for not investing in the e-commerce giant sooner.

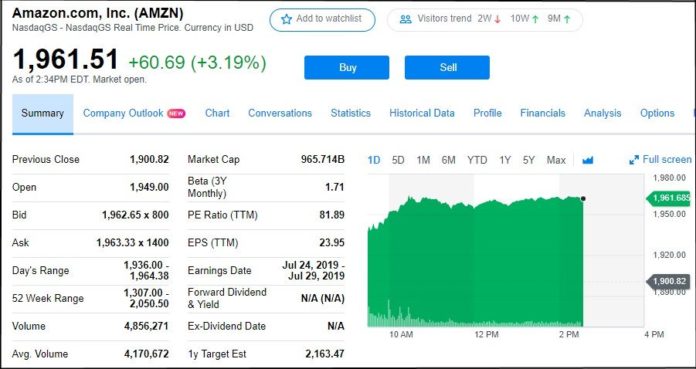

As of this writing, Amazon stock was trading at $1,961, up 3.19%, on above-average volume of 4.85 million shares. Average daily trading volume is 4.17 million shares.

Amazon’s stock price was buoyed after billionaire Warren Buffett announced he has been buying AMZN shares. | Source: Yahoo Finance

Buffett: ‘I’ve Been an Idiot for Not Buying Sooner’

On Friday morning, Amazon stock climbed 2.5% in pre-market trading after Buffett told CNBC yesterday that he had underestimated billionaire Jeff Bezos and his relentless will to dominate the market.

“I’ve been a fan, and I’ve been an idiot for not buying [Amazon stock sooner]. But I want you to know it’s no personality changes taking place.”

Buffett says his multi-national holding company, Berkshire Hathaway, has been quietly buying up Amazon shares. Those purchases will show up in an SEC filing later this month.

“One of the fellows in the office that manage money bought some Amazon, so it will show up in the 13F.”

Warren Buffett says he was “an idiot for not buying” Amazon shares earlier https://t.co/a3L7jwTqLp pic.twitter.com/N274i261S2

— Bloomberg (@business) May 3, 2019

Warren Buffett: Amazon Exceeded My Expectations

This is not the first time that Warren Buffett has expressed remorse for overlooking Amazon’s vast potential and not investing in it earlier. The billionaire mogul says the lapse was “stupidity” on his part.

In 2017, Buffett gushed that Amazon had exceeded his wildest expectations for corporate growth.

“It’s far surpassed anything I would have dreamt could have been done. Because if I really felt it could have been done, I should have bought it. I had no idea that it had the potential. I blew it!”

Charlie Munger: Amazon ‘Is an Utter Phenomenon’

In February 2019, Buffett’s longtime friend and colleague Charlie Munger — the vice chairman of Berkshire Hathaway — called Amazon “an utter phenomenon of nature.”

“There has hardly ever been anything like it in the history of our country…very talented, driven people.”

“I would not have predicted the success that happened. And now that it has happened, I wouldn’t want to predict that it was going to stop, either. I think it may run a long way.”

Jeff Bezos Will Do Whatever It Takes to Win

If Amazon stock is soaring and its corporate dominance continues to rocket, it’s because its fiercely ambitious CEO, Jeff Bezos, will do whatever it takes to annihilate his competition and win.

As CCN reported, Amazon’s Whole Foods subsidiary launched a scorched-earth price war in April 2019 to crush rival Walmart, which has a very successful grocery-shopping business.

To this end, Amazon slashed prices on 500 grocery items at Whole Foods to eat into Walmart’s market share. This was the third round of price cuts the specialty grocer instituted since it was acquired by Amazon in 2017.

Amazon Launches Scorched-Earth Price War Against Walmart

CNBC commentator Jim Cramer, who owns Amazon stock, says Bezos will stop at nothing to decimate the competition.

“They hate, hate, hate Walmart! Walmart is the biggest grocery chain in the country. Amazon will stop at nothing to take away the [market] share that Walmart has gained.”

Cramer excitedly noted that the heated competition between Walmart and Amazon has been good for consumers because they benefit from the price wars between these two corporate juggernauts.

“These guys are doing everything they can to take market share away from each other. That’s great for the consumer.”

Amazon ‘Hates’ Walmart, Schemes to Kill Rival in Bloody Price War https://t.co/532fGPMKS2

— CCN.com (@CCNMarkets) April 2, 2019

[ad_2]

Source link