[ad_1]

All of this talk of ‘altseason’ may be misconstrued as they have all started to pull back again. Bitcoin, however, has held on to its recent gains which is doing wonders for BTC market dominance.

Big Bounce Off Resistance

Crypto markets are correcting again and have dumped $5

billion since their high point over the weekend. The majority of those losses

are from altcoins as nearly all of them are in the red at the time of writing.

Over the past seven days market cap has ranged between $170

and $180 billion and it is currently falling back towards the middle of that

channel at around $176 billion. The altcoins cannot seem to hold their gains

and have fallen into a pump and dump cycle lasting a couple of days at a time.

A number of them have lost over five percent in the past 24

hours and they include EOS, Litecoin, Cardano, Tron, Ethereum Classic, and BAT.

A couple, such as PAI and Bytom have dumped double figures today as the altcoin

avalanche continues.

Several traders are sensing this shift and gradually moving back

into BTC as it is now viewed as a better

bet. Fundstrat’s Tom Lee thinks otherwise stating that one pre-condition to

an alt-rally is a drop in correlation with Bitcoin. He went on to state that

this has already started which could be a precursor to altseason. Some agree

with the sentiment stating that most altcoins are at major support zones;

Others have pointed out that the altcoin dump is good news

for Bitcoin and markets are repeating action last seen in mid-2017 when the two

were inversely correlated.

Bitcoin Dominating

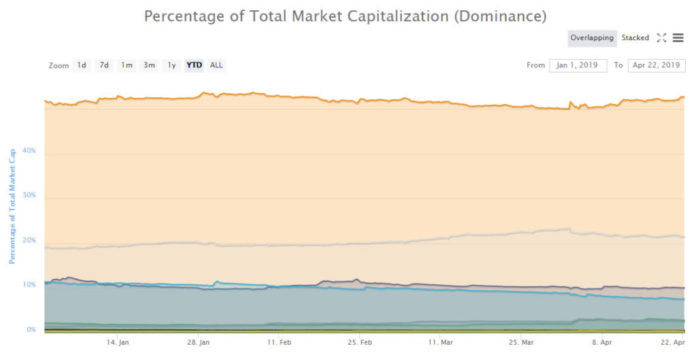

BTC is holding its own at the moment, after reaching a

weekly high of $5,355 a couple of days ago it has only lost a percent or so

pulling back to $5,290 at the time of writing. This has resulted in BTC

dominance climbing to 52.8 percent which is its highest level since early

February.

Bitcoin volume is also up to $14 billion which is another

sign that it could push higher. BTC has made higher lows since its big rally

started at the beginning of April. The slow and steady up trend as met

resistance at $5,400 however and this could prove to be a critical point. The

long awaited ‘golden

cross’ is rapidly approaching and may happen this week as the 50 day moving

average crosses the 200 day. This is generally a very bullish sign for an

asset.

[ad_2]

Source link