[ad_1]

By CCN: The Dow Jones plummeted from 26,502 points to 26,160 points within minutes after the opening bell as investors expressed shock at the decision of U.S. President Donald Trump to raise tariffs to 25 percent on $200 billion worth of Chinese goods.

In the hours that followed, the Dow rebounded to 26,273 points, minimizing the day’s loss to about 0.87 percent.

The Dow Jones has performed relatively well in the past month, today’s stock market sell-off notwithstanding. | Source: Yahoo Finance)

The Dow futures market performance prior to the opening led strategists to forecast a 500 bloodbath at the opening. While it slipped by 450 points at the day’s lowest point, the U.S. stock market bellwether performed better than the expectations of many investors heading into the trading week.

Warren Buffett Isn’t Worried About the Dow

When asked about the 450-point drop of the Dow, billionaire investor Warren Buffett told CNBC’s Squawk Box that selling stocks based on headlines is a pretty stupid portfolio management tactic.

Not phased by the movement of the stock market in the past several hours, Buffett said:

“Well, I’m saying if you own a farm and you’re worried about selling your farm because you read the newspaper this morning or if you own a perfectly decent business and you’re down and you’re worried about selling your business today because of the headlines, then you should worry about selling stocks.”

“But if you look at stocks as businesses that you own little pieces of, why in the world should you sell it based on headlines of any sort? if you expect a farm to be a good investment over the next ten years or if you expect an apartment house to be a good investment over the next ten years and if you own a marketable security and if you expect that business to be a good business over the next ten years, it’s nonsense to get feeling good or bad about what stock prices are doing today.”

More importantly, if the strategy of U.S. President Donald Trump was to mount more pressure on China’s economy to push for a comprehensive trade deal in the near-term, it may have worked.

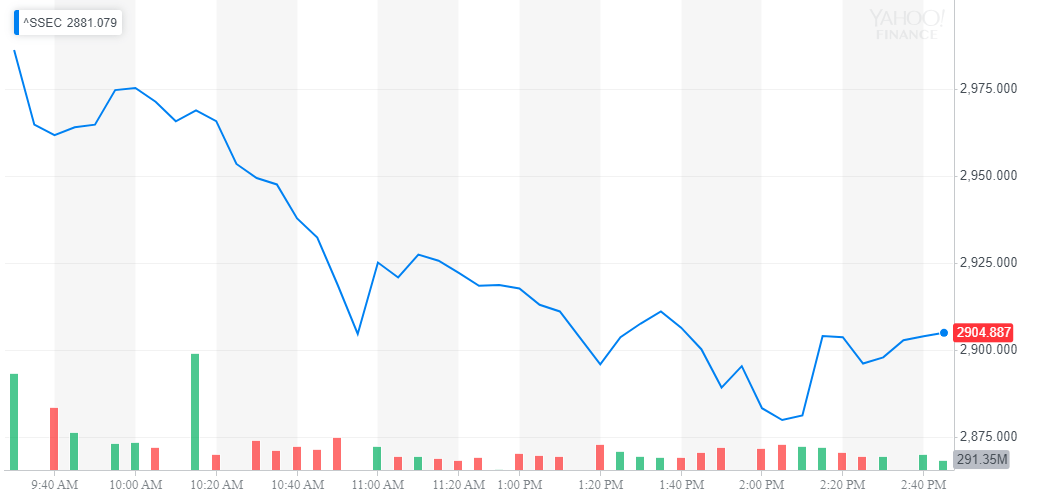

While the Dow fell by 0.87 percent on the day, the SSE Composite, a stock market index of all stocks that are traded at the Shanghai Stock Exchange, plummeted by 5.58 percent following the statement of President Trump.

The SSE has continued to slide in the past five weeks, possibly due to slowing trade talks. | Source: Yahoo Finance

Reports suggest that President Trump delivered an ultimatum after trade negotiations ground to a standstill due to the U.S. demand that China reform its industrial policies, particularly related to intellectual property.

Speaking to Fox News, U.S. secretary of state Mike Pompeo said:

“[It would require a] serious concerted effort [and] a president like President Trump, who is prepared to push back against China, whether that be on trade or their military build up or the theft of our intellectual property. We need a president who will be serious in protecting America against the challenges that China presents.”

Will the Stock Market Rebound?

The first quarter of 2019 has been productive for most major conglomerates in the technology and finance sector with companies in the likes of Microsoft and BlackRock having one of the best quarters in recent years.

Despite signs of noticeable improvement in the U.S. economy as shown by rising jobs growth, the Federal Reserve has resolved to remain patient on future interest rate hikes.

If the interest rate remains low, even with a stalemate between the U.S. and China, stocks could appeal to retail investors in the near-term.

Click here for a real-time Dow Jones Industrial Average price chart.

[ad_2]

Source link