[ad_1]

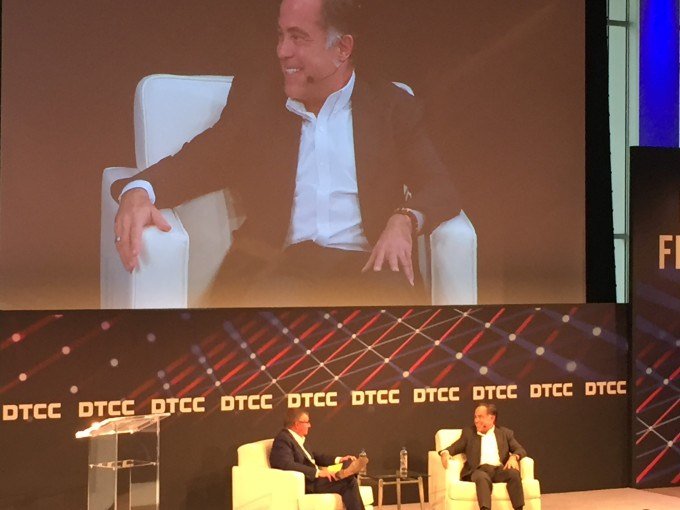

By CCN.com: Goldman Sachs is waiting to throw its hat in the cryptocurrency ring until the U.S. government gives the asset a thumbs-up, American Banker reports. At the DTCC conference this week, Martin Chavez, global co-head of the securities division at Goldman, outlined that we shouldn’t expect to see the investment bank get more involved with crypto until it has solid backing.

That doesn’t mean they’re not interested in the technology, however. Chavez notes,

“We still have things that take overnight or a couple of days. The service level agreement is not where we want it. So there’s no question in my mind that there’s super interesting technology there.”

Goldman Sachs executives believe in the future of cryptocurrency but are leaning towards stablecoins as the solution rather than bitcoin. Chavez continues his reasoning, explaining how a government-backed currency provides market confidence,

“If we’re in the jurisdiction of the U.S. and I owe you some money and I give you one of these bills and you accept it, I’ve extinguished the debt and it’s backed by the force of the sovereign. I wouldn’t forget that as I start thinking about digital currencies and somehow going around sovereign.”

So, while it appears as if the folks at Goldman Sachs are on board with a digital asset future, they want to find a middle ground in which a central party provides some stability. Unfortunately, those two things don’t necessarily mix well as we’ve seen with the recent Tether debacle.

Martin Chavez says Goldman Sachs is staying away from cryptocurrency until it has stable backing from the U.S. government. | Source: American Banker

The Goldman Sachs Rumormill

Hopefully, Chavez’s comments put the rumors about Goldman Sachs entering the cryptocurrency space to rest. Previously, reports surfaced that the firm would be opening a desk dedicated to crypto. However, the stories proved to be untrue as Goldman responded that they never had those plans. Chavez also emphasized at the conference that the firm has no intentions to set up a desk in the immediate future.

There have been rumors that Goldman Sachs is also on the verge of providing cryptocurrency custodial service. But, those are also false. Although clients have requested the ability for the bank to hold cryptocurrency, the firm is waiting until they receive regulatory approval to do so.

To date, the only cryptocurrency service that Goldman Sachs offers to customers is the trading of bitcoin futures.

[ad_2]

Source link