[ad_1]

By CCN: If you think the Dow Jones Industrial Average has had a good run, you haven’t seen anything yet. President Trump wants to see interest rates slashed by 1%, which has the potential to unleash further gains in an already historic bull market for stocks.

On a day when progress surrounding U.S. and China trade talks has shown the most promise yet, he’s looking to the rival economy as a model. He compared the Fed’s recent history of “incessantly” raising rates despite “very low” inflation with China’s “great stimulus” coupled with their low interest rates. When do you ever hear Trump praise anything that has to do with China? Maybe he is just buttering up China’s President Xi Jinping. He went to say:

“We have the potential to go up like a rocket if we did some lowering of rates, like one point, and some quantitative easing…Yes, we are doing very well at 3.2% GDP, but with our wonderfully low inflation, we could be setting major records and, at the same time, make our national debt start to look small!”

China is adding great stimulus to its economy while at the same time keeping interest rates low. Our Federal Reserve has incessantly lifted interest rates, even though inflation is very low, and instituted a very big dose of quantitative tightening. We have the potential to go…

— Donald J. Trump (@realDonaldTrump) April 30, 2019

….up like a rocket if we did some lowering of rates, like one point, and some quantitative easing. Yes, we are doing very well at 3.2% GDP, but with our wonderfully low inflation, we could be setting major records &, at the same time, make our National Debt start to look small!

— Donald J. Trump (@realDonaldTrump) April 30, 2019

The Dow’s up 14% Year-to-Date

To Trump’s point, the Fed has proven to be rate-hike happy. Policymakers have increased interest rates nine times since year-end 2015. The Fed is looking to keep rates within the range of 2.25% – 2.50% and has signaled that it’s laying off from any more increases this year. If the Fed follows President Trump’s advice, they’d return rates to year-end 2017 levels, as CNBC noted.

While everyone knows about the Trumps’ desire to be the best, the economy is doing swimmingly. Inflation is low, which incidentally is what is fueling his request for quantitative easing, the economy is expanding, and corporate profits are growing. America is in a Goldilocks economy with no sign of a recession in sight. Wall Street, meanwhile, has embraced the position of Fed Chairman Jerome Powell to be “patient” with monetary policy, as evidenced by a stock market that’s currently trading at record highs.

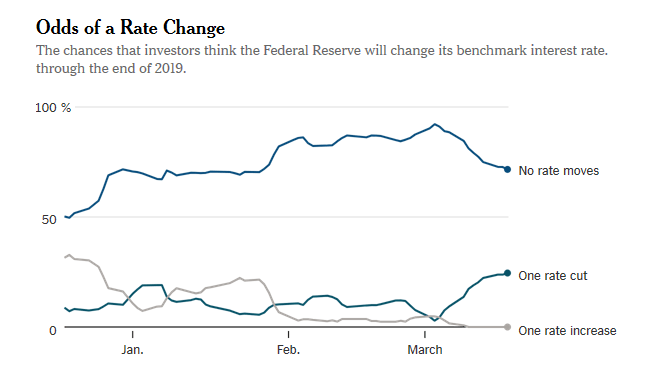

Most investors expect ‘no rate move’ in 2019. | Source: The New York Times

The bull run in the stock market is showing no signs of abating, with the Dow and the S&P 500 both up by double-digit percentages year-to-date. The S&P 500 is trading at a record high and is closing in on the 3,000 level. The Dow, meanwhile, is barreling toward a new high. It’s already surpassed 30,000 and stock market bulls such as Fundstrat’s Tom Lee believe it has more runway for gains in 2019.

The current interest rate environment coupled with hopes of a trade deal between the U.S. and China have been fueling the Dow and S&P. If President Trump gets the rate cut he’s after, it could in fact be to the moon for the Dow and S&P.

[ad_2]

Source link