[ad_1]

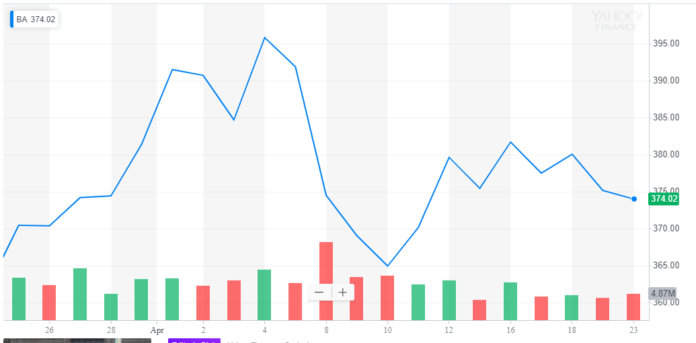

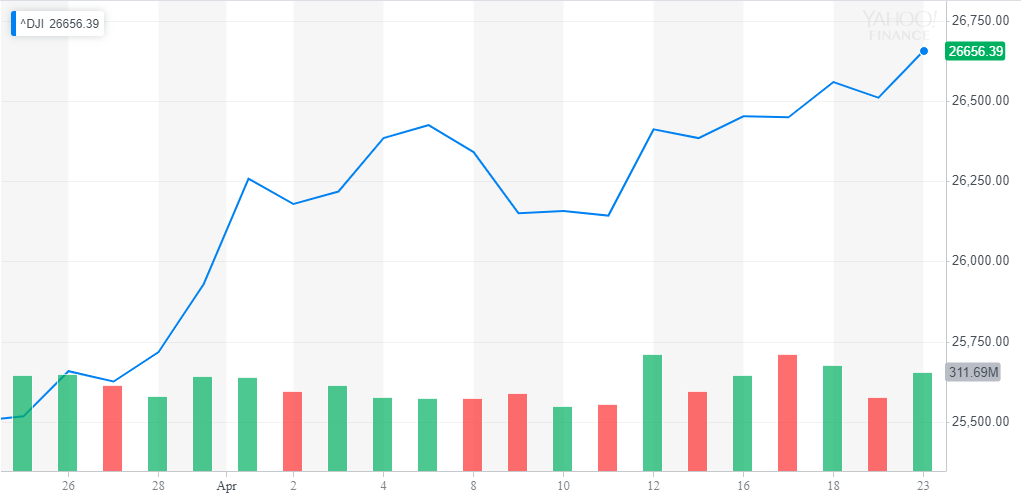

By CCN: Boeing, the largest aircraft manufacturer in the world alongside its rival Airbus, has recorded an 18 percent year-over-year (YoY) drop in quarterly operational earnings. While strategists see a fine future ahead for Boeing in the long run, some fear it could hinder the momentum of the Dow Jones.

The global aircraft manufacturing industry is largely dominated by Boeing and Airbus. Hence, over the next decade, Boeing is expected to recover gradually from the company’s recent struggles.

But, some researchers like Goldman Sachs analyst Noah Poponak said that in the medium-term, at least in the next few years, the temporary suspension of the production of the 737 could pose some issues in the company’s order book, which may lead to an overall drop in the firm’s projected revenues.

Will Boeing Crash Dow’s Historic Bull Run?

The Dow Jones Industrial Average initially plummeted by nearly 9 percent when the fatal 737 Max 8 crash led to the death of 157 people in Ethiopia.

At the time, London Capital Group head of research Jasper Lawler said that Boeing was set for a massive hurdle in the near future.

“This tragic incident will be a massive hurdle for Boeing to overcome,” Lawler said.

The incident occurred in March as the first quarter of 2019 was coming to an end. It remains unclear whether the incident will continue to affect Boeing at a similar magnitude as last month.

Investors generally expected Boeing to record large losses in the first quarter of this year in comparison to last year’s first quarter, and as such, Boeing’s stock slipped after it missed earnings.

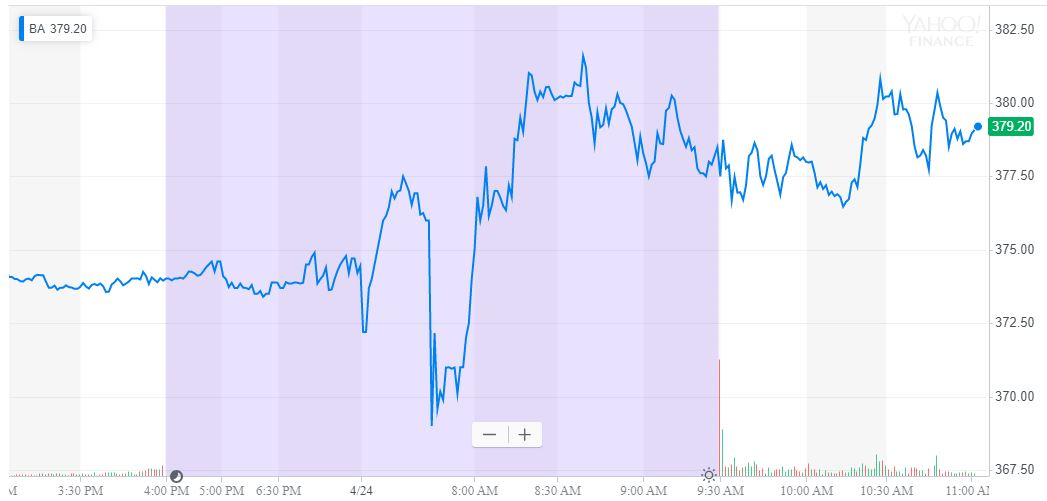

Bizarrely, BA shares quickly recovered and actually rallied 1.34 percent on Wednesday morning.

Given that the performance of Boeing in the first quarter is most likely to be priced into the stock, some analysts suggested that it may be a viable period for investors to buy in.

Despite the short-term weakness in Boeing, Mark Tepper, president of Strategic Wealth Partners, said he remains confident in the long-term performance of the company.

He said:

“We invest in companies that have a good strong growth story that are reasonably priced, and Boeing definitely fits that criteria as a long-term play. This is a stock we want to hold. We love their business mix — over 20% is defense. They’re in a dominant position. We don’t think the airlines are going to switch to Airbus, so we’d be buyers on a pullback.”

In its official first-quarter report, Boeing said that the company saw key defense wins and strategic partnerships, which investors like Tepper have expressed optimism about.

The lack of competitors in the global aircraft manufacturing industry and the dominance displayed by Airbus and Boeing will likely play into Boeing’s favor over the long run.

“The quarter’s operating performance was highlighted by key defense wins, strong commercial widebody performance and orders, continued robust services growth, and receiving Embraer shareholder approval for the proposed strategic partnership,” said Boeing.

Dennis Muilenburg, the CEO of Boeing, also placed heavy emphasis on the long-term fundamentals on the company, reassuring investors a healthy sustained growth.

“As we work through this challenging time for our customers, stakeholders and the company, our attention remains on driving excellence in quality and performance and running a healthy sustained growth business built on strong, long-term fundamentals,” he said.

Why the Dow Will Weather the Boeing Storm

While Boeing had a rough period in the past four months and is expected to struggle in the foreseeable future, the Dow has demonstrated enough strength to maintain its momentum.

With fundamental factors like jobs growth and the Federal Reserve’s patience on interest rates, the U.S. stock market is in a better position that it was at the start of 2019.

Click here for a real-time Dow Jones Industrial Average price chart.

[ad_2]

Source link