[ad_1]

Bitcoin Poised To See Another 10% Jump

Crypto Rand, a popular trader that recently had a bit of a run-in with XRP’s fanatics, recently remarked that Bitcoin (BTC) is showing clear signs that a move higher is on the horizon. Rand’s analysis was simple but sound.

Per the chart (seen below), as BTC has stagnated over the past week or so, it has entered a “bullish pennant” pattern, marked by a tightening range and higher lows. If the pennant plays out as technical analysis bibles expect, Bitcoin will soon see a massive breakout higher, potentially “over the $6,000 region” as Rand explains. This is notable, as the analyst somewhat called BTC’s previous breakout past $4,200 earlier this year.

Rand isn’t the only one sure that $6,000 is inbound. Lisa Edwards, the sister of Bitcoin Satoshi’s Vision (BSV) supporter Craig Wright (yes, the Dr. Craig Wright), recently claimed that Bitcoin’s logarithmic weekly chart is currently expressing “a strong bullish divergence and bull flag.” With this, the analyst determined that a move to $6,250 could come to fruition in the short-term.

And a recent CoinDesk technical analysis piece would confirm that the “BTC will hit $6,000 soon” sentiment has some veracity. In the piece, analyst Omkar Godbole explained that Bitcoin’s 14-week Relative Strength Index (RSI) has entered a bullish territory, all while BTC has broken out of a falling channel. Godbole remarked that this could mean BTC is ready to “rise to the former support-turned-resistance of $6,000” over the coming weeks and months.

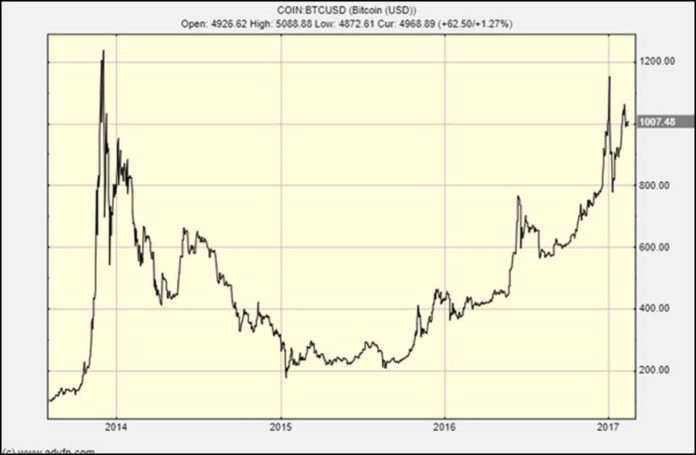

In a recent Forbes contributor post, Clem Chambers, the chief executive of ADVFN, agreed with Rand’s sentiment that $6,000 is incoming for BTC. Chambers explained that just by looking at the chart, which he deems “extremely strong,” a rally to the aforementioned level is to be expected. He went on to back his call.

The ADVFN CEO first explains that the “passion for crypto” is still here and is not going away, adding that Bitcoin has an underlying use case that will give it value for the long haul. Next, he looked to the recent influx of Tether’s USDT supply, explaining that this shows that dry powder is returning to cryptocurrency, setting the stage for a rally.

And finally, he looks to Bitcoin’s price action in the 2013 to 2016 cycle, which saw a massive rally to $1,000, a significant 80%+ drawdown, and an eventual return to previous all-time highs and beyond. As Chambers wrote: “My general expectation of the future (and naturally my hope) is expressed by this old Bitcoin crash chart.”

Interestingly, one analyst has somewhat jokingly proposed that Bitcoin moving to $6,000 could create a “maximum pain scenario.” Alex Kruger explained that if BTC shoots past $6,000, holds above that level, and then plummets to $4,000 in a short period of time, investors would have experienced maximum pain, meaning that their hopes in crypto may be dashed. This, of course, is a hypothetical scenario. But who knows what will happen when/if BTC runs past $6,000 for the first time in months?

Photo by Chris Liverani on Unsplash

[ad_2]

Source link