[ad_1]

By CCN: The Zoom IPO was a resounding success, as the videoconferencing giant’s stock soared 72% after its stock market debut. But investors in a different company called ZOOM Technologies raked in much more moolah in what seems like a classic case of mistaken identity.

You Wish You’d Invested in the Wrong Zoom Stock

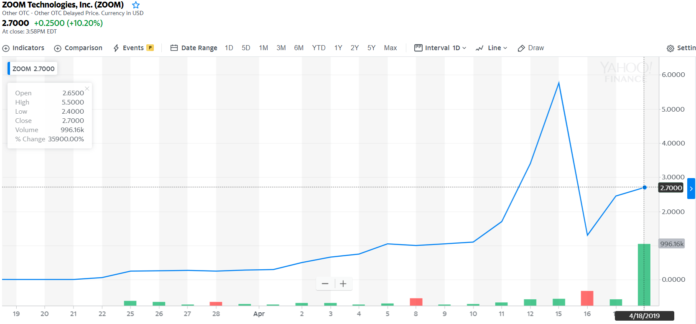

A month ago, shares of ZOOM Technologies (whose ticker is “ZOOM”) were trading at $0.005 – far less than even their “penny stock” designation. They closed at $2.70 a share on April 18, a massive jump of 53,900% as the euphoria from the Zoom IPO spilled over into the penny stock. This means that an investment of $1,000 in ZOOM Technologies at $0.005 a pop would have been worth nearly $550,000 on Thursday.

That’s much higher than what an investor in the Zoom IPO would have made. The IPO was priced at $36 a share and the stock closed its first day as a public company at $62 per share.

But ZOOM Technologies’ rally was awesome on an entirely different level as the company hardly does any business and was reportedly looking to delist from its OTC platform.

MarketWatch reports that ZOOM Technologies hasn’t reported revenue for the past eight years. The company is based out of Beijing, China. Its Yahoo! Finance profile page clearly says that it doesn’t have “significant operations,” though it was in the business of distributing wireless communications products in the US at one point of time.

But that didn’t stop investors, who were either very smart or – more likely – very stupid, from buying loads of ZOOM stock. Even so, there’s probably at least one foolish trader laughing all the way to the bank.

Stupid But Lucky? It’s Time to Cash Out

If you are one of those stupid-but-lucky investors who invested in the wrong ZOOM, now would be a good time to cash out and buy a stock – maybe the company whose shares you thought you were purchasing in the first place? – that’s actually going to make you money in the long run.

The Zoom IPO was a success was because of the impressive financial progress made by the company. The IPO filings revealed a profit of $7.6 million in fiscal 2019 on revenue of $330.5 million.

The company’s revenue in the prior-year period was $151.5 million and its loss stood at $3.8 million, so the company more than doubled its revenue and wiped out its loss. This makes Zoom’s IPO a rarity in today’s landscape as the other tech names going public have been burning loads of money.

Uber, for instance, is seeking a $100 billion valuation but its IPO filing said that the ridesharing specialist might not ever turn a profit. Pinterest, which made its stock market debut along with Zoom, is another company that’s incurring losses and is yet to find a path to monetize its business.

Zoom investors can only hope that the actual company replicates the feat of its doppelganger by delivering terrific financial growth for years to come.

[ad_2]

Source link