[ad_1]

Deception runs rampant within the cryptocurrency trading industry. Unethical bitcoin exchanges openly allow wash trading, a shady practice long ago expunged from mainstream finance. Scrubbing out these fake trading volumes to discern the true nature of the crypto economy produces astonishing results.

True Ripple Trading Volume Just $82 Million

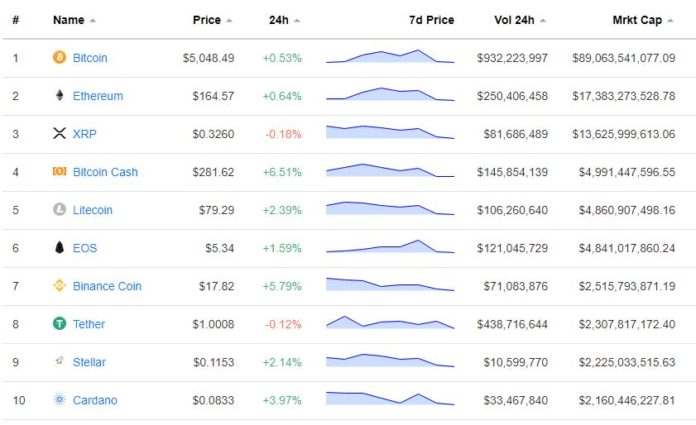

Ripple (XRP), the third-largest cryptocurrency with a $13.7 billion market cap, allegedly boasts $1.2 billion in 24-hour trading volume as of the time of writing, according to widely-used data aggregator CoinMarketCap. However, OpenMarketCap – which only aggregates data from exchanges that don’t allow washing trading and other shady practices – puts XRP turnover at just $81.7 million. That’s a shockingly illiquid figure and suggests that up to 93% of reported ripple volume is fake.

Ripple, whose market cap is nearly $14 billion, boasts less than $100 million in daily liquidity. | Source: OpenMarketCap

Apart from ripple, other top coins plagued by fake volumes include:

- Litecoin – $106 million real volume versus $2.9 billion reported

- EOS – $121 million real volume versus $2.9 billion reported

- Bitcoin Cash – $146 million real volume versus $1.6 billion reported

The real winner from the fake volume purge? Bitcoin, whose share of overall crypto trading volume balloons to 48% from 29% after removing the suspicious data.

Why Accurate Bitcoin Exchange Reporting Matters

OpenMarketCap is a product of DIRT Protocol, whose founder – Yin Wu – published a blog post outlining why so many crypto exchanges report fake volumes to deceive their users.

“Exchanges are incentivized to report false numbers to climb price tracker listings (and thus be featured more prominently to users.”

OpenMarketCap is a new crypto tracker that calculates price and volume using data from the 10 trusted exchanges on the @BitwiseInvest report.

A 95% drop in trading volume means the market for most alts is extremely illiquid / non-existent: https://t.co/J6yLb5VxAx

— Yin Yin Wu (@yinyinwu) March 26, 2019

Speaking to CCN, Yin Wu said that it is important for users in crypto to have a say in what data they trust and use. This is perfectly aligned with the ethos of the crypto ecosystem in general. That’s why the platform allows users to have a say in what exchanges can feed data into OpenMarketCap.

Hearkening back to the Token Curated Registry (TCR) project, users who want to challenge the reliability of a particular bitcoin exchange must put skin in the game by staking tokens.

Apart from the challenge of ensuring that users have an incentive to vote correctly, Yin said that a major hurdle towards building a reliable TCR is curating evidence. Users must have access to trustworthy data, or else it won’t matter if they place skin in the game or not.

[ad_2]

Source link