[ad_1]

The CFTC chief delivered more than an earful about the way some outsiders really feel about bitcoin. J. Christopher Giancarlo, chairman of the U.S. Commodity Futures Trading Commission (CFTC), is nearing retirement when his term ends later this month. Known as Crypto Dad to the SEC’s Crypto Mom Hester Peirce, Giancarlo might deserve the title as Crypto Hero, instead, considering the heat he has had to endure for refusing to stifle blockchain innovation.

Crypto Dad Defends CFTC’s Blockchain Stance Against Bitcoin Skeptics

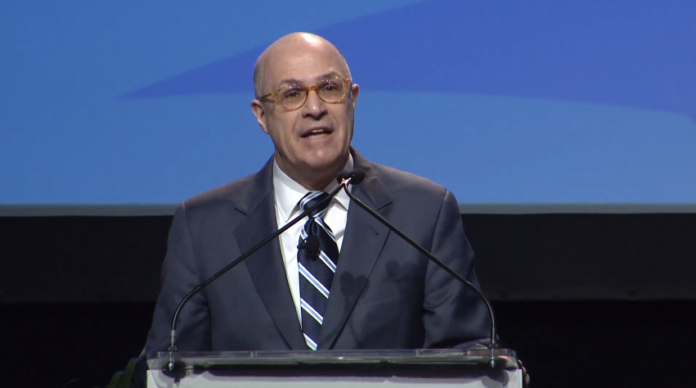

CFTC Chairman J. Christopher Giancarlo has more than earned his affectionate “Crypto Dad” nickname. | Source: YouTube

In a speech at the Eurofi Financial Forum in Bucharest, Romania, Giancarlo was generous with his opinions, citing Romanian poet Ion Luca Cariagiale who once said:

“Opinions are free, but not mandatory.”

Giancarlo might think he used the platform to “put forth a few free opinions,” but he also dropped a bomb with details of his experience as a regulator in the crypto space. While he didn’t squeal on anyone, the CFTC chief said enough. Crypto Dad made it clear that while the CFTC’s approach has been to nurture “the development of new derivatives products on crypto-assets like bitcoin,” not everyone he comes across feels the same.

“We have resisted calls to use our legal powers to suppress the development of crypto-assets and the underlying technologies that support them. Instead, we have favored close monitoring of market developments while not hindering the introduction of new products like bitcoin futures, which have proven invaluable in letting market forces determine the appropriate value of the bitcoin.”

This resistance Crypto Dad refers to has been a hurdle not only to innovation but also to the adoption of blockchain technology by businesses across jurisdictions.

CFTC’s Crypto Openness Bittersweet for Bitcoin Speculators

Giancarlo referenced an economic letter by the Federal Reserve Bank of San Francisco. In the letter, economists argued that the advent of bitcoin futures had created more of a balance in speculative demand among optimists and pessimists, the latter of whom were handed a way to bet on the decline in the bitcoin price.

Regardless how bitcoin bulls feel about BTC futures, if it weren’t for Giancarlo’s open mind, this institutional product would never have seen the light of day. While the commodities regulator wasn’t responsible for approving the product, they did give the green light to the Chicago derivatives exchanges to launch their respective contracts. That has paved the way for exchanges such as Bakkt, which is poised to “pay out” its bitcoin futures contracts in crypto and is viewed as a catalyst for the crypto market in 2019.

Now that Giancarlo is nearing the end of his term, the crypto community will not be without an advocate in regulatory circles. U.S. SEC Commissioner Hester Peirce has embraced her role as Crypto Mom and seems prepared to carry the torch for both of them.

CryptoDad gave a great speech: “While markets are not always perfect, they have proven time and again to be the most effective means humans have to drive economic productivity and prosperity.” https://t.co/mltC6tliWi https://t.co/TxGE7yjMn9

— Hester Peirce (@HesterPeirce) March 7, 2019

Nonetheless, Giancarlo’s light-touch regulatory approach to regulation will be missed. He crafted the Project KISS initiative with the overarching goal to simplify CFTC rules and regulations. What the crypto community will miss most, however, is most likely his candor, including a second Ion Luca Cariagiale quote, which should resonate with blockchain folks:

“Do you want to get to know things? Look at them closely. Do you want to like them? Look at them from afar.”

[ad_2]

Source link